A SOP Template for Fee Collection Process provides a structured framework to ensure consistent and efficient handling of payments. It outlines step-by-step procedures for invoicing, payment tracking, and reconciliation to minimize errors and delays. This template helps maintain transparency and accountability throughout the entire fee collection cycle.

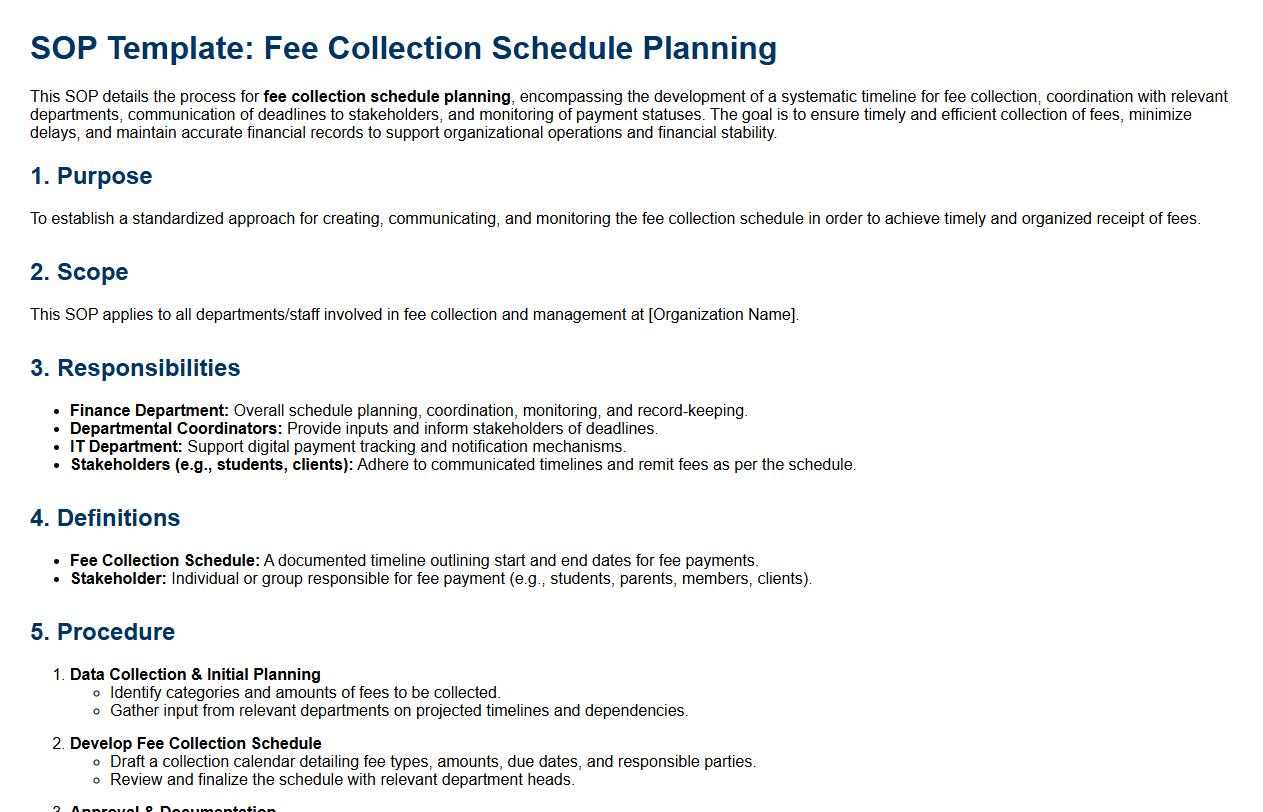

Fee collection schedule planning.

This SOP details the process for fee collection schedule planning, encompassing the development of a systematic timeline for fee collection, coordination with relevant departments, communication of deadlines to stakeholders, and monitoring of payment statuses. The goal is to ensure timely and efficient collection of fees, minimize delays, and maintain accurate financial records to support organizational operations and financial stability.

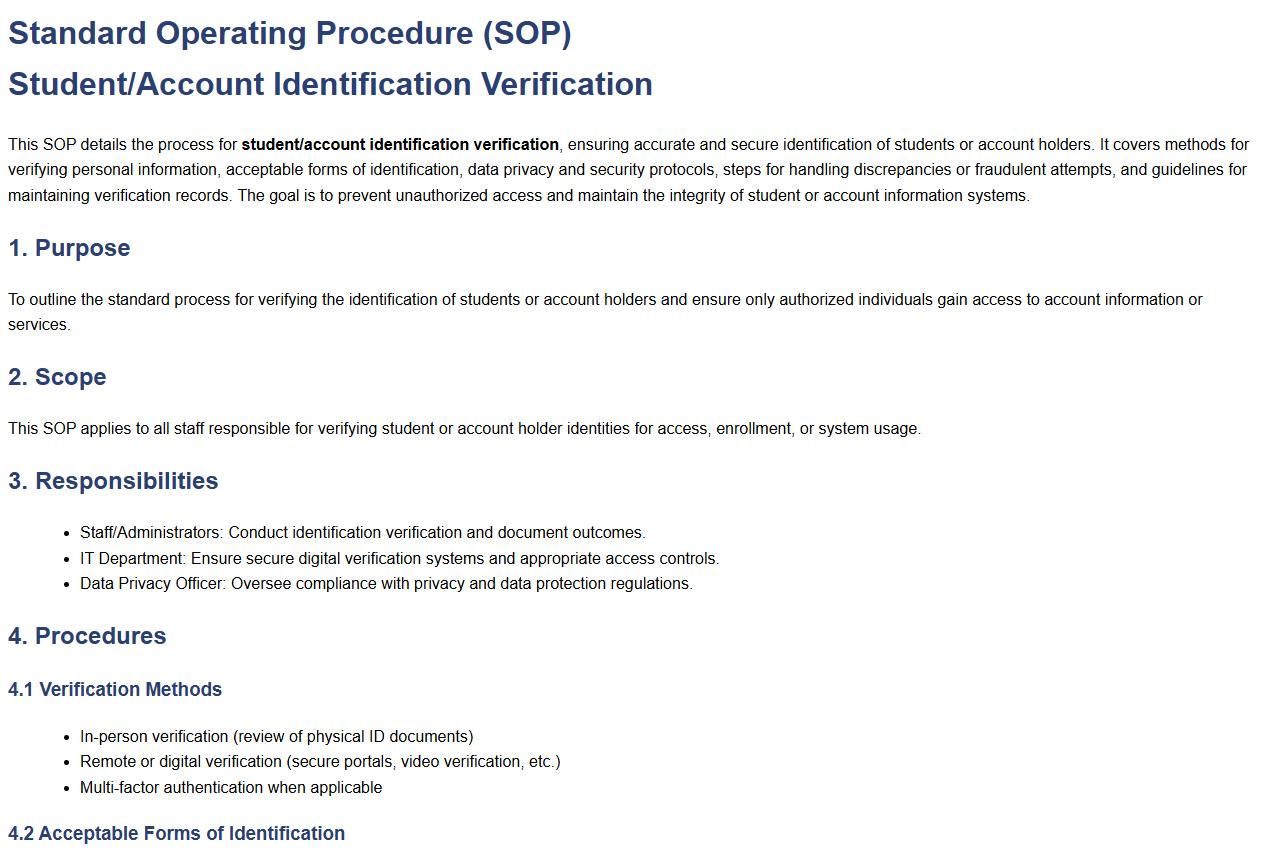

Student/account identification verification.

This SOP details the process for student/account identification verification, ensuring accurate and secure identification of students or account holders. It covers methods for verifying personal information, acceptable forms of identification, data privacy and security protocols, steps for handling discrepancies or fraudulent attempts, and guidelines for maintaining verification records. The goal is to prevent unauthorized access and maintain the integrity of student or account information systems.

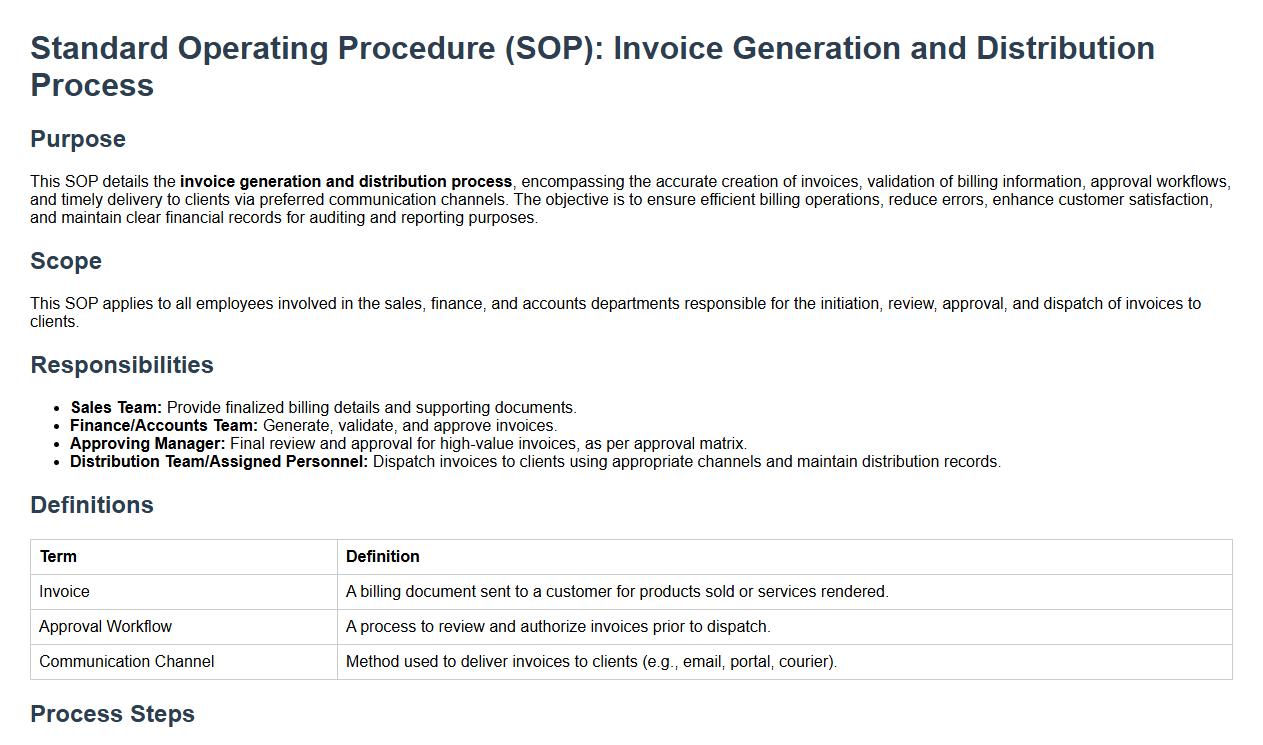

Invoice generation and distribution process.

This SOP details the invoice generation and distribution process, encompassing the accurate creation of invoices, validation of billing information, approval workflows, and timely delivery to clients via preferred communication channels. The objective is to ensure efficient billing operations, reduce errors, enhance customer satisfaction, and maintain clear financial records for auditing and reporting purposes.

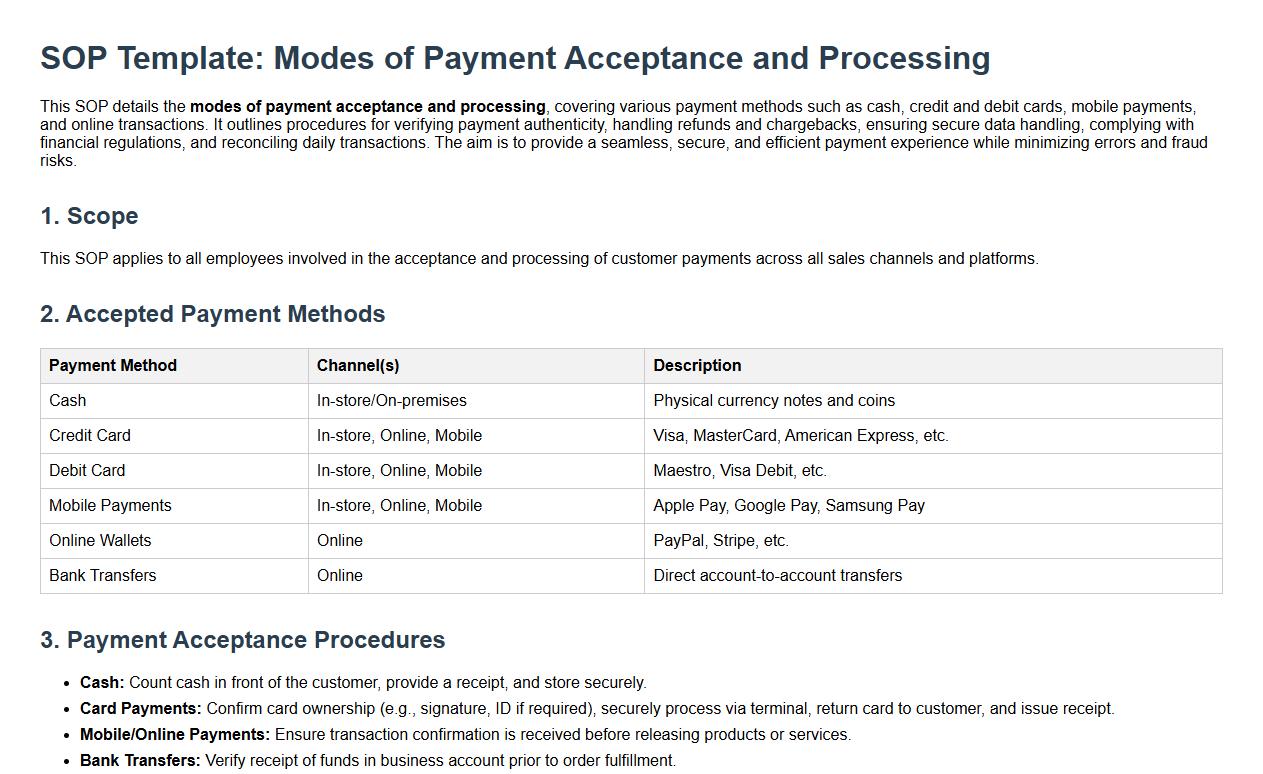

Modes of payment acceptance and processing.

This SOP details the modes of payment acceptance and processing, covering various payment methods such as cash, credit and debit cards, mobile payments, and online transactions. It outlines procedures for verifying payment authenticity, handling refunds and chargebacks, ensuring secure data handling, complying with financial regulations, and reconciling daily transactions. The aim is to provide a seamless, secure, and efficient payment experience while minimizing errors and fraud risks.

Cash, cheque, and online payment handling procedures.

This SOP details the cash, cheque, and online payment handling procedures, encompassing the collection, verification, recording, and secure storage of cash and cheques, as well as the processing of online payments. It aims to maintain accurate financial records, prevent fraud and errors, ensure timely deposit of funds, and uphold accountability through clear roles and responsibilities. The procedures include guidelines for handling discrepancies, reconciliation of payments, and secure transmission of payment information to safeguard the organization's financial assets.

Receipt issuance and documentation standards.

This SOP defines the receipt issuance and documentation standards, covering the proper procedures for generating, issuing, and recording receipts. It ensures accuracy, consistency, and compliance with financial and legal requirements by outlining the steps for documenting transactions, maintaining organized records, and safeguarding against errors or fraud. This standardization facilitates transparent financial management, audit readiness, and effective communication with clients and internal departments.

Late payment reminder and penalty enforcement process.

This SOP describes the late payment reminder and penalty enforcement process, outlining steps for timely notification of overdue payments, communication protocols with customers, calculation and application of penalties, and documentation requirements. The purpose is to ensure consistent handling of late payments, encourage prompt settlements, maintain financial discipline, and reduce outstanding receivables effectively.

Reconciliation and deposit of collected fees.

This SOP details the procedures for reconciliation and deposit of collected fees, including accurate recording of all collected payments, verification of amounts against receipts, resolving discrepancies, preparing deposit documentation, timely submission of funds to the bank, and maintaining secure records. The purpose is to ensure financial accountability, prevent errors or fraud, and streamline the handling of collected fees within the organization.

Record-keeping and archival procedures for transactions.

This SOP details the record-keeping and archival procedures for transactions, encompassing the systematic documentation, organization, and secure storage of all transactional records. The procedure ensures accurate, timely recording of financial and operational data, compliance with regulatory requirements, and establishment of reliable archives for future reference, audits, and reporting purposes. Emphasis is placed on maintaining confidentiality, data integrity, and accessibility of records throughout their retention period.

Reporting and escalation of discrepancies or issues.

This SOP details the process for reporting and escalation of discrepancies or issues within the organization. It covers the identification and documentation of discrepancies, timely communication to relevant stakeholders, clear escalation pathways based on issue severity, roles and responsibilities of personnel involved, and follow-up actions to ensure resolution. The goal is to enhance transparency, accountability, and prompt corrective measures to maintain operational efficiency and quality standards.

What are the authorized payment methods specified in the SOP for fee collection?

The SOP explicitly lists authorized payment methods including cash, credit/debit cards, and bank transfers. It mandates the use of secure and traceable channels to ensure accuracy and accountability. Any payment outside these methods requires prior approval from the financial department.

What steps must be followed for issuing and reconciling payment receipts?

Issuing payment receipts begins with generating a unique receipt number for each transaction, ensuring full traceability. Receipts must be promptly provided to customers and accurately recorded in the financial system. The reconciliation process involves cross-checking received payments with issued receipts to identify and resolve discrepancies.

Who is responsible for verifying and recording daily fee transactions according to the SOP?

The SOP designates the finance officer as responsible for verifying and recording all daily fee collections. They must ensure that each transaction aligns with internal records and report any inconsistencies immediately. This role includes maintaining updated logs and securing documentation for audit purposes.

How does the SOP outline the process for managing and reporting fee discrepancies?

The SOP requires immediate identification and documentation of any fee discrepancies during transaction reviews. The finance officer must report discrepancies to the management team for investigation and corrective action. A structured reporting system ensures timely resolution and prevention of future errors.

What are the security protocols for handling and storing collected fees as per the SOP?

Collected fees must be handled following strict security protocols including secure cash boxes and restricted access areas. All physical and electronic payment records are to be stored in locked environments with authorized personnel only. Regular audits and surveillance measures are outlined to safeguard collected funds effectively.