A SOP Template for Cash Handling in Food Services ensures standardized procedures for managing cash transactions securely and efficiently. It outlines steps for cash collection, counting, reconciliation, and documentation to minimize errors and prevent theft. Proper implementation enhances accountability and streamlines financial operations within food service establishments.

Opening and closing cash register procedures.

This SOP details the opening and closing cash register procedures, covering the steps for cash drawer setup, cash count verification, register system initialization, transaction logging, cash reconciliation, end-of-day balancing, secure cash storage, and accurate reporting. The objective is to ensure efficient, accurate, and secure handling of cash transactions to maintain financial integrity and prevent discrepancies.

Cash drawer setup and verification at shift start.

This SOP details the cash drawer setup and verification at shift start, including counting the starting cash float, verifying denominations, ensuring accuracy, documenting discrepancies, and securing the cash drawer for shift operations. The goal is to maintain financial integrity, prevent cash handling errors, and ensure smooth transaction processes throughout the shift.

Safe and secure cash storage protocols.

This SOP establishes safe and secure cash storage protocols to minimize the risk of theft, loss, or damage. It covers procedures for handling cash, secure storage methods, access controls, regular audits, and emergency response measures. The goal is to ensure that all cash assets are protected through consistent and effective security practices.

Transaction handling and customer payment acceptance.

This SOP details the processes for transaction handling and customer payment acceptance, covering payment method verification, secure transaction processing, fraud prevention measures, receipt issuance, and reconciliation procedures. The objective is to ensure accurate, efficient, and secure handling of all customer payments while maintaining compliance with financial regulations and enhancing customer satisfaction.

Issuing and recording receipts for all transactions.

This SOP establishes the standardized process for issuing and recording receipts for all transactions. It ensures accurate documentation, proper authorization, and consistent record-keeping to maintain financial transparency and accountability. The procedure includes verifying transaction details, generating receipts promptly, providing copies to customers, and securely storing records for auditing and reconciliation purposes.

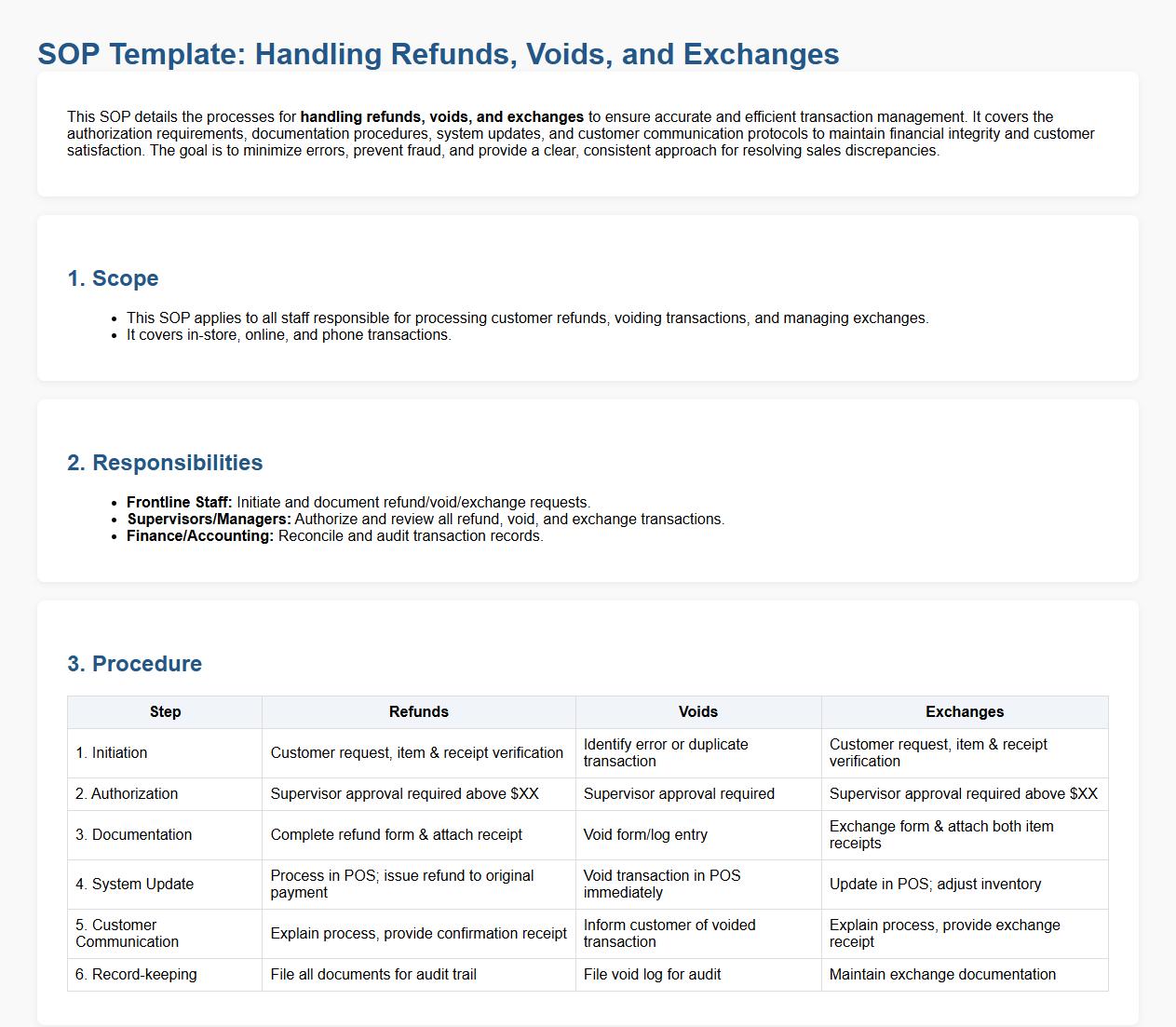

Handling refunds, voids, and exchanges.

This SOP details the processes for handling refunds, voids, and exchanges to ensure accurate and efficient transaction management. It covers the authorization requirements, documentation procedures, system updates, and customer communication protocols to maintain financial integrity and customer satisfaction. The goal is to minimize errors, prevent fraud, and provide a clear, consistent approach for resolving sales discrepancies.

Monitoring and managing cash levels during shifts.

This SOP details the process for monitoring and managing cash levels during shifts, covering cash handling protocols, cash register reconciliation, cash count frequency, handling discrepancies, secure storage of cash, and reporting procedures. The goal is to maintain accuracy, prevent theft or loss, and ensure accountability of cash transactions throughout each shift.

Procedures for cash drops and safe deposits.

This SOP details procedures for cash drops and safe deposits, including secure handling of cash, timing and frequency of cash drops, verification and counting processes, use of drop safes and deposit bags, documentation and recording of deposits, roles and responsibilities of personnel involved, compliance with company policies and banking regulations, and measures to prevent theft or loss. The aim is to ensure the integrity and security of cash management during drops and deposits.

Reconciling cash drawers and end-of-shift balancing.

This SOP details the process for reconciling cash drawers and end-of-shift balancing, including accurate counting of cash and coins, verifying sales receipts and transaction records, identifying and resolving discrepancies, documenting cash variances, and securing funds for deposit. The procedure ensures financial accuracy, accountability, and integrity in cash handling at the close of each shift.

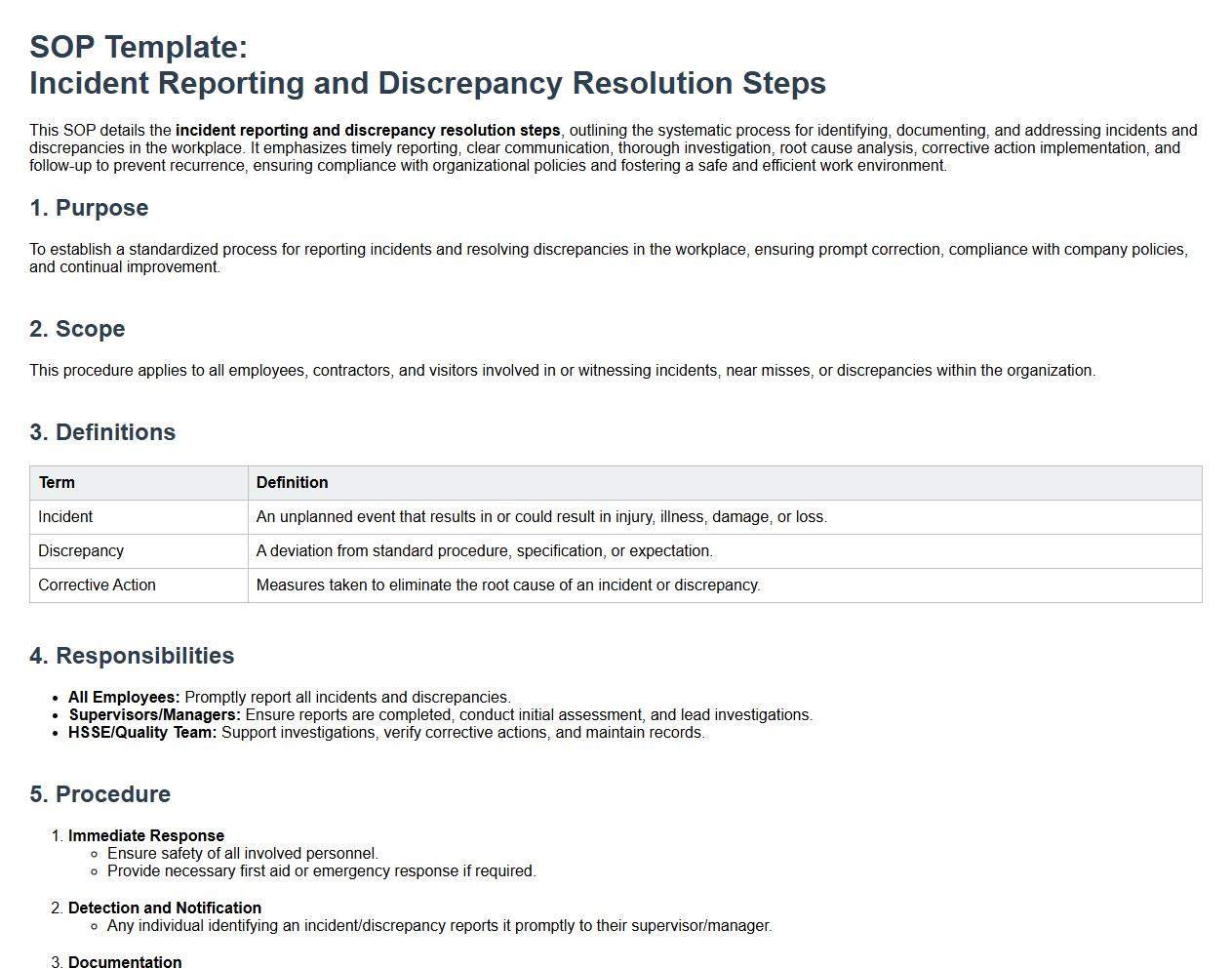

Incident reporting and discrepancy resolution steps.

This SOP details the incident reporting and discrepancy resolution steps, outlining the systematic process for identifying, documenting, and addressing incidents and discrepancies in the workplace. It emphasizes timely reporting, clear communication, thorough investigation, root cause analysis, corrective action implementation, and follow-up to prevent recurrence, ensuring compliance with organizational policies and fostering a safe and efficient work environment.

What are the required steps for cash reconciliation at the end of each shift according to the SOP?

According to the SOP, the cash reconciliation at the end of each shift involves counting all cash in the register and matching it with the sales records. Any discrepancies must be noted and immediately reported to the supervisor. This ensures accuracy and accountability in daily financial operations.

Which security measures must be followed during cash handling as outlined in the SOP?

The SOP mandates strict security measures such as keeping cash in a secure drawer and limiting cash exposure during transactions. Employees must avoid leaving the cash register unattended at any time. Additionally, all cash handling should be performed discreetly to prevent theft or loss.

Who is authorized to access the cash register as per the SOP guidelines?

Only authorized personnel, such as designated cashiers and supervisors, are permitted to access the cash register. Unauthorized access is strictly prohibited to maintain security and integrity. Access is typically controlled through employee ID codes or keys assigned by management.

What procedures are mandated by the SOP for reporting cash discrepancies?

The SOP requires employees to immediately report any cash discrepancies to the shift supervisor or manager. A detailed discrepancy report must be completed, outlining the variance and possible reasons. Prompt reporting helps in quick resolution and prevents ongoing issues.

How does the SOP specify the process for documenting cash transactions in food services?

The SOP specifies that all cash transactions must be accurately recorded in the cash register system at the time of the sale. Receipts should be issued for every transaction to provide a clear audit trail. Moreover, daily transaction logs must be reviewed and signed off by a supervisor for verification.