A SOP Template for Employee Expense Reimbursement provides a clear and standardized process for submitting, reviewing, and approving expense claims. It ensures employees follow consistent guidelines, improving accuracy and compliance with company policies. This template helps streamline reimbursement workflows, reducing delays and errors in expense management.

**SOP Template for Employee Expense Reimbursement:**

This SOP Template for Employee Expense Reimbursement provides a structured process for submitting, reviewing, and approving employee expenses. It details the required documentation, submission timelines, approval workflow, and reimbursement methods to ensure transparency, accuracy, and compliance with company policies. The template aims to streamline expense claims, minimize errors, and facilitate timely reimbursement for employees.

Employee eligibility and covered expense categories.

This SOP defines the employee eligibility and covered expense categories for company benefits, detailing criteria for employee participation, types of expenses eligible for reimbursement, required documentation, and claim submission procedures to ensure clarity and compliance with organizational policies.

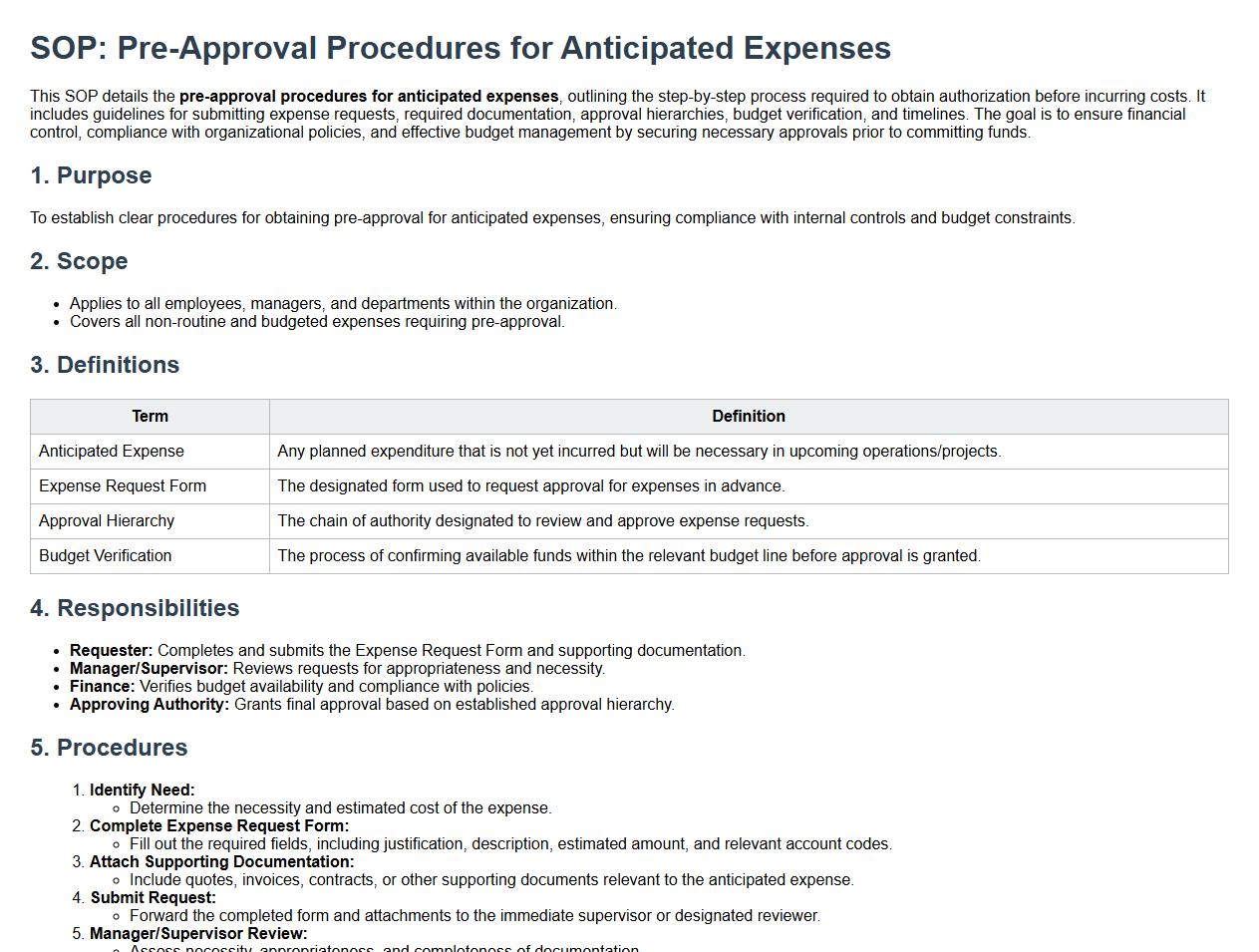

Pre-approval procedures for anticipated expenses.

This SOP details the pre-approval procedures for anticipated expenses, outlining the step-by-step process required to obtain authorization before incurring costs. It includes guidelines for submitting expense requests, required documentation, approval hierarchies, budget verification, and timelines. The goal is to ensure financial control, compliance with organizational policies, and effective budget management by securing necessary approvals prior to committing funds.

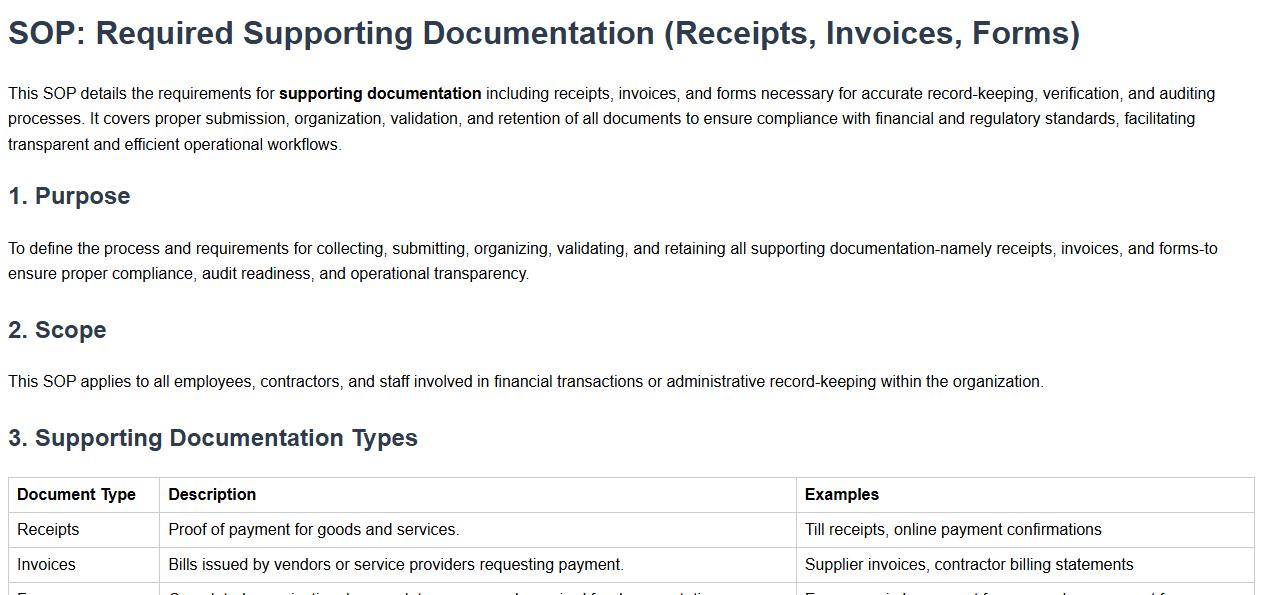

Required supporting documentation (receipts, invoices, forms).

This SOP details the requirements for supporting documentation including receipts, invoices, and forms necessary for accurate record-keeping, verification, and auditing processes. It covers proper submission, organization, validation, and retention of all documents to ensure compliance with financial and regulatory standards, facilitating transparent and efficient operational workflows.

Expense reporting timeline and submission deadlines.

This SOP details the expense reporting timeline and submission deadlines to ensure timely and accurate reimbursement processes. It covers the specific timeframes for submitting expense reports, required documentation, approval workflows, and consequences for late submissions. The purpose is to streamline financial operations, maintain compliance with company policies, and support efficient budget management.

Step-by-step instructions for completing reimbursement forms.

This SOP provides step-by-step instructions for completing reimbursement forms, detailing the process from gathering necessary receipts and documentation, accurately filling out form fields, obtaining required approvals, to submitting the forms for processing. It aims to ensure timely and accurate reimbursement claims while maintaining compliance with organizational financial policies.

Approval workflow: manager review and finance department authorization.

This SOP defines the approval workflow process, detailing the procedures for manager review and finance department authorization. It ensures that all requests undergo thorough evaluation and validation by the designated manager before being forwarded to the finance department for final approval. This structured workflow aims to enhance accountability, maintain financial control, and ensure compliance with organizational policies.

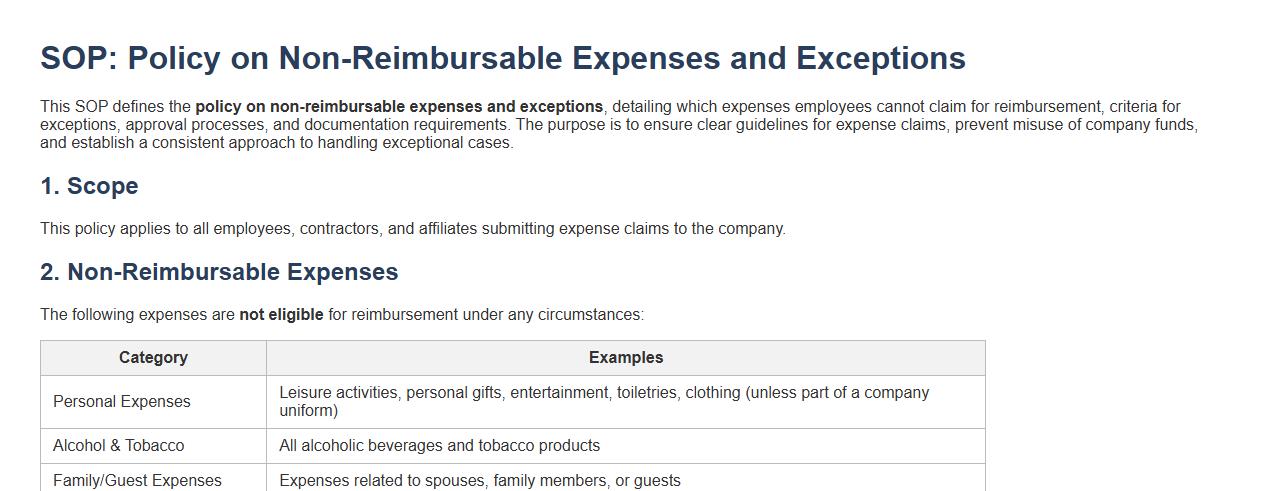

Policy on non-reimbursable expenses and exceptions.

This SOP defines the policy on non-reimbursable expenses and exceptions, detailing which expenses employees cannot claim for reimbursement, criteria for exceptions, approval processes, and documentation requirements. The purpose is to ensure clear guidelines for expense claims, prevent misuse of company funds, and establish a consistent approach to handling exceptional cases.

Methods and timing of reimbursement (e.g., direct deposit, payroll).

This SOP details the methods and timing of reimbursement, including processes for direct deposit and payroll distribution. It ensures timely and accurate payment to employees by defining reimbursement schedules, approved payment methods, and procedures for handling discrepancies. The goal is to maintain efficient financial operations and clear communication regarding employee compensation.

Procedures for addressing discrepancies or rejected claims.

This SOP details procedures for addressing discrepancies or rejected claims, including the identification of claim errors, documentation requirements, communication protocols with claimants, steps for claim correction or resubmission, and timelines for resolution. The goal is to ensure efficient handling of claim issues to minimize delays and maintain accurate financial records.

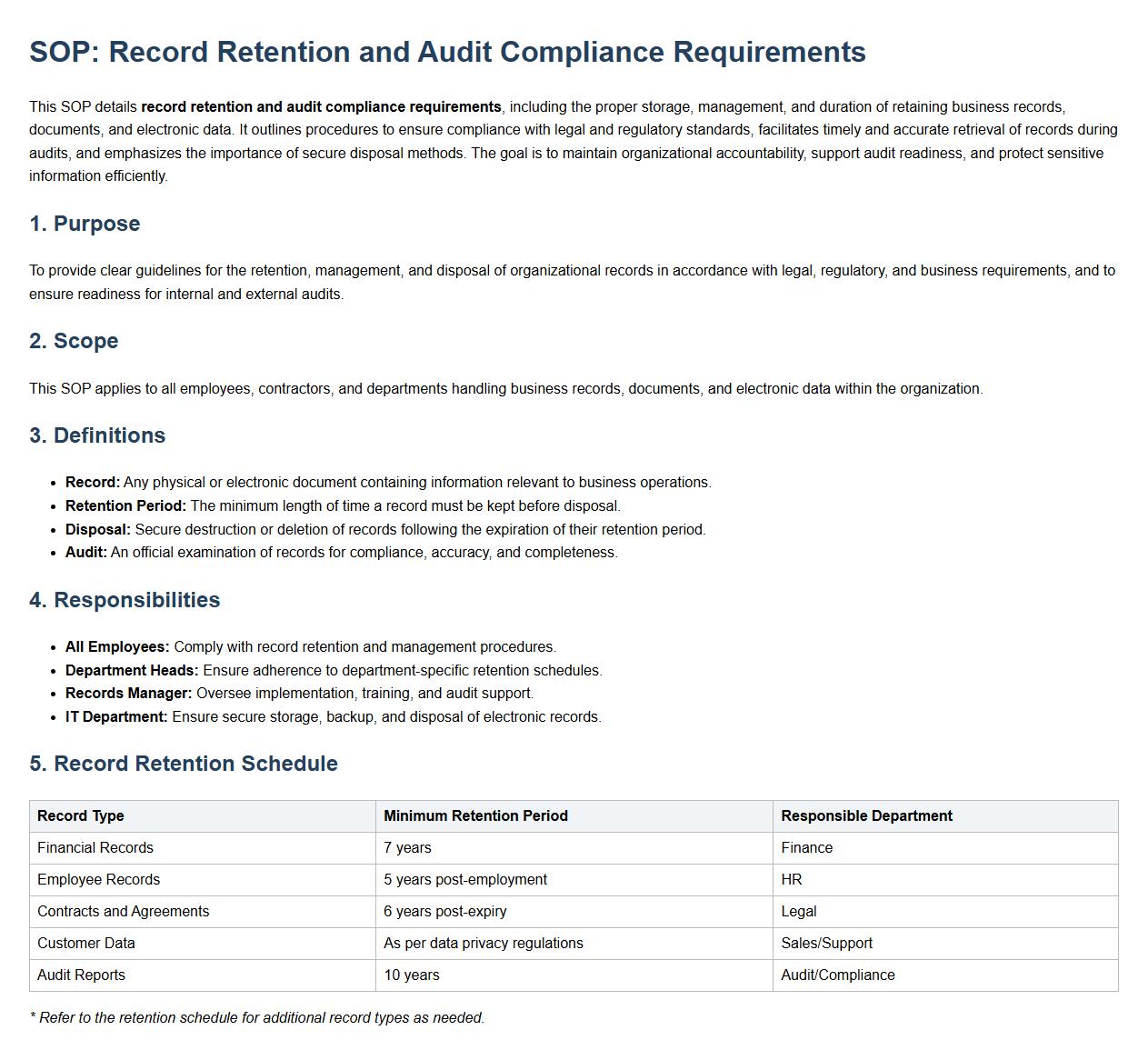

Record retention, audit, and compliance requirements.

This SOP details the record retention, audit, and compliance requirements necessary to maintain accurate documentation, ensure regulatory adherence, and facilitate effective audits. It covers proper record-keeping practices, retention periods for different types of records, audit preparation and execution, compliance monitoring, and corrective action implementation to uphold organizational integrity and meet legal obligations.

Submission of expense report by employee.

This SOP details the submission of expense reports by employees, outlining the procedures for accurate documentation, timely submission, and necessary approvals. It covers the preparation of expense forms, attaching relevant receipts, compliance with company policies, review processes by supervisors, and final reimbursement procedures. The goal is to ensure transparency, accountability, and efficient processing of employee expenses.

Attachment of original receipts and supporting documents.

This SOP details the process for the attachment of original receipts and supporting documents to ensure accurate record-keeping and verification. It outlines the proper handling, organization, and submission of all original financial documents, including receipts, invoices, and related paperwork. The procedure aims to maintain compliance with accounting standards, facilitate audits, and support transparent financial reporting by securely attaching and preserving all necessary documentation.

Completion of expense reimbursement form with accurate details.

This SOP details the process for the completion of expense reimbursement forms with accurate details. It includes guidelines on gathering all necessary receipts and documentation, ensuring correct entry of expense dates, amounts, and descriptions, verifying eligibility of expenses, obtaining required approvals, and submitting the form within stipulated deadlines. This procedure aims to facilitate timely and accurate reimbursement while maintaining compliance with organizational financial policies.

Supervisor/manager review and approval process.

This SOP details the supervisor/manager review and approval process, outlining the steps for reviewing documents, verifying compliance, providing feedback, and granting final approval. It establishes clear roles and responsibilities, ensures consistency and accuracy in decision-making, and promotes accountability. The procedure aims to streamline workflow, maintain quality control, and support effective management oversight in organizational operations.

Verification of expenses against company policy.

This SOP details the process for verification of expenses against company policy, ensuring that all submitted expenses comply with established guidelines. It covers the review procedure for expense reports, validation of receipts and documentation, adherence to allowable expense categories and limits, identification of discrepancies or policy violations, and the approval or rejection workflow. The objective is to maintain financial integrity, prevent fraud, and promote accountability in expense management within the organization.

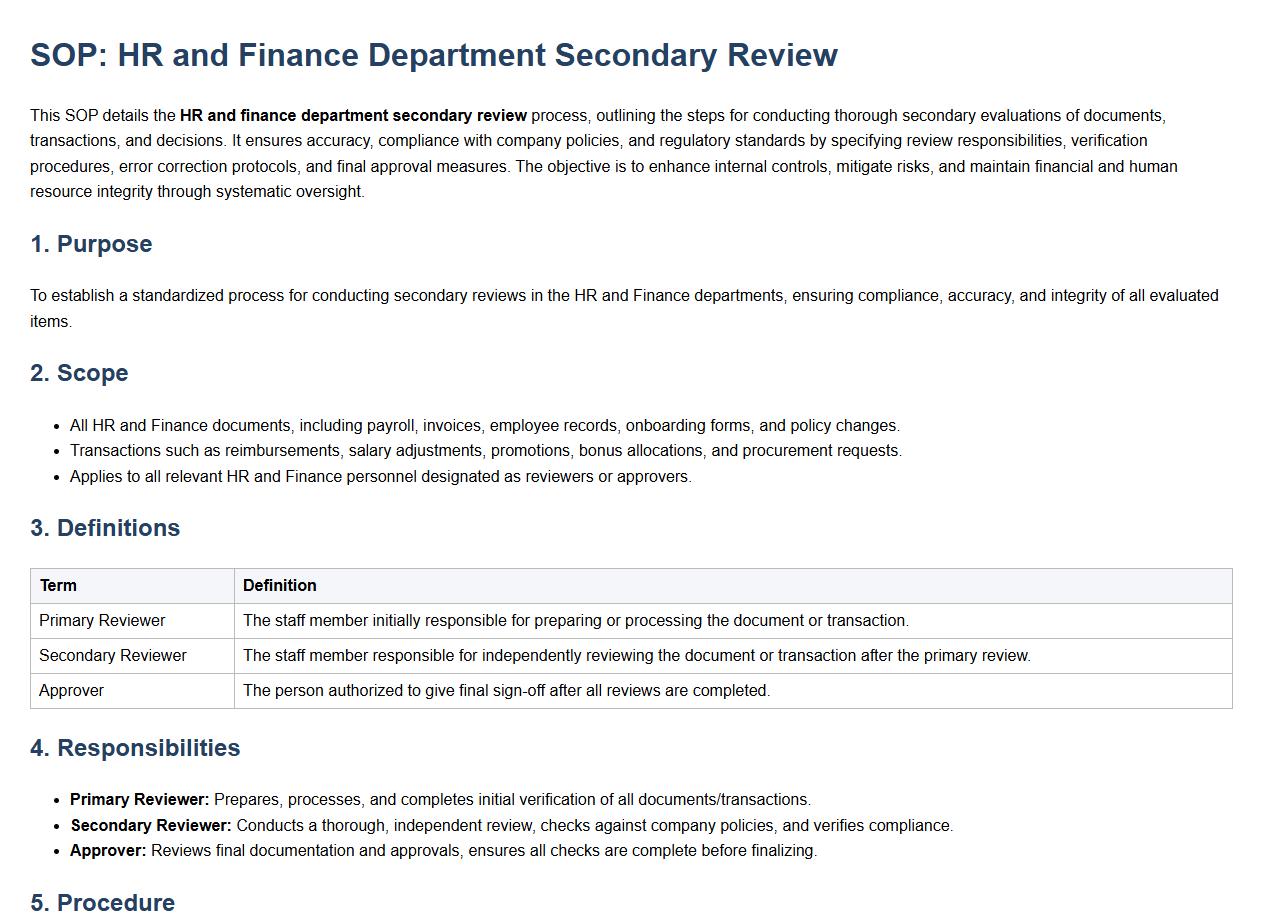

HR or finance department secondary review.

This SOP details the HR and finance department secondary review process, outlining the steps for conducting thorough secondary evaluations of documents, transactions, and decisions. It ensures accuracy, compliance with company policies, and regulatory standards by specifying review responsibilities, verification procedures, error correction protocols, and final approval measures. The objective is to enhance internal controls, mitigate risks, and maintain financial and human resource integrity through systematic oversight.

Data entry of approved expenses into accounting system.

This SOP details the process for data entry of approved expenses into the accounting system, ensuring accuracy and consistency in financial records. It covers the verification of expense approvals, entry of expense details, categorization of expenses, timely posting to the accounting software, and reconciliation procedures to maintain up-to-date and reliable financial data for reporting and auditing purposes.

Notification to employee of approval or denial status.

This SOP details the process for notification to employee of approval or denial status, including timely communication methods, documentation requirements, handling of appeals or queries, and maintaining confidentiality. The procedure ensures that employees are promptly informed about the outcome of their requests or applications, supporting transparency and effective record-keeping within the organization.

Disbursement of funds through preferred payment method.

This SOP details the process for the disbursement of funds through preferred payment methods, covering authorization protocols, verification of payment details, selection of appropriate payment channels, transaction processing, documentation and record-keeping, compliance with financial policies, and audit procedures. The objective is to ensure efficient, secure, and accurate transfer of funds while maintaining transparency and accountability.

Archiving and record-keeping of all related documents.

This SOP details the archiving and record-keeping process for all related documents, ensuring proper organization, secure storage, and easy retrieval of records. It covers document categorization, retention periods, digital and physical storage methods, access control, backup procedures, and compliance with legal and regulatory requirements to maintain accurate and reliable documentation over time.

Expense submission process and timeline.

This SOP defines the expense submission process and timeline, detailing the required steps for employees to submit expense reports accurately and on time. It includes guidelines for documenting expenses, required approvals, submission deadlines, and procedures for handling discrepancies. The objective is to ensure efficient processing and reimbursement of expenses while maintaining compliance with company policies and financial controls.

Required documentation and receipt guidelines.

This SOP details the required documentation and receipt guidelines, including the proper preparation, submission, and retention of receipts, invoices, and related financial documents. It outlines the standards for verifying and approving documents, ensuring compliance with organizational policies, and maintaining accurate records for auditing and reimbursement purposes. The aim is to establish a clear and consistent process for managing documentation to support transparent and efficient financial operations.

Eligibility criteria for reimbursable expenses.

This SOP defines the eligibility criteria for reimbursable expenses, detailing the types of expenses that qualify for reimbursement, documentation requirements, approval processes, and timelines for submission. The objective is to ensure clarity, consistency, and compliance in expense reimbursement to support accurate financial management and employee accountability.

Expense approval workflow and authorization levels.

This SOP defines the expense approval workflow and authorization levels to ensure proper financial control and accountability. It details the step-by-step process for submitting, reviewing, and approving expense requests, including the roles and responsibilities of employees, managers, and finance personnel. The document establishes clear authorization thresholds based on expense amounts, promotes compliance with company policies, and aims to streamline expense management while minimizing errors and unauthorized expenditures.

Expense reporting form completion instructions.

This SOP provides detailed expense reporting form completion instructions, guiding employees through the accurate and timely submission of expense reports. It covers required documentation, proper categorization of expenses, approval workflows, and compliance with company policies to ensure expenses are reported consistently and reimbursed efficiently.

Travel and accommodation expense guidelines.

This SOP provides comprehensive travel and accommodation expense guidelines, detailing the procedures for planning, approving, and reimbursing expenses related to business travel. It includes rules for booking transportation and lodging, allowable expense categories, submission of receipts and documentation, per diem limits, and compliance with organizational budgets and policies. The aim is to ensure consistent, transparent, and cost-effective management of travel expenditures while supporting employee needs during official travel.

Non-reimbursable expense categories.

This SOP defines non-reimbursable expense categories to ensure clarity and consistency in expense reporting. It outlines the types of expenses that employees are not authorized to claim for reimbursement, including personal expenses, fines and penalties, entertainment costs not directly related to business, unauthorized travel expenses, and other costs deemed ineligible by company policy. The purpose is to prevent misuse of company funds and maintain compliance with financial guidelines.

Procedures for lost or missing receipts.

This SOP details the procedures for lost or missing receipts, including steps for reporting, documentation requirements, verification processes, approval protocols, and record-keeping standards. The aim is to maintain accurate financial records, prevent discrepancies, and ensure accountability by implementing a standardized approach to handle lost or missing receipt incidents effectively.

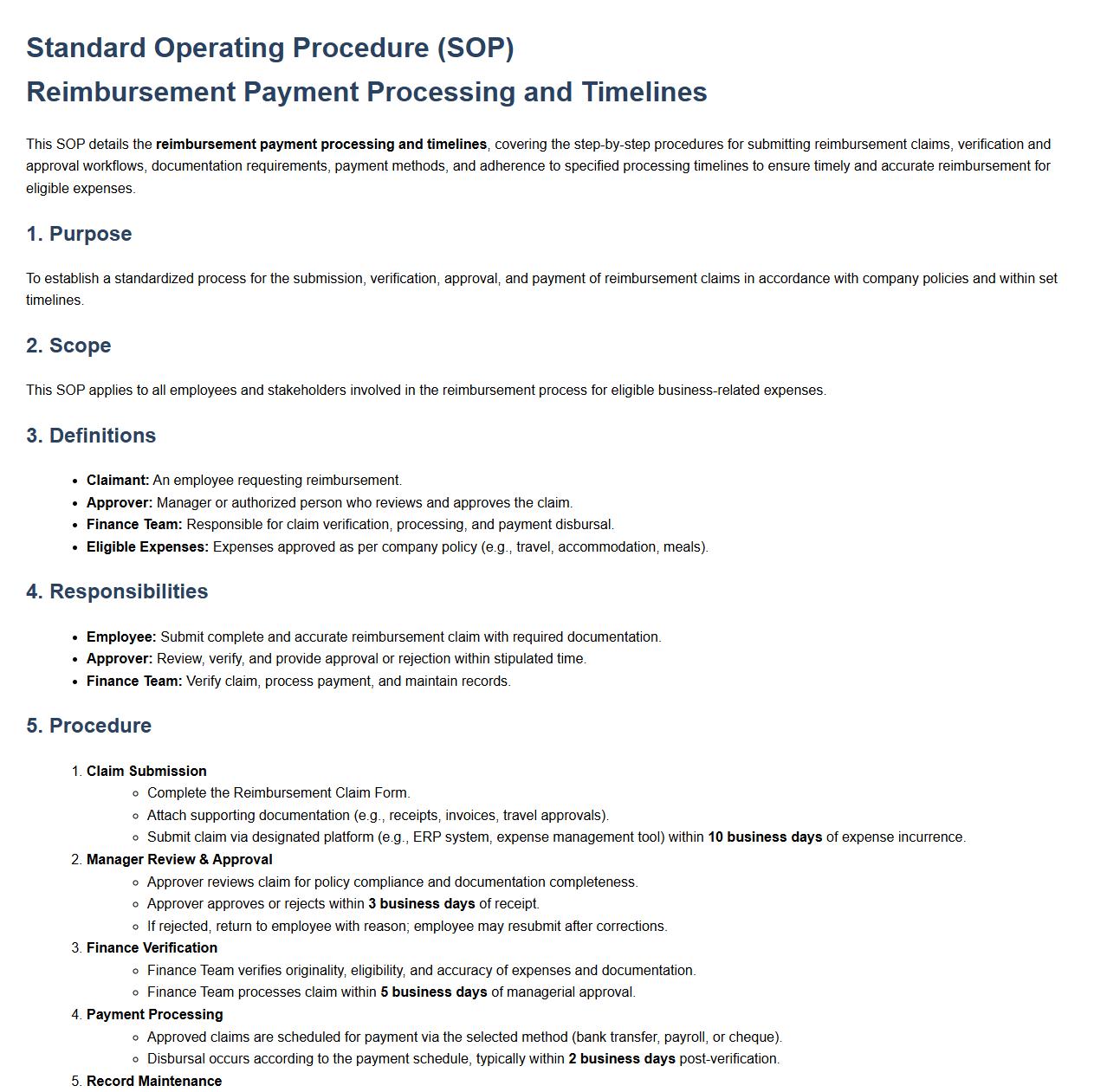

Reimbursement payment processing and timelines.

This SOP details the reimbursement payment processing and timelines, covering the step-by-step procedures for submitting reimbursement claims, verification and approval workflows, documentation requirements, payment methods, and adherence to specified processing timelines to ensure timely and accurate reimbursement for eligible expenses.

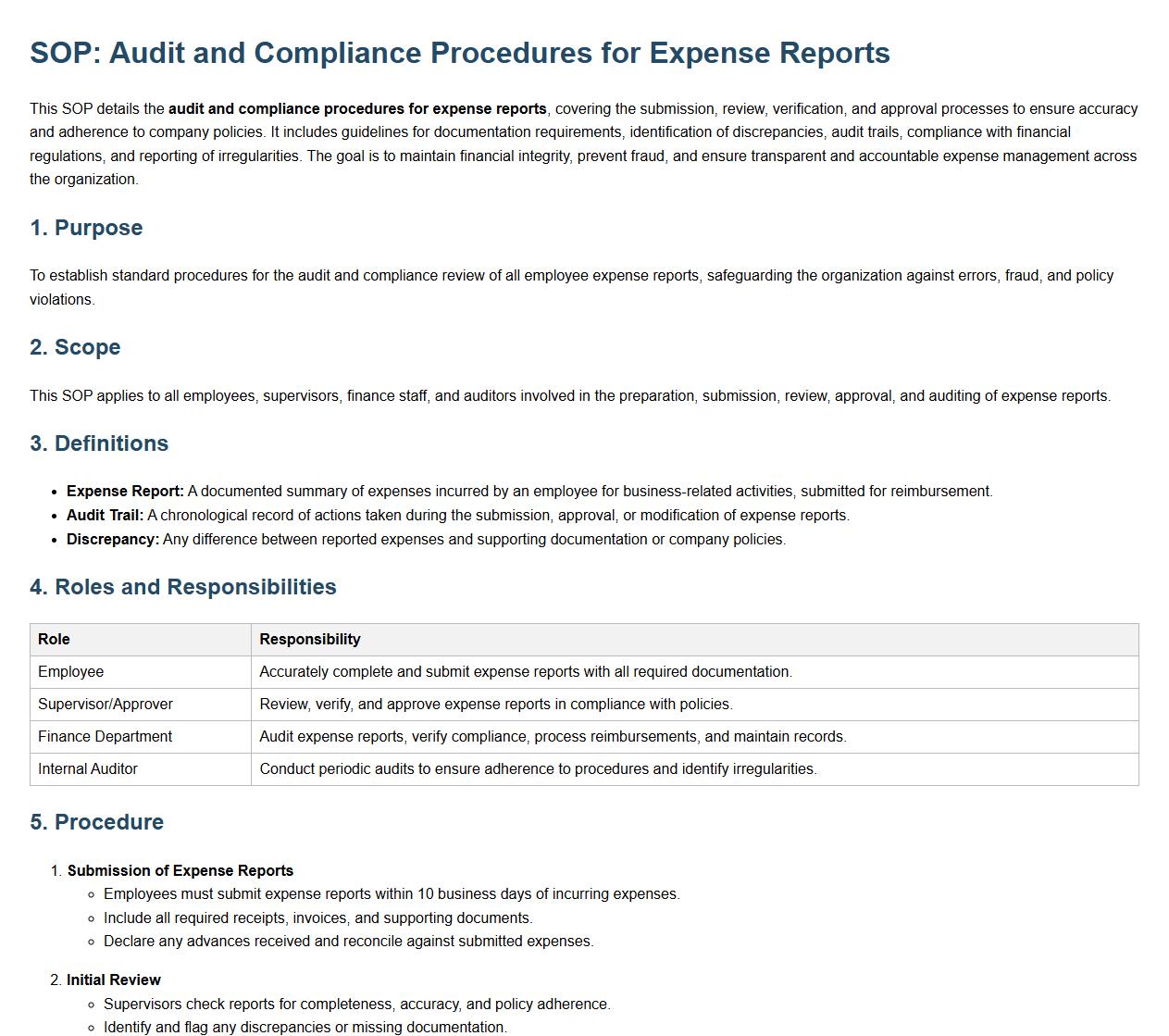

Audit and compliance procedures for expense reports.

This SOP details the audit and compliance procedures for expense reports, covering the submission, review, verification, and approval processes to ensure accuracy and adherence to company policies. It includes guidelines for documentation requirements, identification of discrepancies, audit trails, compliance with financial regulations, and reporting of irregularities. The goal is to maintain financial integrity, prevent fraud, and ensure transparent and accountable expense management across the organization.

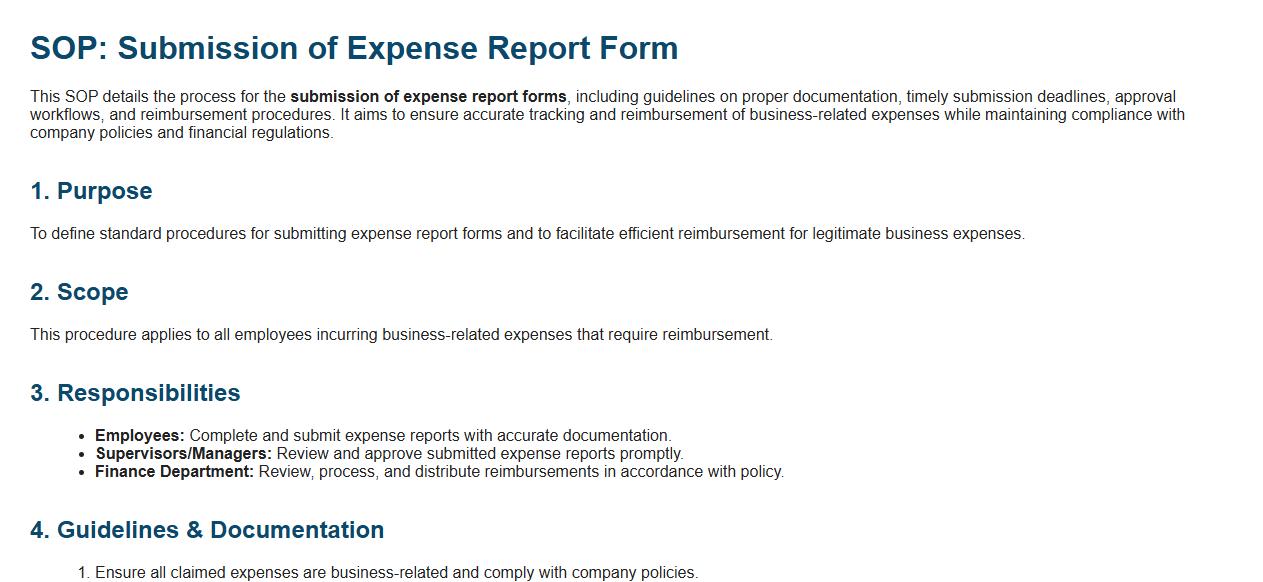

Submission of Expense Report Form.

This SOP details the process for the submission of expense report forms, including guidelines on proper documentation, timely submission deadlines, approval workflows, and reimbursement procedures. It aims to ensure accurate tracking and reimbursement of business-related expenses while maintaining compliance with company policies and financial regulations.

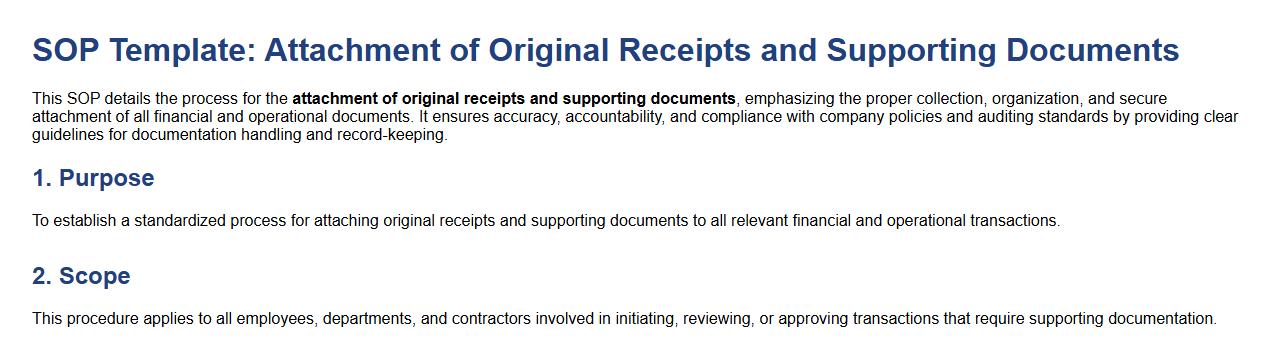

Attachment of Original Receipts and Supporting Documents.

This SOP details the process for the attachment of original receipts and supporting documents, emphasizing the proper collection, organization, and secure attachment of all financial and operational documents. It ensures accuracy, accountability, and compliance with company policies and auditing standards by providing clear guidelines for documentation handling and record-keeping.

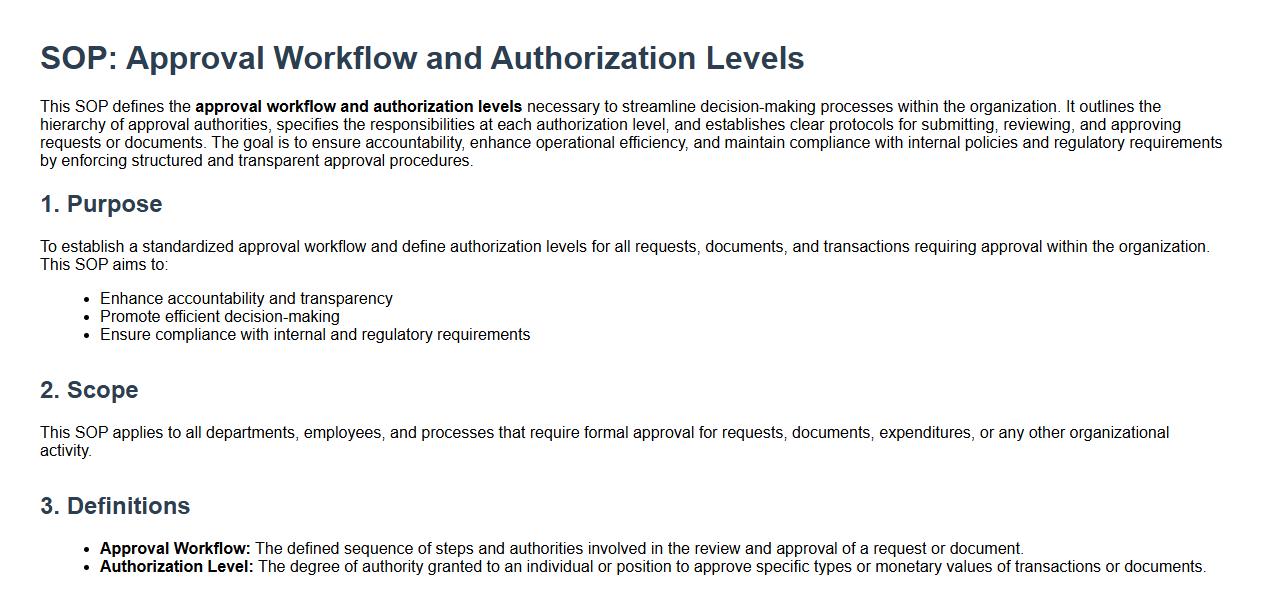

Approval Workflow and Authorization Levels.

This SOP defines the approval workflow and authorization levels necessary to streamline decision-making processes within the organization. It outlines the hierarchy of approval authorities, specifies the responsibilities at each authorization level, and establishes clear protocols for submitting, reviewing, and approving requests or documents. The goal is to ensure accountability, enhance operational efficiency, and maintain compliance with internal policies and regulatory requirements by enforcing structured and transparent approval procedures.

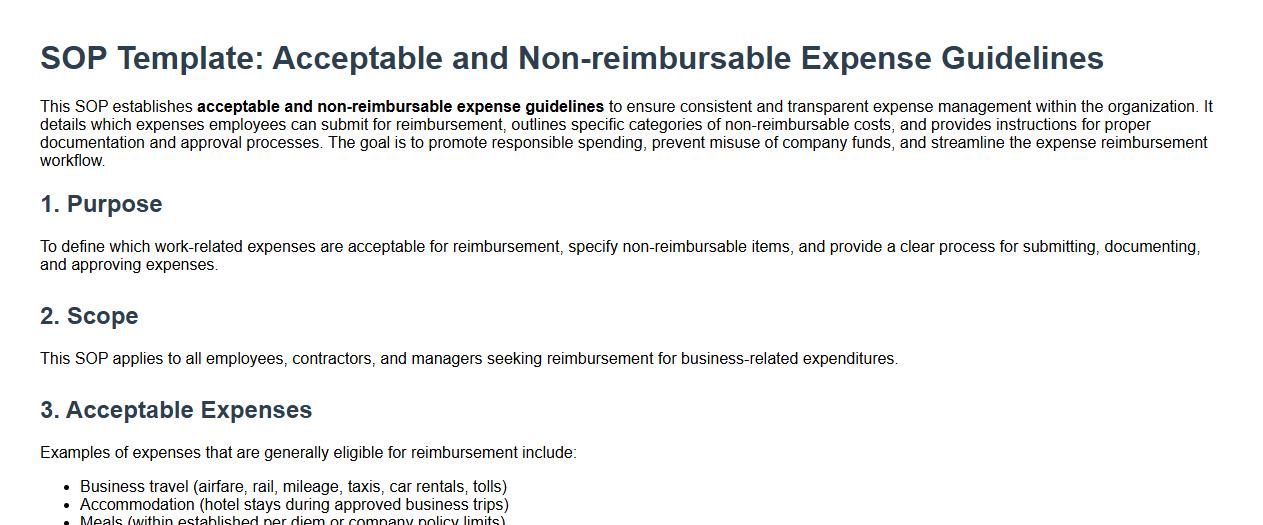

Acceptable and Non-reimbursable Expense Guidelines.

This SOP establishes acceptable and non-reimbursable expense guidelines to ensure consistent and transparent expense management within the organization. It details which expenses employees can submit for reimbursement, outlines specific categories of non-reimbursable costs, and provides instructions for proper documentation and approval processes. The goal is to promote responsible spending, prevent misuse of company funds, and streamline the expense reimbursement workflow.

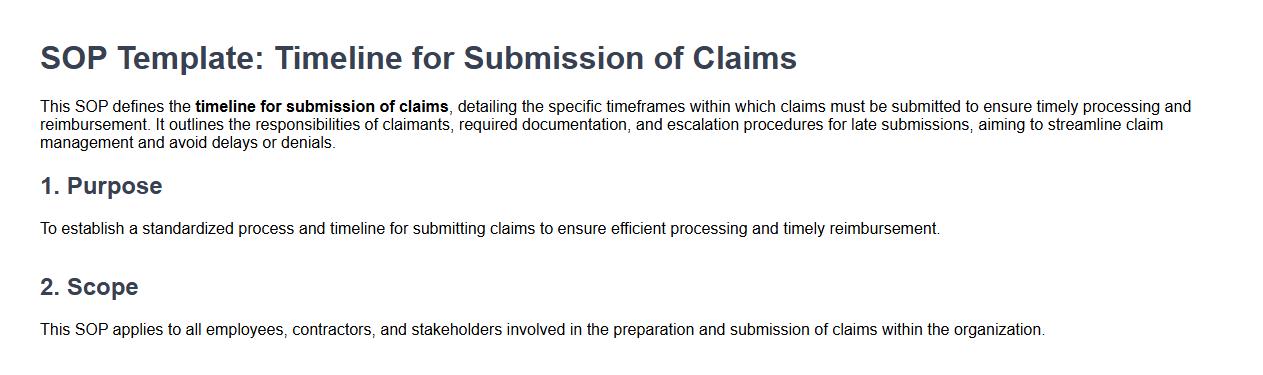

Timeline for Submission of Claims.

This SOP defines the timeline for submission of claims, detailing the specific timeframes within which claims must be submitted to ensure timely processing and reimbursement. It outlines the responsibilities of claimants, required documentation, and escalation procedures for late submissions, aiming to streamline claim management and avoid delays or denials.

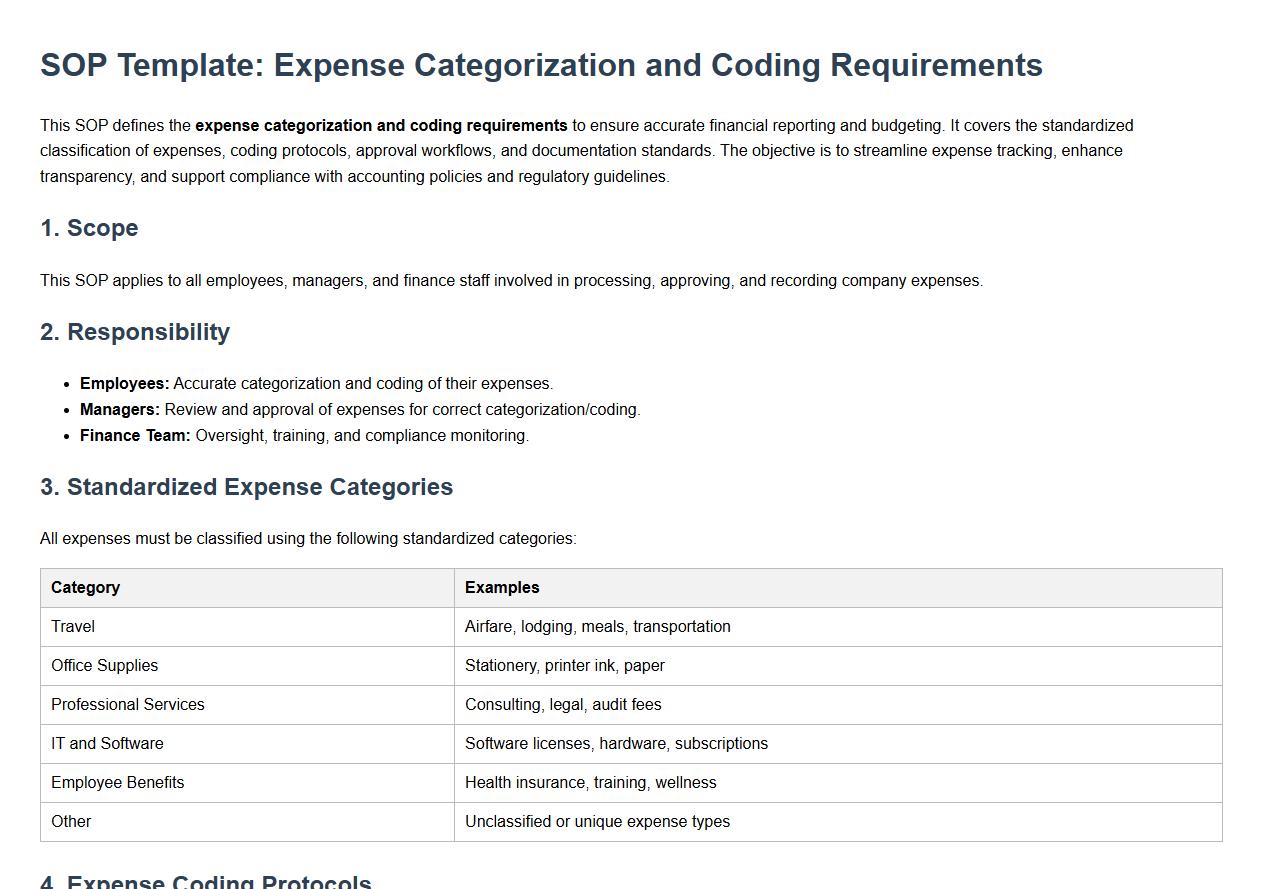

Expense Categorization and Coding Requirements.

This SOP defines the expense categorization and coding requirements to ensure accurate financial reporting and budgeting. It covers the standardized classification of expenses, coding protocols, approval workflows, and documentation standards. The objective is to streamline expense tracking, enhance transparency, and support compliance with accounting policies and regulatory guidelines.

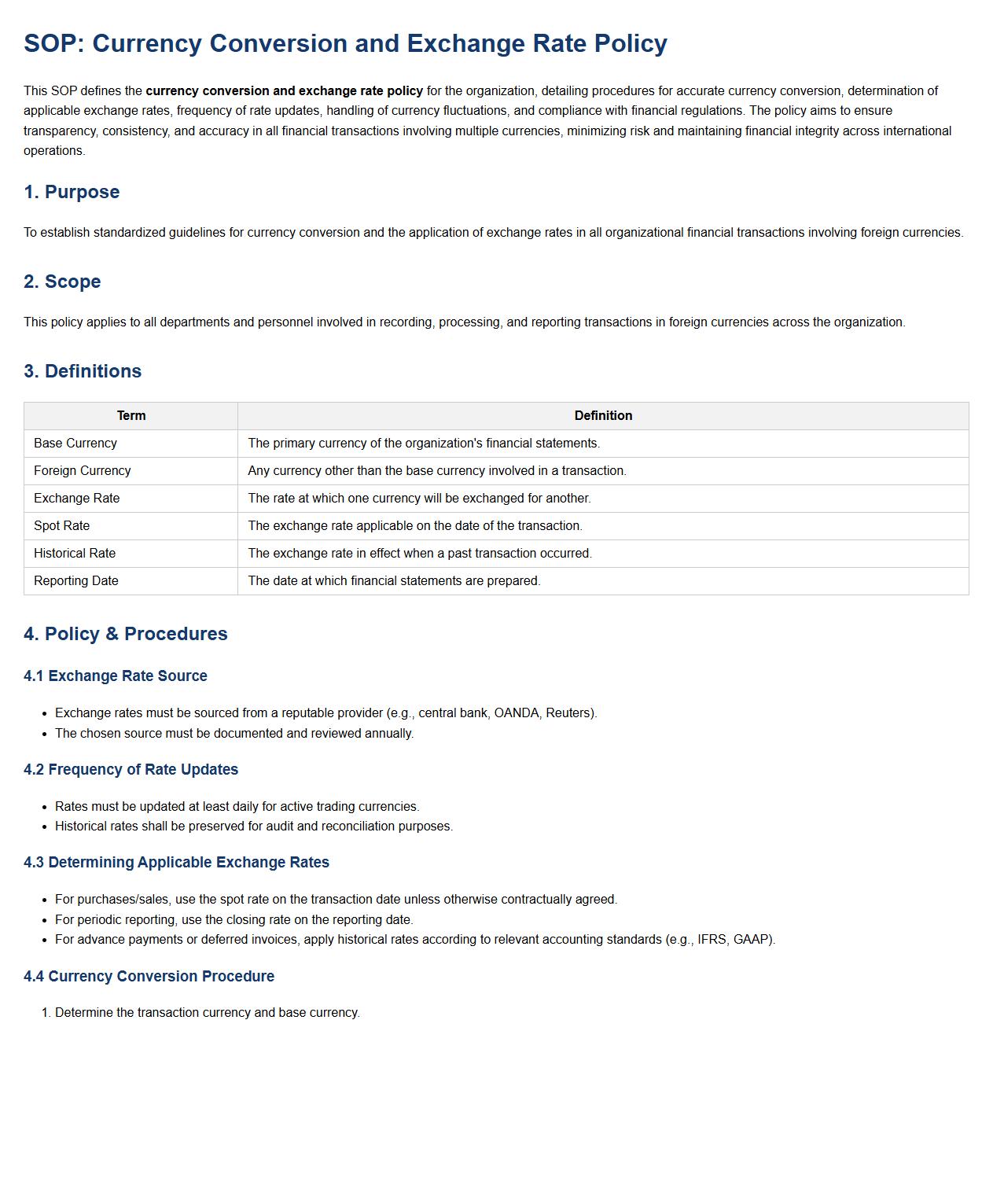

Currency Conversion and Exchange Rate Policy.

This SOP defines the currency conversion and exchange rate policy for the organization, detailing procedures for accurate currency conversion, determination of applicable exchange rates, frequency of rate updates, handling of currency fluctuations, and compliance with financial regulations. The policy aims to ensure transparency, consistency, and accuracy in all financial transactions involving multiple currencies, minimizing risk and maintaining financial integrity across international operations.

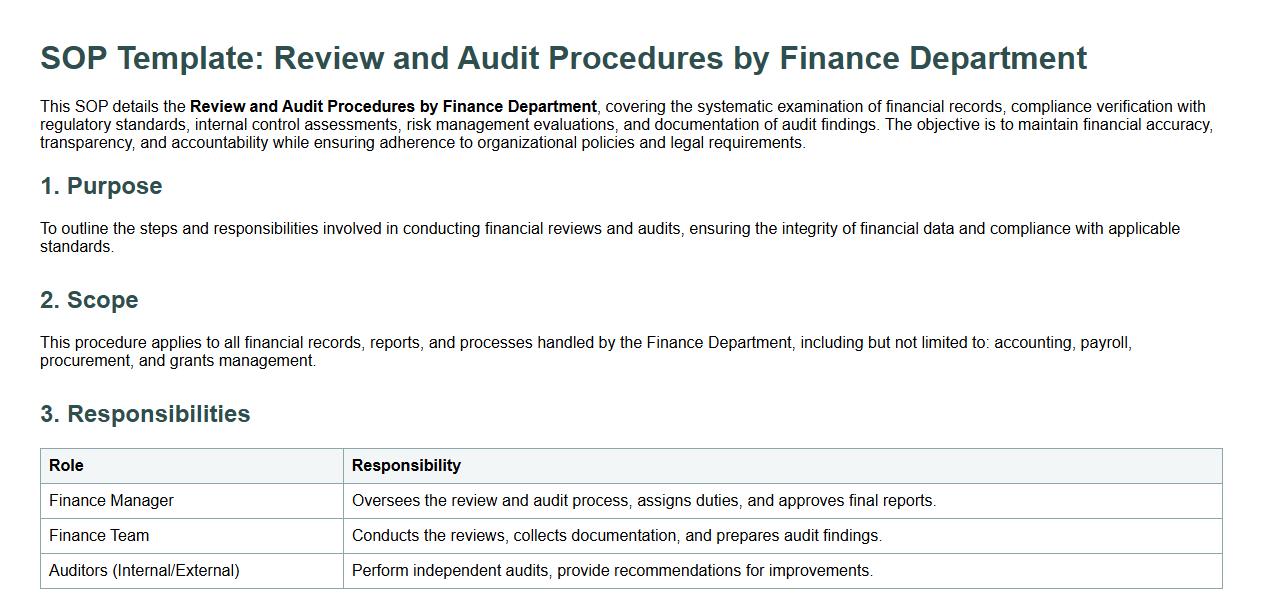

Review and Audit Procedures by Finance Department.

This SOP details the Review and Audit Procedures by Finance Department, covering the systematic examination of financial records, compliance verification with regulatory standards, internal control assessments, risk management evaluations, and documentation of audit findings. The objective is to maintain financial accuracy, transparency, and accountability while ensuring adherence to organizational policies and legal requirements.

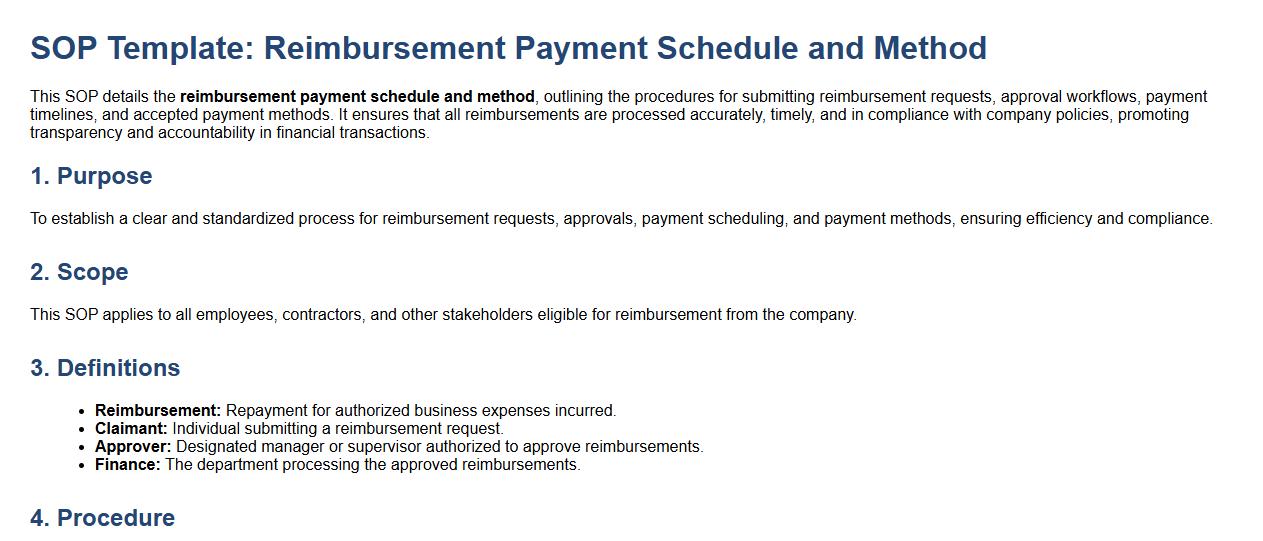

Reimbursement Payment Schedule and Method.

This SOP details the reimbursement payment schedule and method, outlining the procedures for submitting reimbursement requests, approval workflows, payment timelines, and accepted payment methods. It ensures that all reimbursements are processed accurately, timely, and in compliance with company policies, promoting transparency and accountability in financial transactions.

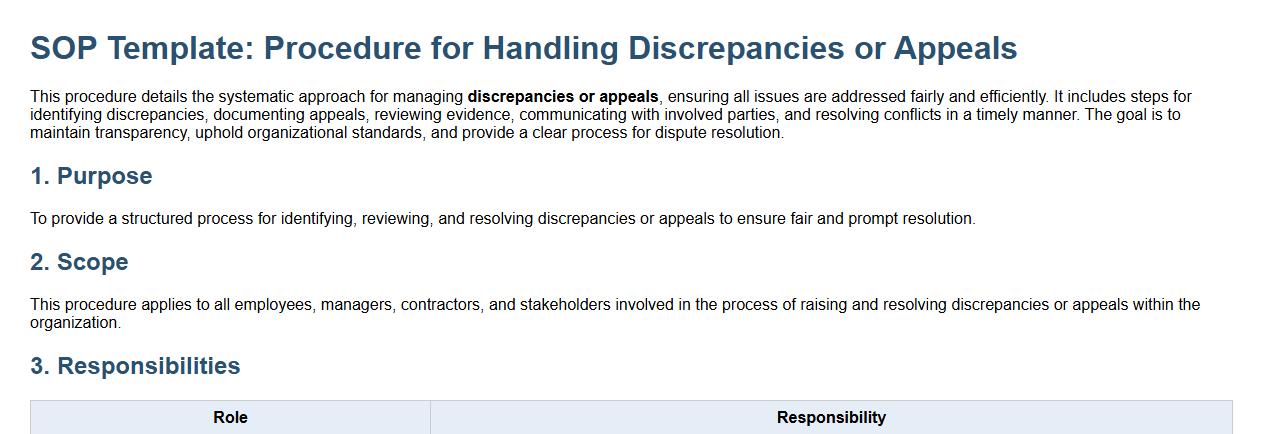

Procedure for Handling Discrepancies or Appeals.

This procedure details the systematic approach for managing discrepancies or appeals, ensuring all issues are addressed fairly and efficiently. It includes steps for identifying discrepancies, documenting appeals, reviewing evidence, communicating with involved parties, and resolving conflicts in a timely manner. The goal is to maintain transparency, uphold organizational standards, and provide a clear process for dispute resolution.

Submission of Expense Report Form.

This SOP details the submission of expense report forms, covering the process for accurately documenting expenses, required approvals, submission deadlines, and supporting documentation requirements. The goal is to ensure timely reimbursement, compliance with company policies, and accurate financial record-keeping by standardizing the expense reporting procedure for all employees.

Attaching original receipts and supporting documents.

This SOP details the procedure for attaching original receipts and supporting documents to ensure accurate financial record-keeping and compliance with auditing standards. It covers the proper handling, labeling, and filing of original receipts, verification of supporting documents, and maintaining an organized system to facilitate easy retrieval and transparency during financial reviews.

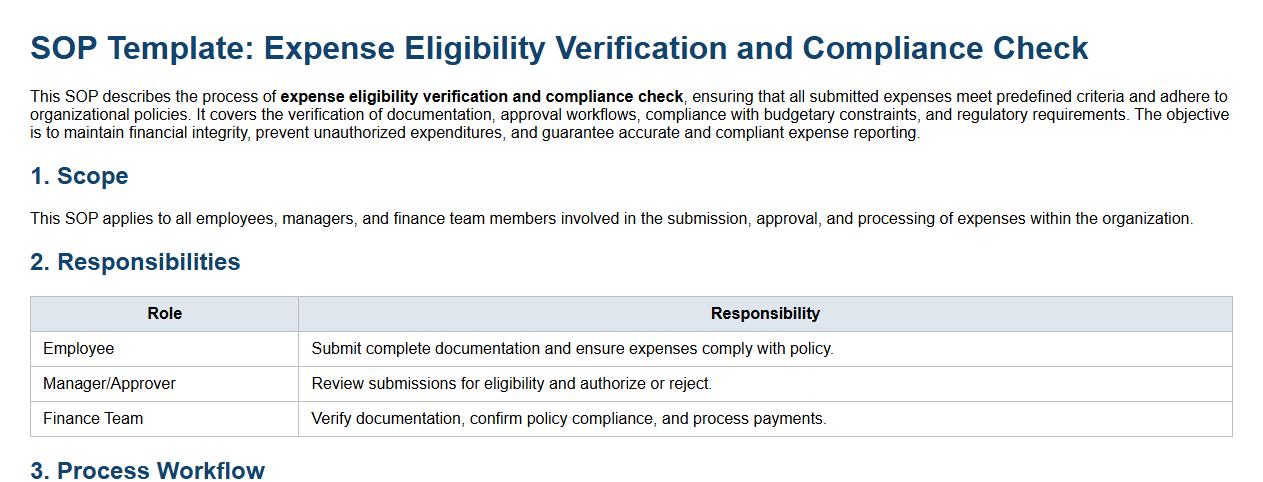

Expense eligibility verification and compliance check.

This SOP describes the process of expense eligibility verification and compliance check, ensuring that all submitted expenses meet predefined criteria and adhere to organizational policies. It covers the verification of documentation, approval workflows, compliance with budgetary constraints, and regulatory requirements. The objective is to maintain financial integrity, prevent unauthorized expenditures, and guarantee accurate and compliant expense reporting.

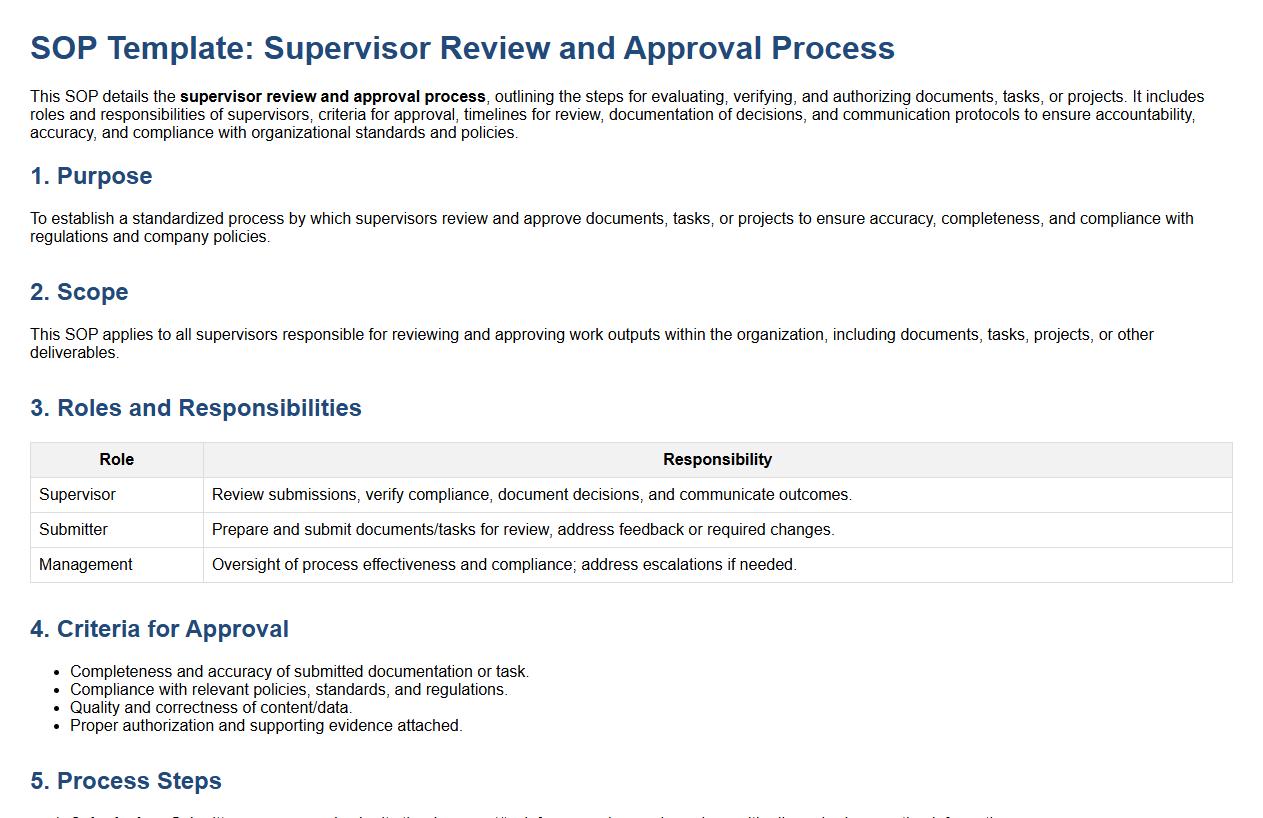

Supervisor review and approval process.

This SOP details the supervisor review and approval process, outlining the steps for evaluating, verifying, and authorizing documents, tasks, or projects. It includes roles and responsibilities of supervisors, criteria for approval, timelines for review, documentation of decisions, and communication protocols to ensure accountability, accuracy, and compliance with organizational standards and policies.

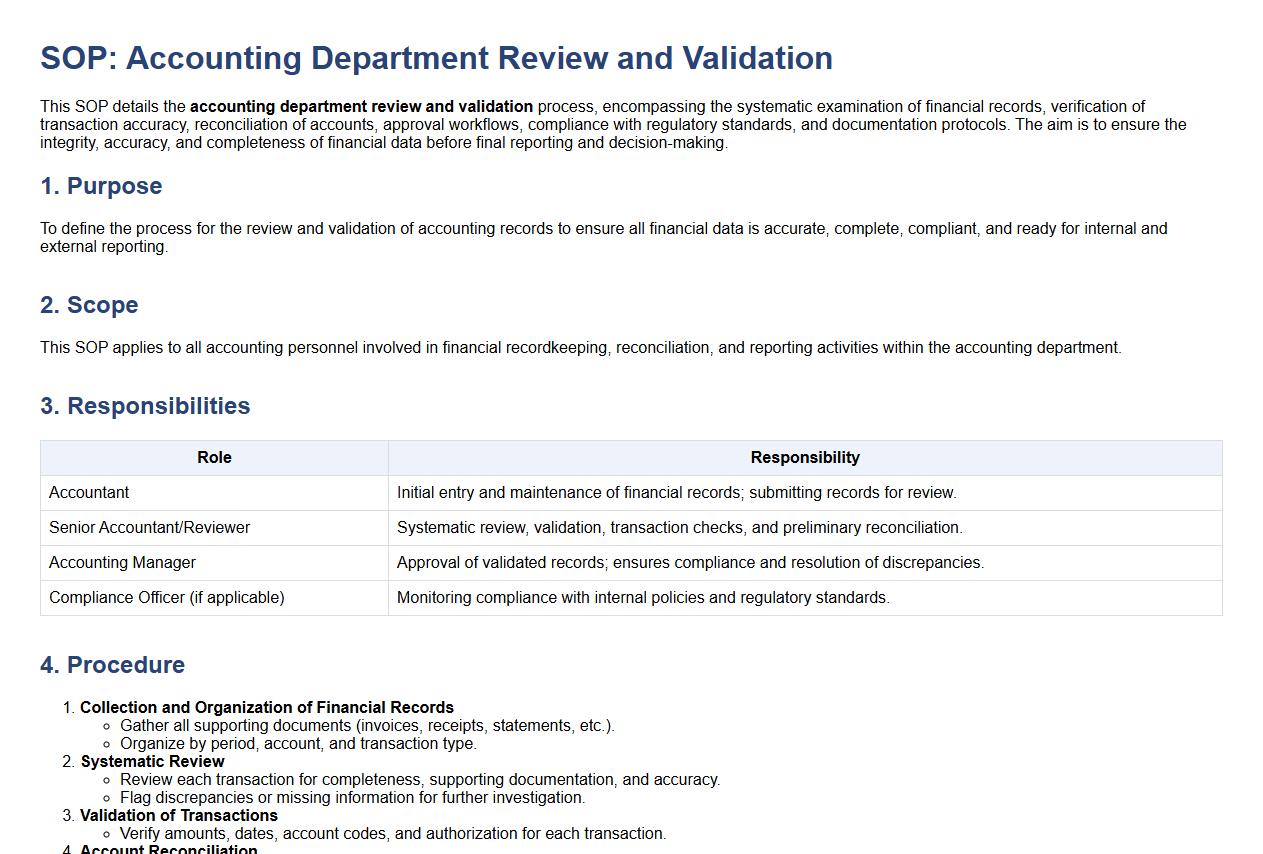

Accounting department review and validation.

This SOP details the accounting department review and validation process, encompassing the systematic examination of financial records, verification of transaction accuracy, reconciliation of accounts, approval workflows, compliance with regulatory standards, and documentation protocols. The aim is to ensure the integrity, accuracy, and completeness of financial data before final reporting and decision-making.

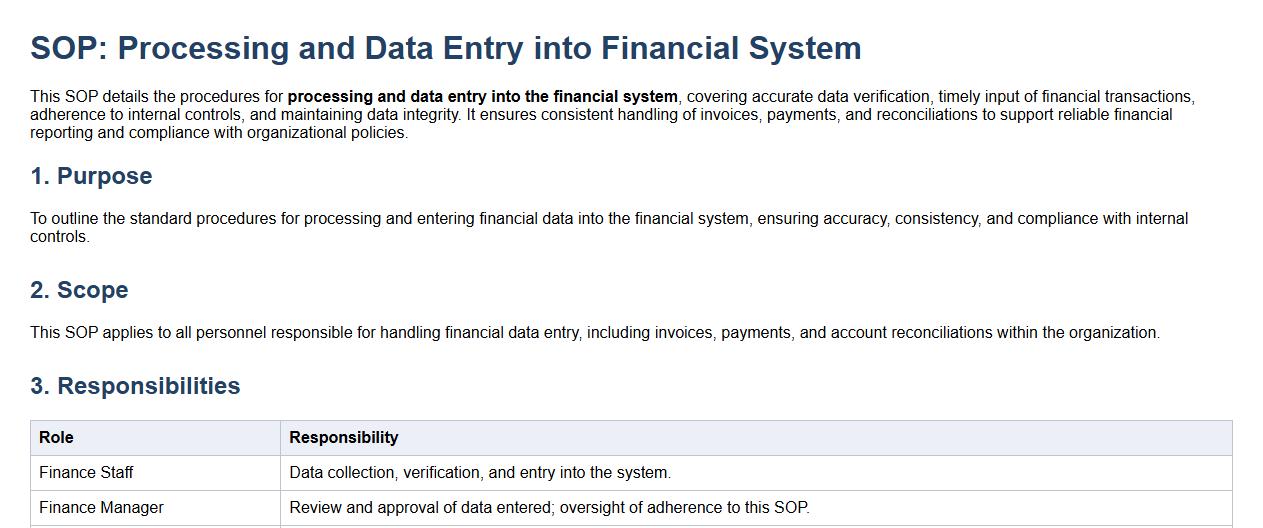

Processing and data entry into financial system.

This SOP details the procedures for processing and data entry into the financial system, covering accurate data verification, timely input of financial transactions, adherence to internal controls, and maintaining data integrity. It ensures consistent handling of invoices, payments, and reconciliations to support reliable financial reporting and compliance with organizational policies.

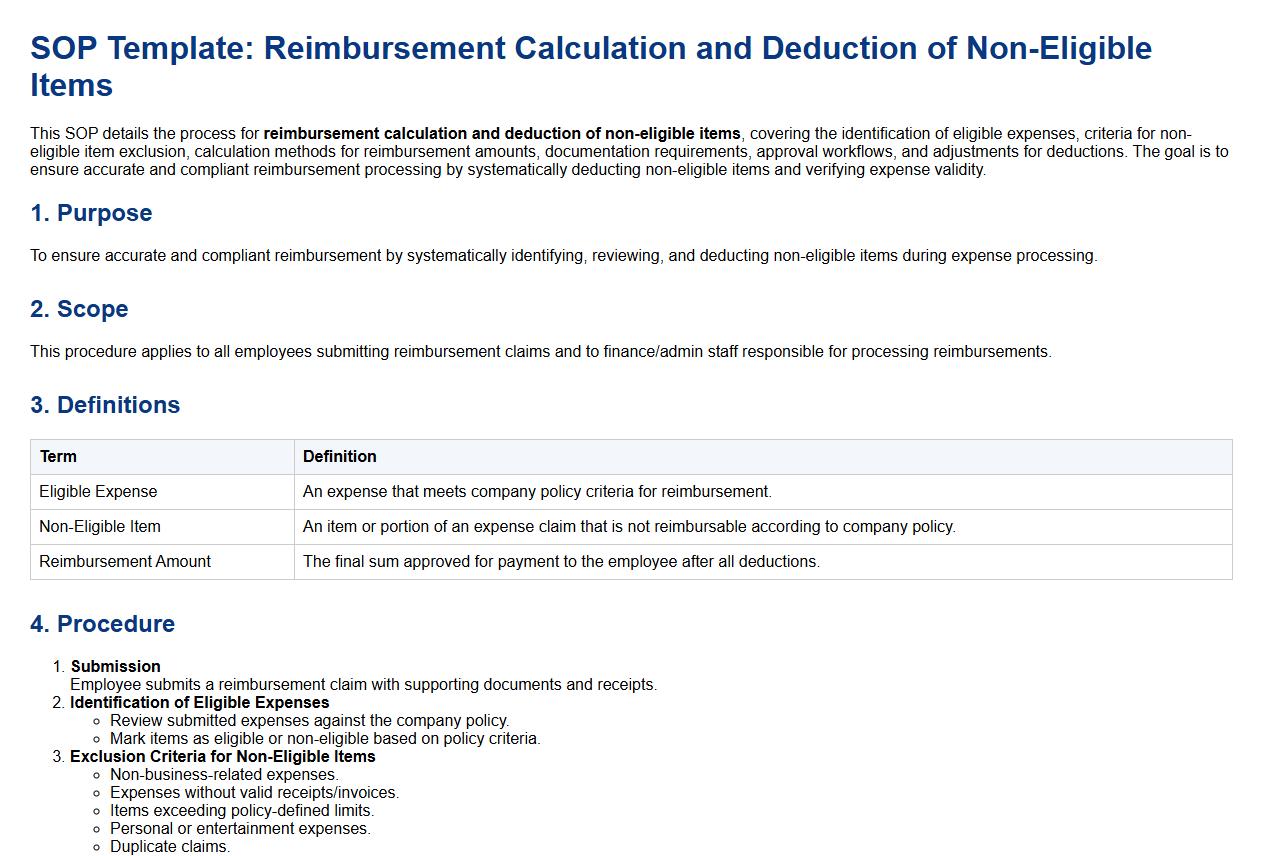

Reimbursement calculation and deduction of non-eligible items.

This SOP details the process for reimbursement calculation and deduction of non-eligible items, covering the identification of eligible expenses, criteria for non-eligible item exclusion, calculation methods for reimbursement amounts, documentation requirements, approval workflows, and adjustments for deductions. The goal is to ensure accurate and compliant reimbursement processing by systematically deducting non-eligible items and verifying expense validity.

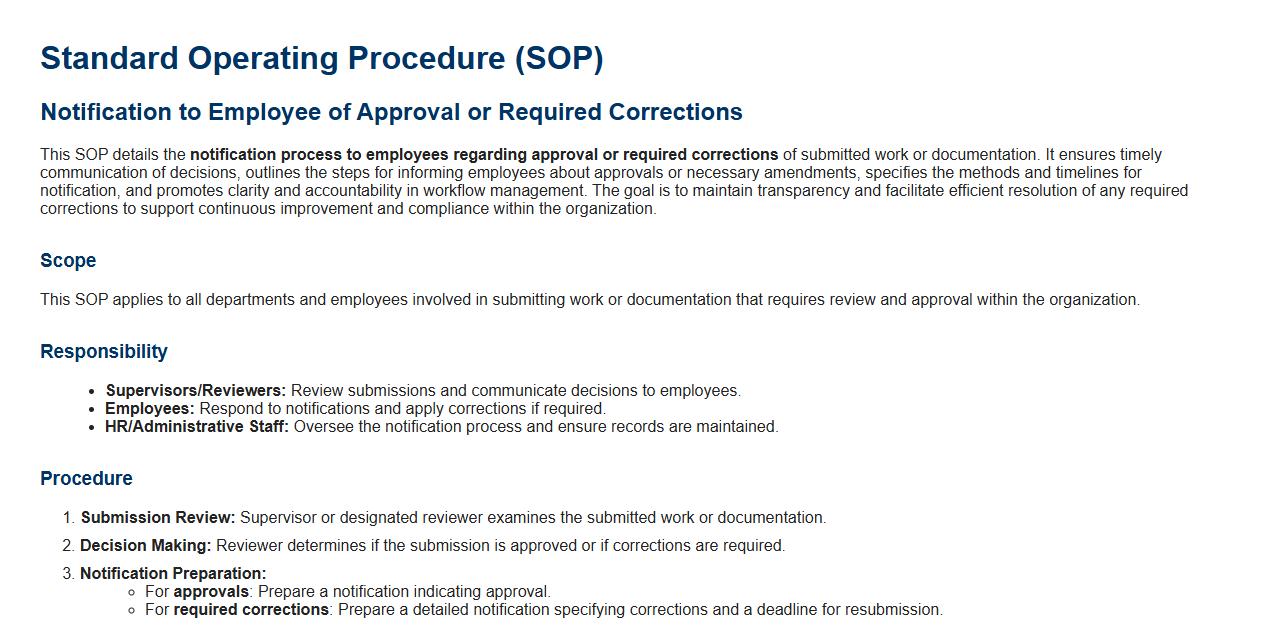

Notification to employee of approval or required corrections.

This SOP details the notification process to employees regarding approval or required corrections of submitted work or documentation. It ensures timely communication of decisions, outlines the steps for informing employees about approvals or necessary amendments, specifies the methods and timelines for notification, and promotes clarity and accountability in workflow management. The goal is to maintain transparency and facilitate efficient resolution of any required corrections to support continuous improvement and compliance within the organization.

Payment processing and fund disbursement.

This SOP details the procedures for payment processing and fund disbursement, covering invoice verification, payment authorization, transaction recording, fund allocation, disbursement methods, internal controls, compliance with financial policies, and audit preparation. The aim is to ensure accurate, timely, and secure handling of payments while maintaining transparency and preventing errors or fraud.

What types of expenses are eligible for reimbursement according to the SOP?

The SOP defines eligible expenses as those directly related to business activities, including travel, accommodation, meals, and office supplies. Personal expenses are explicitly excluded from reimbursement. Only costs that are reasonable, necessary, and documented can be claimed back.

What is the required documentation that employees must submit when requesting reimbursement?

Employees must provide original receipts or electronic proof of payment for all claimed expenses. A completed expense report form detailing the nature and purpose of each expense is also mandatory. Without proper documentation, reimbursement requests will not be processed.

What is the timeline for submitting and processing expense reimbursement requests?

Reimbursement requests must be submitted within 30 days from the date the expense was incurred. The review and processing timeframe typically takes up to 15 business days, ensuring timely payment. Delays in submission may lead to claim rejection or deferred reimbursement.

Who is responsible for reviewing and approving employee expense claims as per the SOP?

The employee's immediate supervisor or manager is primarily responsible for reviewing and approving expense claims. Additionally, the finance department performs a secondary verification to ensure compliance with policies. This dual review process helps maintain accountability and accuracy.

What are the specified approval limits and exceptions outlined in the document?

The SOP outlines approval limits based on expense categories and managerial levels, with higher amounts requiring senior management authorization. Exceptions to standard limits may be granted in special circumstances but must be documented and justified. Adherence to these limits prevents unauthorized spending and budget overruns.