A SOP Template for Accounting and Bookkeeping Services provides a clear, step-by-step guide to streamline financial processes and ensure consistency in record-keeping. This template helps organizations maintain accuracy, compliance, and efficiency in managing accounts, transactions, and financial reporting. Implementing a standardized SOP improves accountability and reduces errors in daily accounting tasks.

Client onboarding and information collection.

This SOP details the process of client onboarding and information collection, encompassing initial client engagement, verification of client details, comprehensive data gathering, consent and compliance checks, system entry of client information, and communication of next steps. The goal is to ensure a seamless and efficient onboarding experience while maintaining data accuracy and regulatory compliance.

Chart of accounts setup and maintenance.

This SOP details the chart of accounts setup and maintenance process, covering the creation, organization, and regular updating of account codes to ensure accurate financial reporting. It includes defining account categories, assigning account numbers, maintaining consistency across accounting periods, and ensuring compliance with regulatory standards. The procedure aims to streamline financial data management and support accurate bookkeeping and financial analysis.

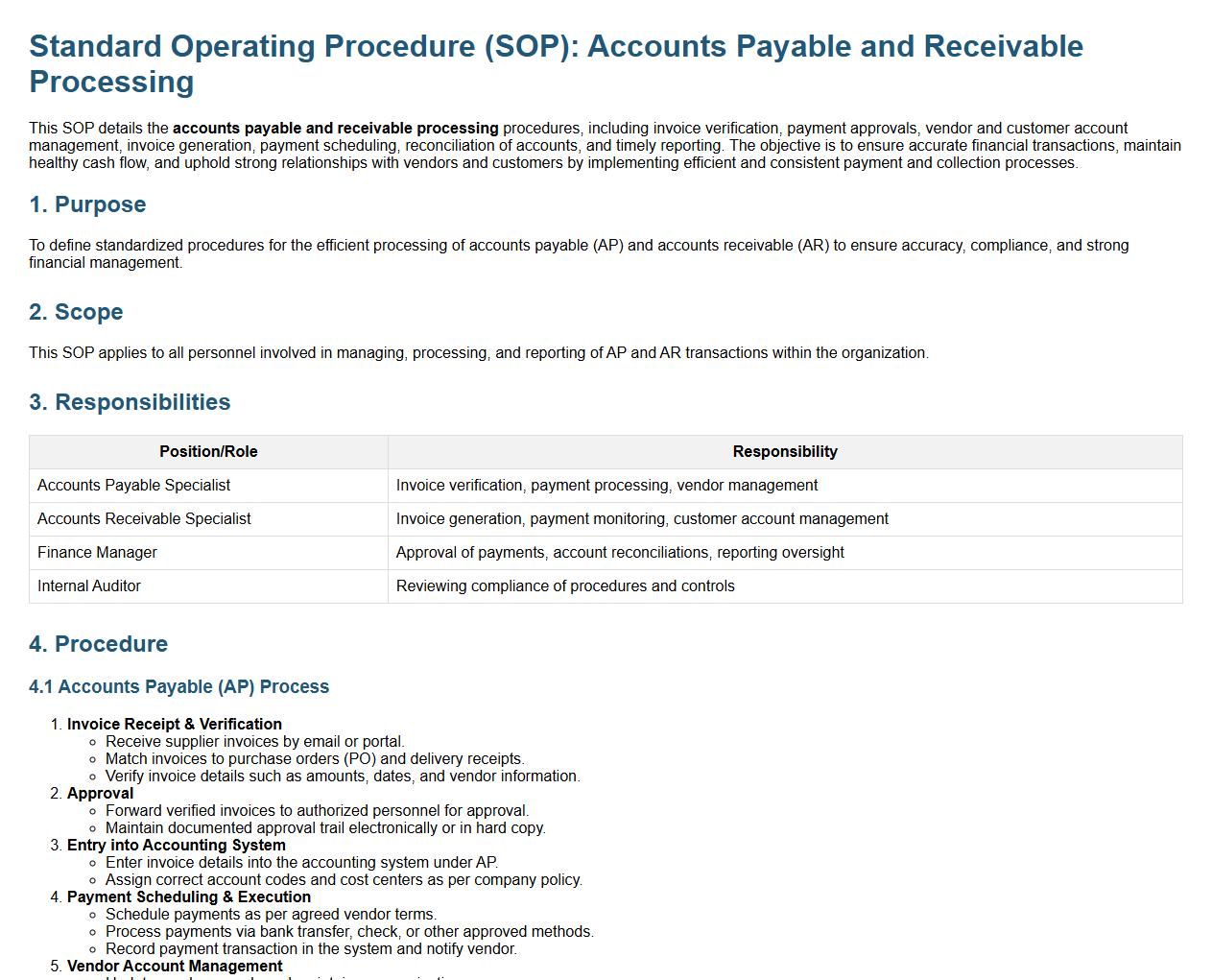

Accounts payable and receivable processing.

This SOP details the accounts payable and receivable processing procedures, including invoice verification, payment approvals, vendor and customer account management, invoice generation, payment scheduling, reconciliation of accounts, and timely reporting. The objective is to ensure accurate financial transactions, maintain healthy cash flow, and uphold strong relationships with vendors and customers by implementing efficient and consistent payment and collection processes.

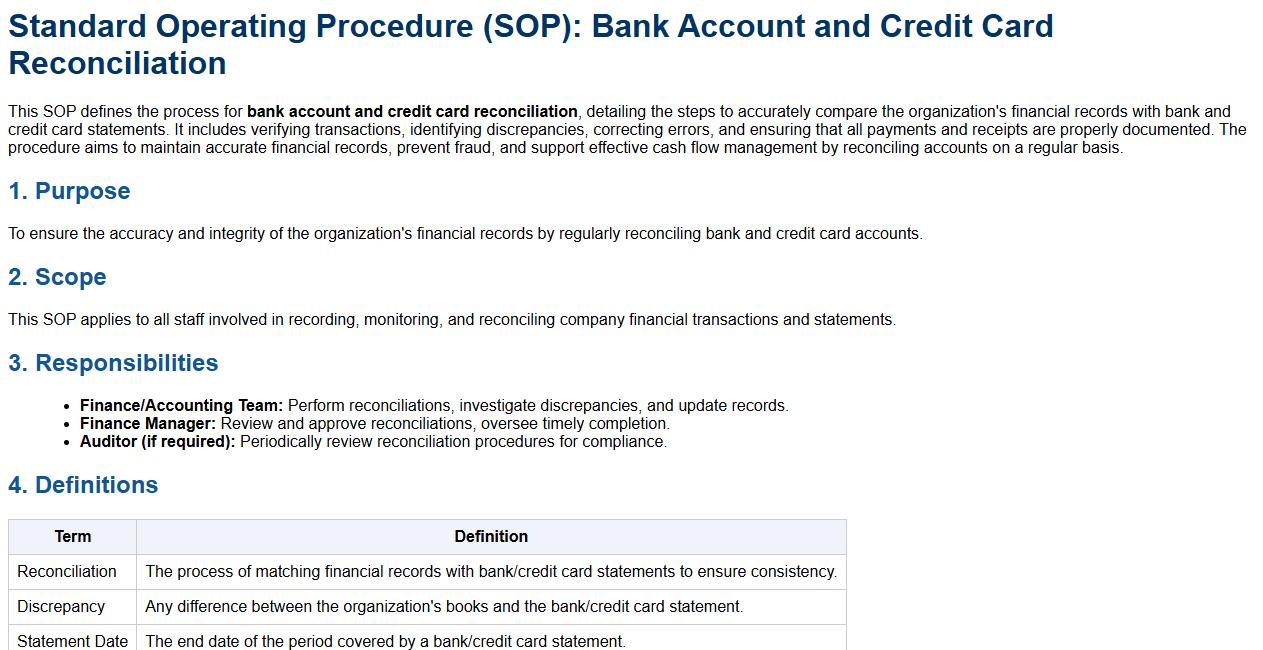

Bank account and credit card reconciliation.

This SOP defines the process for bank account and credit card reconciliation, detailing the steps to accurately compare the organization's financial records with bank and credit card statements. It includes verifying transactions, identifying discrepancies, correcting errors, and ensuring that all payments and receipts are properly documented. The procedure aims to maintain accurate financial records, prevent fraud, and support effective cash flow management by reconciling accounts on a regular basis.

Expense tracking and categorization procedures.

This SOP defines expense tracking and categorization procedures to ensure accurate financial record-keeping, streamline budgeting processes, and facilitate efficient expense management. It includes steps for recording expenses promptly, classifying transactions into appropriate categories, verifying receipts and documentation, utilizing expense tracking software tools, and performing regular audits to maintain accuracy and compliance. The goal is to enhance financial transparency, simplify reporting, and support informed decision-making within the organization.

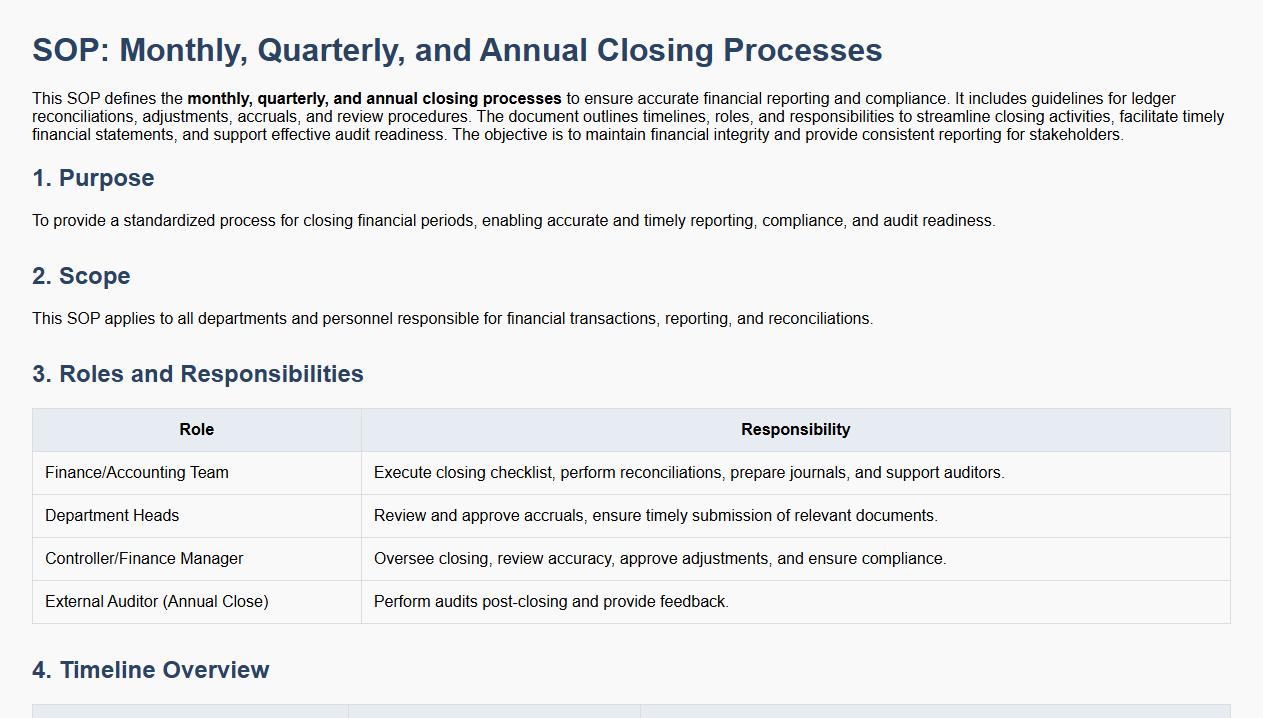

Monthly, quarterly, and annual closing processes.

This SOP defines the monthly, quarterly, and annual closing processes to ensure accurate financial reporting and compliance. It includes guidelines for ledger reconciliations, adjustments, accruals, and review procedures. The document outlines timelines, roles, and responsibilities to streamline closing activities, facilitate timely financial statements, and support effective audit readiness. The objective is to maintain financial integrity and provide consistent reporting for stakeholders.

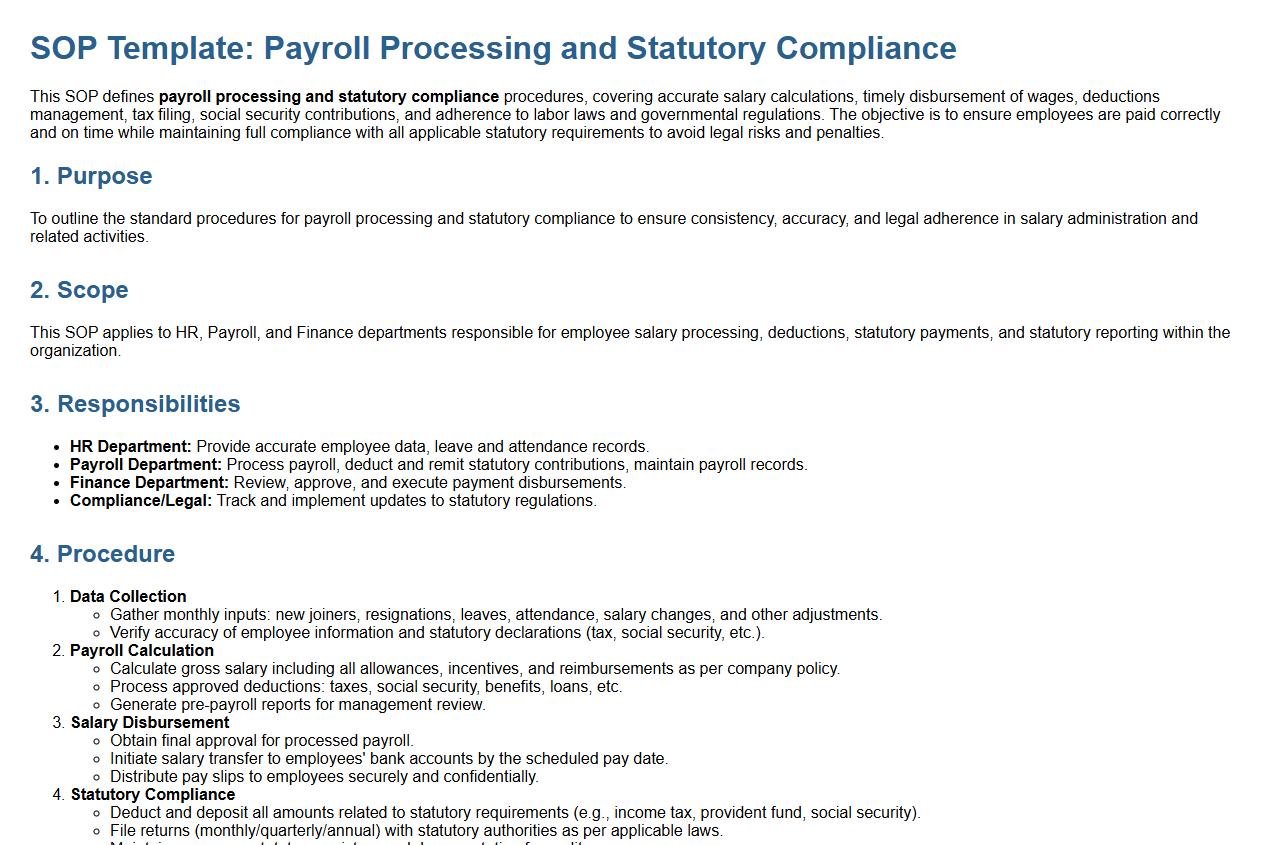

Payroll processing and statutory compliance.

This SOP defines payroll processing and statutory compliance procedures, covering accurate salary calculations, timely disbursement of wages, deductions management, tax filing, social security contributions, and adherence to labor laws and governmental regulations. The objective is to ensure employees are paid correctly and on time while maintaining full compliance with all applicable statutory requirements to avoid legal risks and penalties.

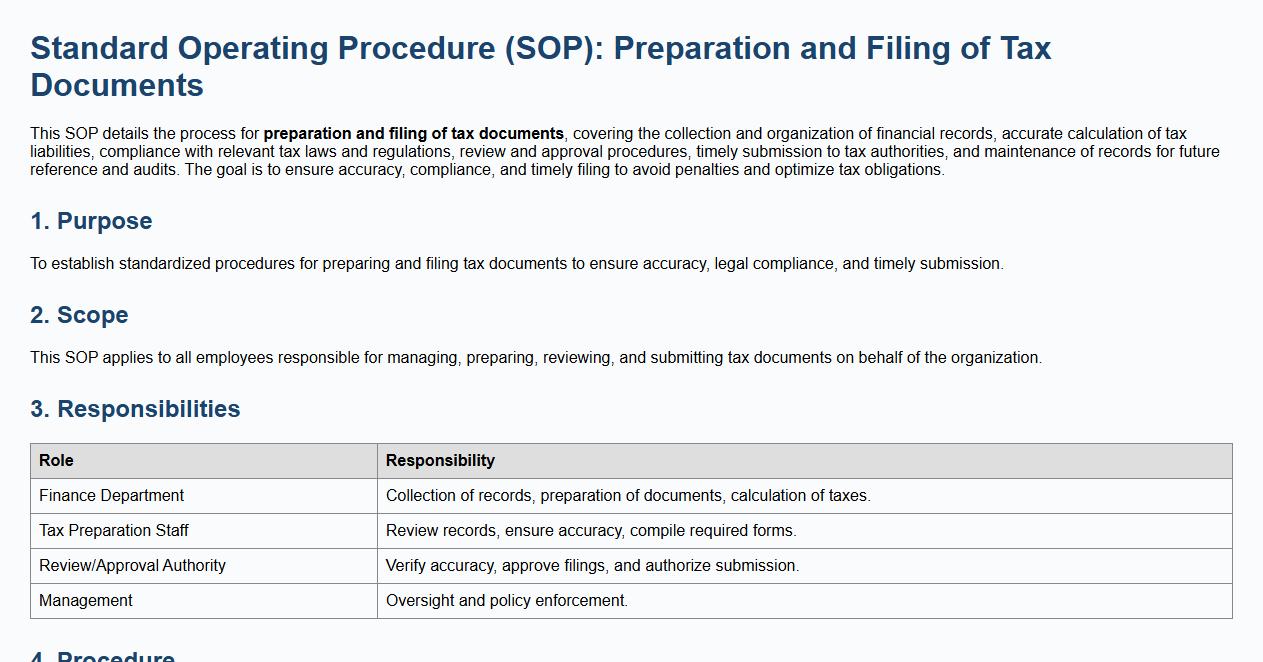

Preparation and filing of tax documents.

This SOP details the process for preparation and filing of tax documents, covering the collection and organization of financial records, accurate calculation of tax liabilities, compliance with relevant tax laws and regulations, review and approval procedures, timely submission to tax authorities, and maintenance of records for future reference and audits. The goal is to ensure accuracy, compliance, and timely filing to avoid penalties and optimize tax obligations.

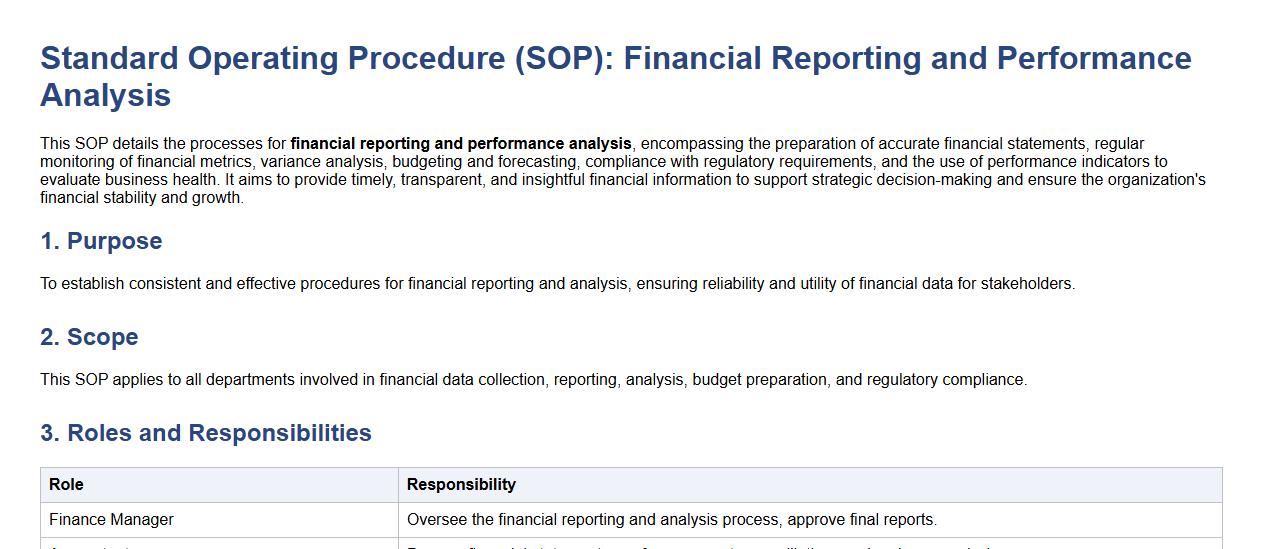

Financial reporting and performance analysis.

This SOP details the processes for financial reporting and performance analysis, encompassing the preparation of accurate financial statements, regular monitoring of financial metrics, variance analysis, budgeting and forecasting, compliance with regulatory requirements, and the use of performance indicators to evaluate business health. It aims to provide timely, transparent, and insightful financial information to support strategic decision-making and ensure the organization's financial stability and growth.

Data backup, confidentiality, and document retention.

This SOP details data backup, confidentiality, and document retention procedures, emphasizing the secure and systematic handling of data. It covers regular data backup schedules, secure storage methods, confidentiality protocols to protect sensitive information, compliance with legal and regulatory document retention requirements, and the proper disposal of documents. The objective is to ensure data integrity, prevent data loss, safeguard sensitive information, and maintain compliance with organizational and legal standards.

What key procedures are outlined in the SOP for processing client invoices and receipts?

The SOP outlines standardized procedures for the accurate issuance of client invoices and proper recording of receipts. It emphasizes timely generation of invoices to maintain cash flow and ensure client satisfaction. Additionally, it mandates verification of invoice details against service agreements to prevent discrepancies.

How does the SOP address the approval workflow for financial transactions and entries?

The SOP specifies a clear approval workflow that involves multiple levels of authorization to ensure accuracy and prevent fraud. Each financial transaction must undergo review by designated personnel before entry into the accounting system. This structured process enhances accountability and compliance with organizational policies.

What are the documentation retention requirements specified in the SOP for accounting records?

The SOP requires that all accounting records, including invoices and receipts, be retained for a minimum of seven years to comply with legal and regulatory standards. It prescribes secure storage methods, both physical and electronic, to safeguard document integrity. Proper documentation ensures audit readiness and supports financial transparency.

Which steps in the SOP ensure reconciliation of accounts and error reduction?

The SOP outlines routine procedures for account reconciliation, including monthly comparison of ledger entries against bank statements. It mandates investigation and correction of discrepancies to maintain data accuracy. These controls substantially reduce errors and improve financial reporting reliability.

How does the SOP detail roles and responsibilities for bookkeeping activities and compliance?

The SOP clearly defines the roles and responsibilities of accounting personnel to streamline bookkeeping operations and ensure regulatory compliance. It assigns tasks such as data entry, transaction review, and report generation to specific team members. This clarity promotes efficiency and accountability within the finance department.