A SOP template for invoice processing ensures a standardized approach to handling invoices, improving accuracy and efficiency. It outlines clear steps for verifying, approving, and recording invoices to streamline accounts payable. Utilizing such a template minimizes errors and accelerates payment cycles.

Invoice receipt and documentation procedures.

This SOP details the invoice receipt and documentation procedures, covering the systematic process for receiving, verifying, and recording invoices, ensuring accuracy and compliance with company policies. It includes steps for validating invoice details against purchase orders, proper filing and storage methods, handling discrepancies or disputes, and maintaining a clear audit trail for financial accountability and timely payment processing.

Invoice data verification and matching with purchase orders.

This SOP details the process of invoice data verification and matching with purchase orders, including steps for reviewing invoice accuracy, cross-checking invoice details against purchase orders, validating quantities and prices, identifying discrepancies, obtaining necessary approvals, and ensuring timely and accurate payment processing. The goal is to maintain financial accuracy, prevent payment errors, and support efficient accounts payable operations.

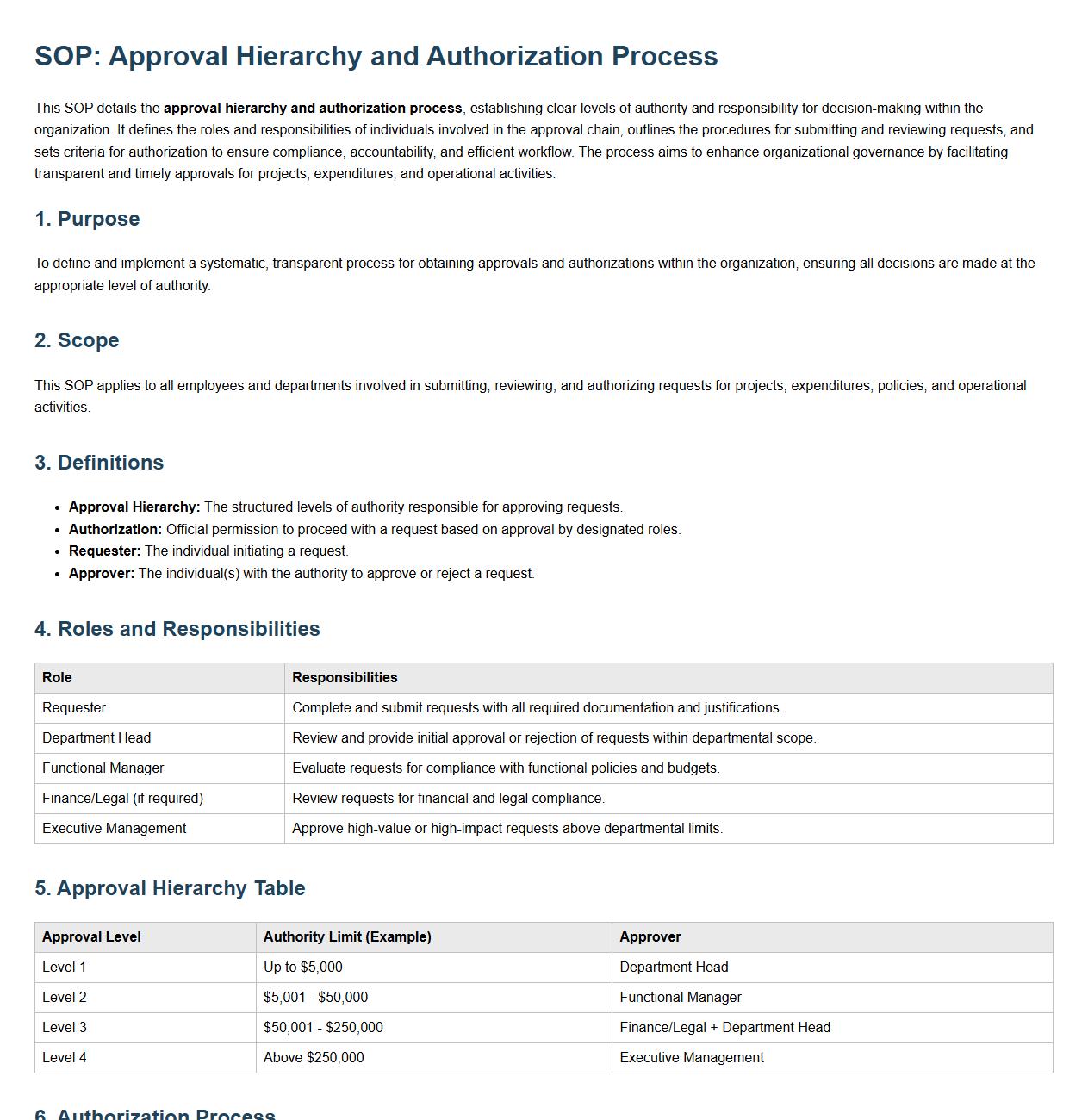

Approval hierarchy and authorization process.

This SOP details the approval hierarchy and authorization process, establishing clear levels of authority and responsibility for decision-making within the organization. It defines the roles and responsibilities of individuals involved in the approval chain, outlines the procedures for submitting and reviewing requests, and sets criteria for authorization to ensure compliance, accountability, and efficient workflow. The process aims to enhance organizational governance by facilitating transparent and timely approvals for projects, expenditures, and operational activities.

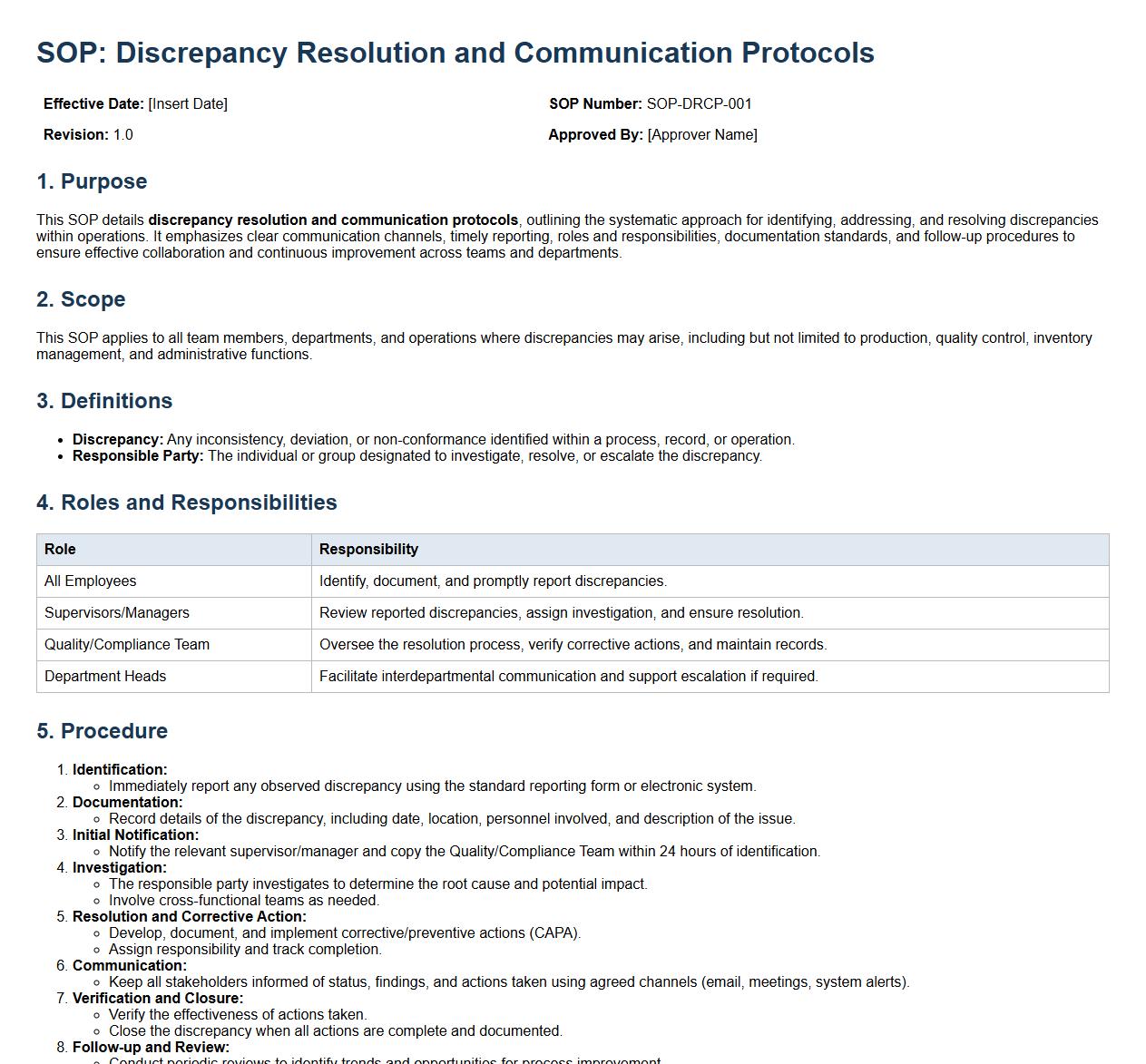

Discrepancy resolution and communication protocols.

This SOP details discrepancy resolution and communication protocols, outlining the systematic approach for identifying, addressing, and resolving discrepancies within operations. It emphasizes clear communication channels, timely reporting, roles and responsibilities, documentation standards, and follow-up procedures to ensure effective collaboration and continuous improvement across teams and departments.

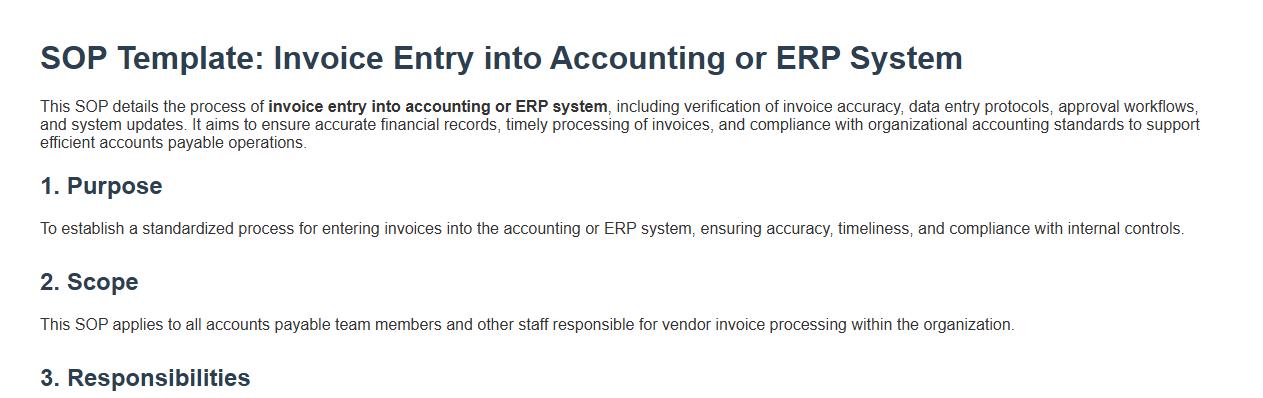

Invoice entry into accounting or ERP system.

This SOP details the process of invoice entry into accounting or ERP system, including verification of invoice accuracy, data entry protocols, approval workflows, and system updates. It aims to ensure accurate financial records, timely processing of invoices, and compliance with organizational accounting standards to support efficient accounts payable operations.

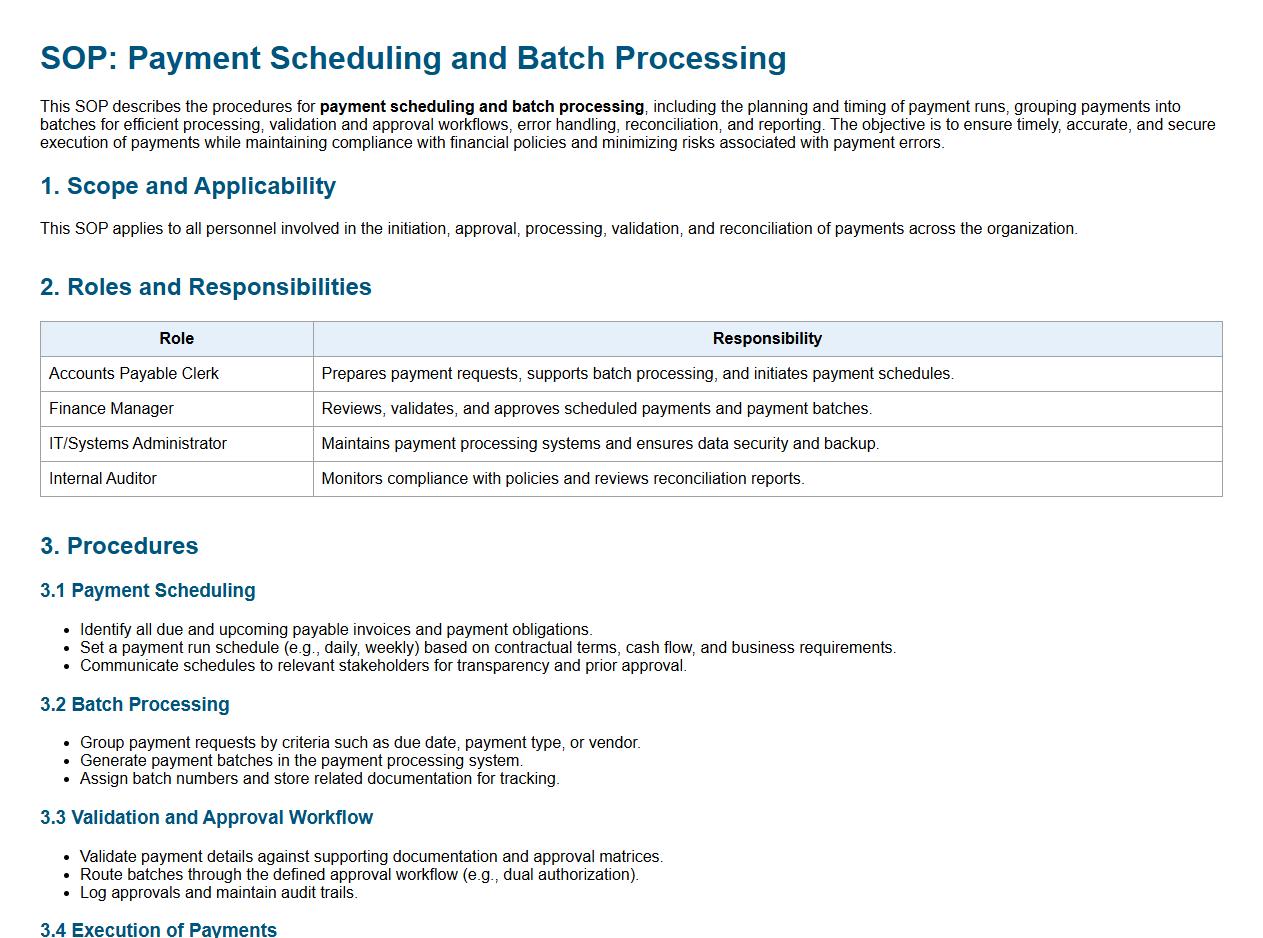

Payment scheduling and batch processing.

This SOP describes the procedures for payment scheduling and batch processing, including the planning and timing of payment runs, grouping payments into batches for efficient processing, validation and approval workflows, error handling, reconciliation, and reporting. The objective is to ensure timely, accurate, and secure execution of payments while maintaining compliance with financial policies and minimizing risks associated with payment errors.

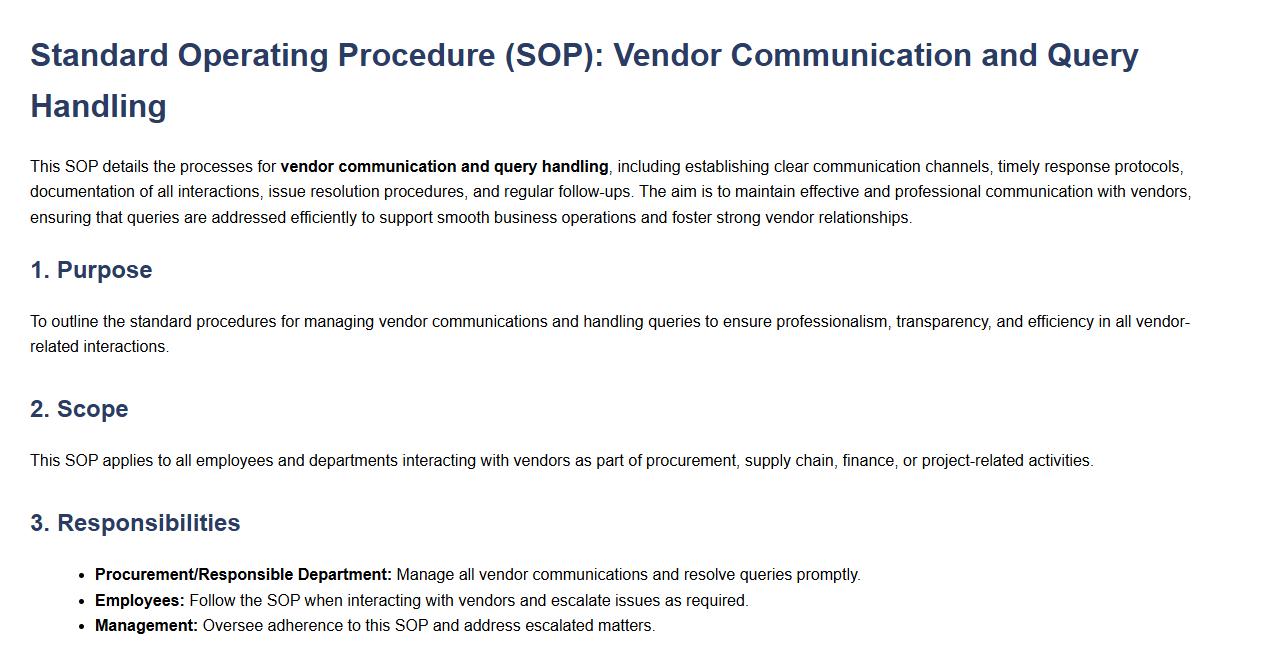

Vendor communication and query handling.

This SOP details the processes for vendor communication and query handling, including establishing clear communication channels, timely response protocols, documentation of all interactions, issue resolution procedures, and regular follow-ups. The aim is to maintain effective and professional communication with vendors, ensuring that queries are addressed efficiently to support smooth business operations and foster strong vendor relationships.

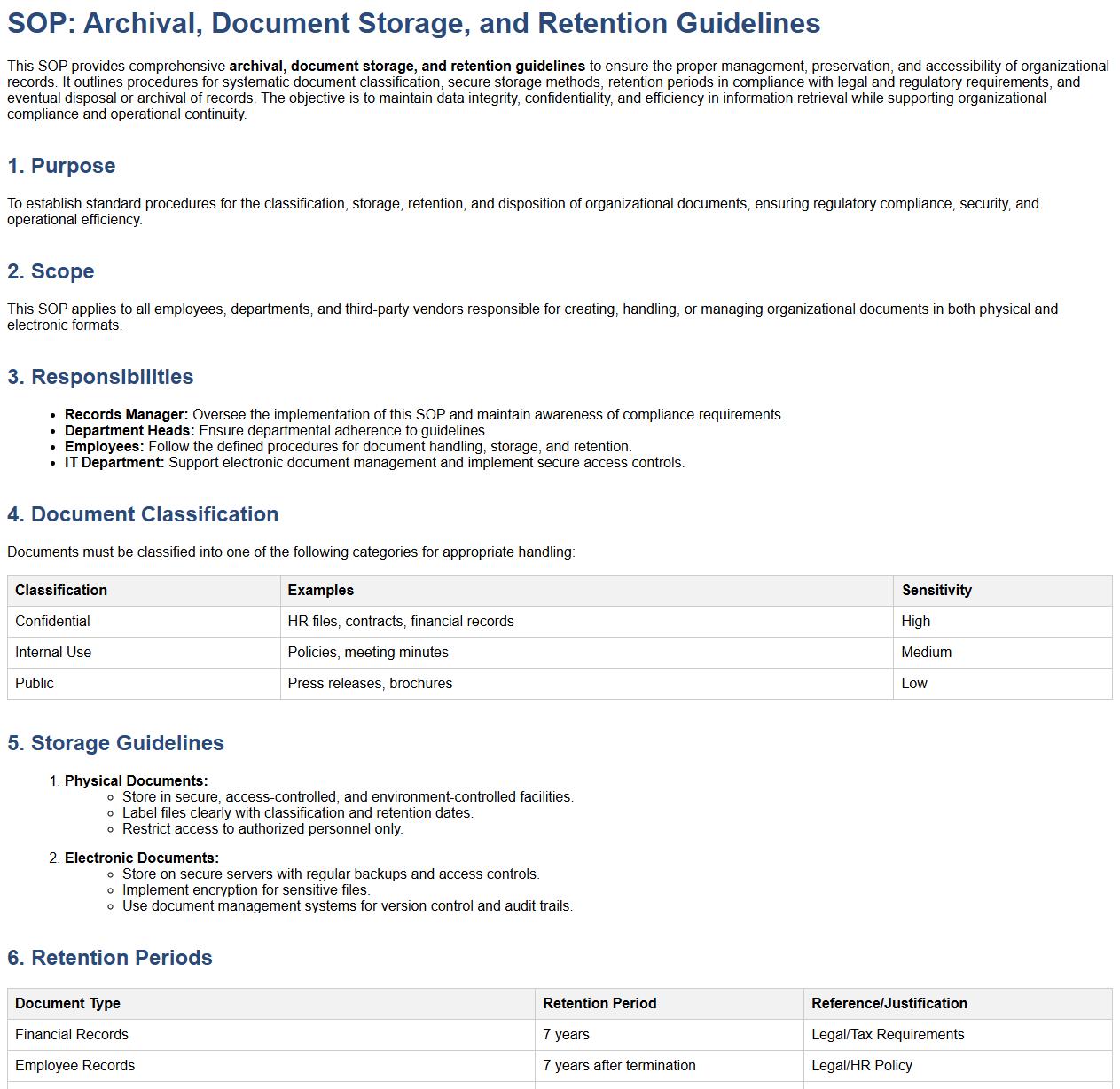

Archival, document storage, and retention guidelines.

This SOP provides comprehensive archival, document storage, and retention guidelines to ensure the proper management, preservation, and accessibility of organizational records. It outlines procedures for systematic document classification, secure storage methods, retention periods in compliance with legal and regulatory requirements, and eventual disposal or archival of records. The objective is to maintain data integrity, confidentiality, and efficiency in information retrieval while supporting organizational compliance and operational continuity.

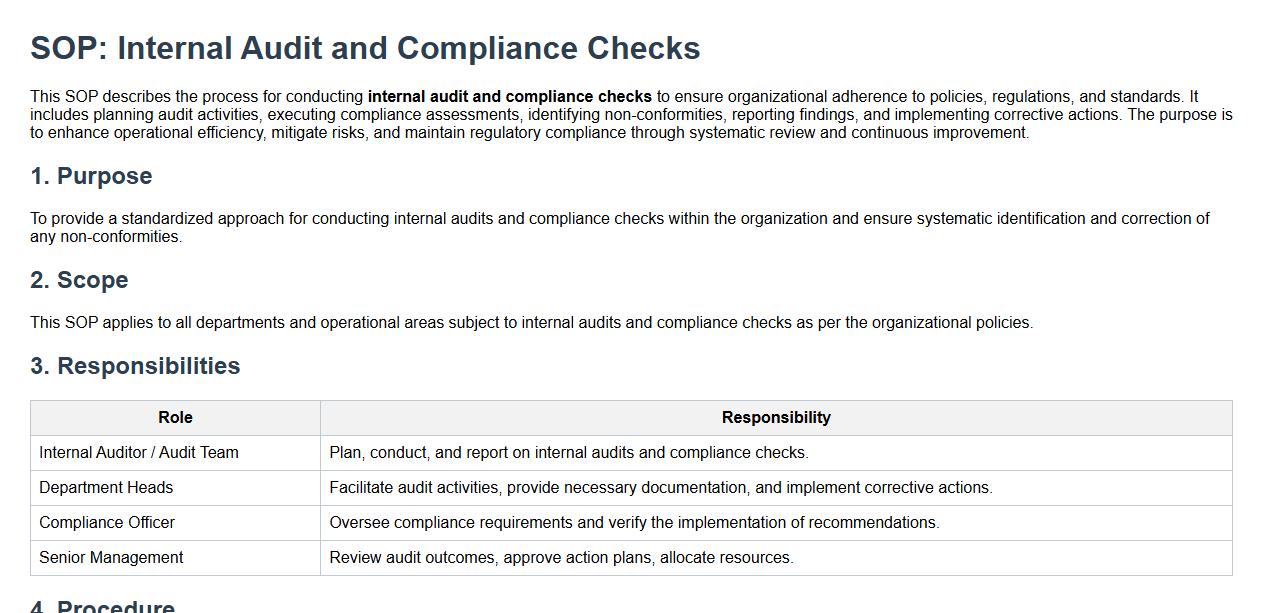

Internal audit and compliance checks.

This SOP describes the process for conducting internal audit and compliance checks to ensure organizational adherence to policies, regulations, and standards. It includes planning audit activities, executing compliance assessments, identifying non-conformities, reporting findings, and implementing corrective actions. The purpose is to enhance operational efficiency, mitigate risks, and maintain regulatory compliance through systematic review and continuous improvement.

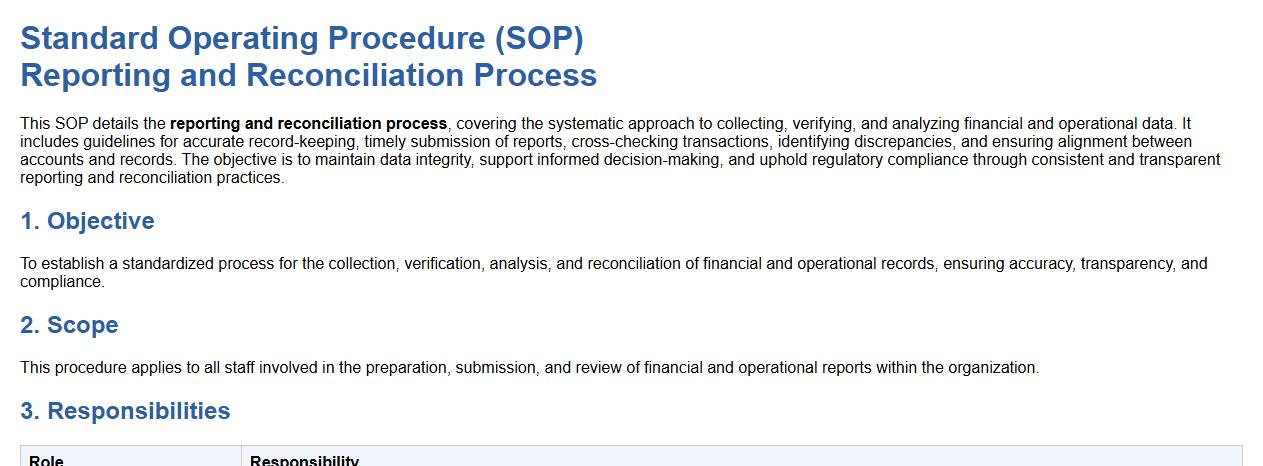

Reporting and reconciliation process.

This SOP details the reporting and reconciliation process, covering the systematic approach to collecting, verifying, and analyzing financial and operational data. It includes guidelines for accurate record-keeping, timely submission of reports, cross-checking transactions, identifying discrepancies, and ensuring alignment between accounts and records. The objective is to maintain data integrity, support informed decision-making, and uphold regulatory compliance through consistent and transparent reporting and reconciliation practices.

What are the essential steps outlined in the SOP for invoice receipt, verification, and approval?

The SOP emphasizes the structured process for invoice management starting with the receipt of invoices from vendors. Each invoice undergoes a thorough verification against purchase orders and delivery receipts to ensure accuracy. Finally, the invoice proceeds to the approval stage where authorized personnel validate and approve payment.

Which supporting documents and data are required to accompany each invoice according to the SOP?

Every invoice must be accompanied by purchase orders and delivery confirmations that validate the transaction. Additional required documents include contract agreements and proof of services or goods received. This comprehensive documentation forms a critical part of the invoice verification process.

What are the defined timelines and escalation procedures for exceptions or discrepancies in invoice processing?

The SOP mandates strict timeline adherence for invoice processing, typically within 30 days of receipt. In case of discrepancies, invoices are flagged and sent through a formal escalation procedure to the finance manager for resolution. Persistent issues are escalated further to senior management to ensure timely corrective action.

Who are the authorized personnel responsible for each stage in the invoice processing workflow as per the SOP?

The SOP clearly defines that the accounts payable team handles receipt and initial verification of invoices. Approval responsibility lies with designated department heads or project managers who confirm service or product delivery. Final payment authorization is performed by the finance controller or authorized signatories.

How does the SOP ensure compliance with regulatory, audit, and internal control requirements for invoice management?

The SOP incorporates regulatory standards and audit trails as a mandatory part of invoice documentation. It enforces internal controls such as segregation of duties, authorization protocols, and systematic record-keeping. These measures provide transparency and ensure compliance with legal and financial auditing requirements.