A SOP Template for Travel and Expense Reimbursement streamlines the process of submitting, reviewing, and approving travel-related expenses, ensuring consistency and compliance with company policies. This template outlines clear steps for employees to document expenses, attach receipts, and meet deadlines, reducing errors and delays. Implementing this standard procedure increases transparency and accelerates reimbursement cycles for business travel costs.

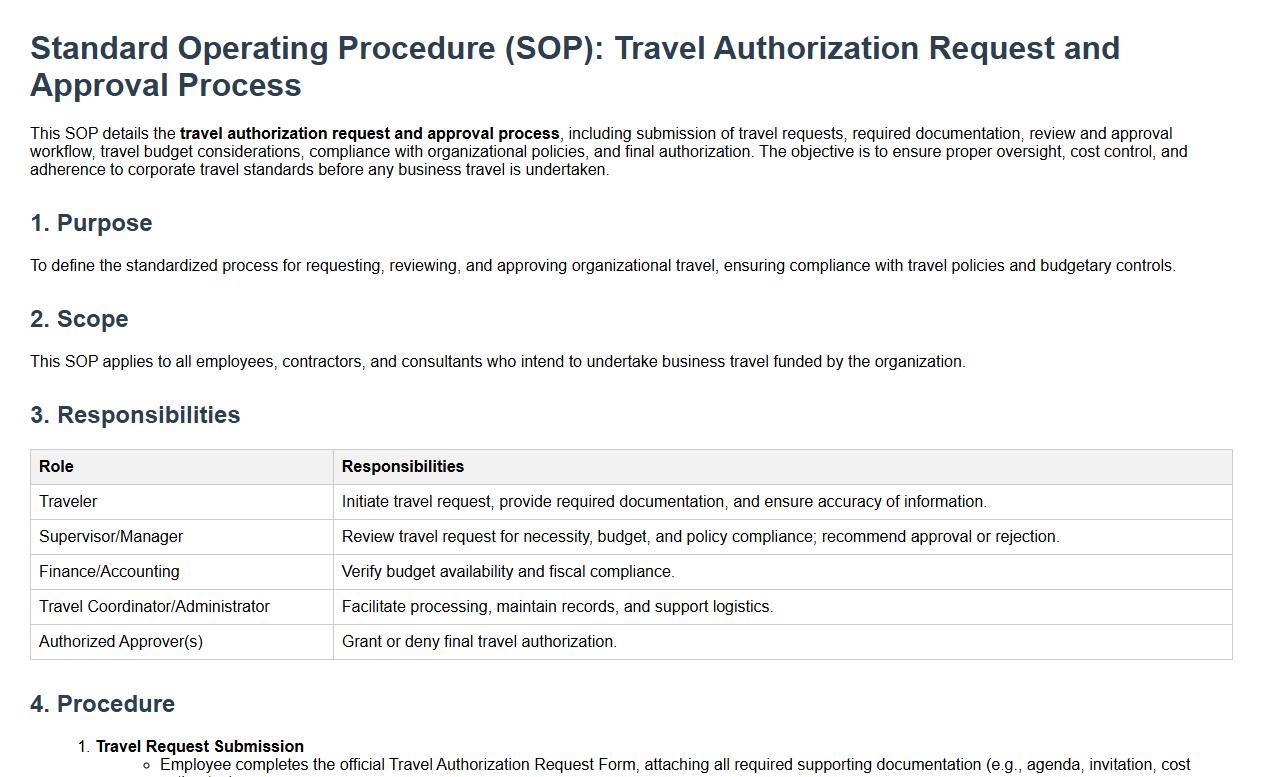

Travel authorization request and approval process.

This SOP details the travel authorization request and approval process, including submission of travel requests, required documentation, review and approval workflow, travel budget considerations, compliance with organizational policies, and final authorization. The objective is to ensure proper oversight, cost control, and adherence to corporate travel standards before any business travel is undertaken.

Pre-trip planning and booking procedures.

This SOP details the pre-trip planning and booking procedures, covering itinerary preparation, transportation arrangements, accommodation reservations, budget estimation, risk assessment, and confirmation protocols. Its goal is to ensure organized, efficient, and error-free trip management by following standardized steps for planning and booking.

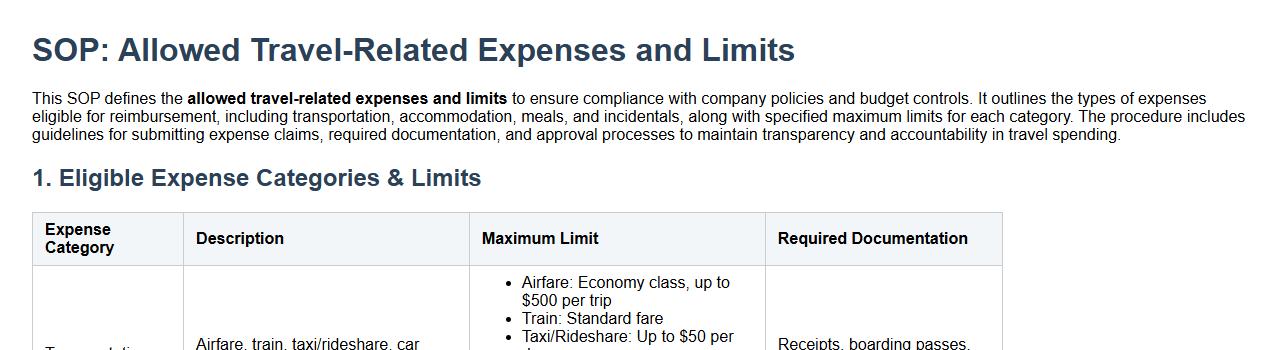

Allowed travel-related expenses and limits.

This SOP defines the allowed travel-related expenses and limits to ensure compliance with company policies and budget controls. It outlines the types of expenses eligible for reimbursement, including transportation, accommodation, meals, and incidentals, along with specified maximum limits for each category. The procedure includes guidelines for submitting expense claims, required documentation, and approval processes to maintain transparency and accountability in travel spending.

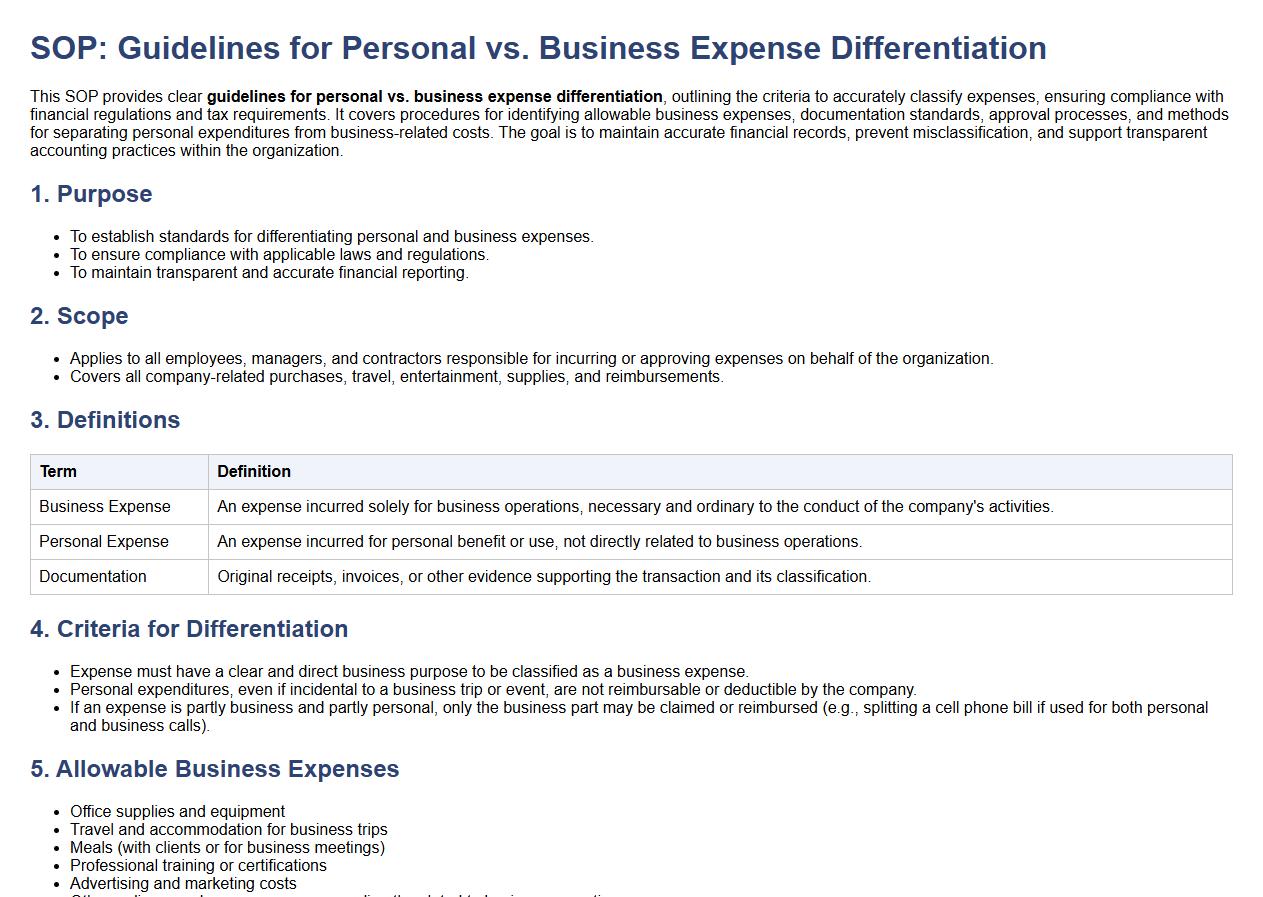

Guidelines for personal vs. business expense differentiation.

This SOP provides clear guidelines for personal vs. business expense differentiation, outlining the criteria to accurately classify expenses, ensuring compliance with financial regulations and tax requirements. It covers procedures for identifying allowable business expenses, documentation standards, approval processes, and methods for separating personal expenditures from business-related costs. The goal is to maintain accurate financial records, prevent misclassification, and support transparent accounting practices within the organization.

Receipts and documentation requirements.

This SOP details the receipts and documentation requirements essential for accurate financial tracking and compliance. It covers proper issuance, recording, storage, and retention of receipts, ensuring all transactions are documented systematically to support auditing, accountability, and operational transparency within the organization.

Expense report preparation and submission steps.

This SOP details the expense report preparation and submission steps, including gathering all relevant receipts and documentation, accurately recording expenses in the designated format, verifying allowable expenses against company policy, obtaining necessary approvals, and timely submission through the approved expense management system. The goal is to ensure accurate, compliant, and efficient reimbursement processes while maintaining financial accountability and transparency.

Timelines for expense report submission.

This SOP defines the timelines for expense report submission to ensure timely reimbursement and accurate financial tracking. It outlines the deadlines for submitting expense reports after incurring costs, approval workflows, required documentation, and consequences of late submissions. The objective is to streamline the expense management process, improve compliance with company policies, and maintain effective budget control.

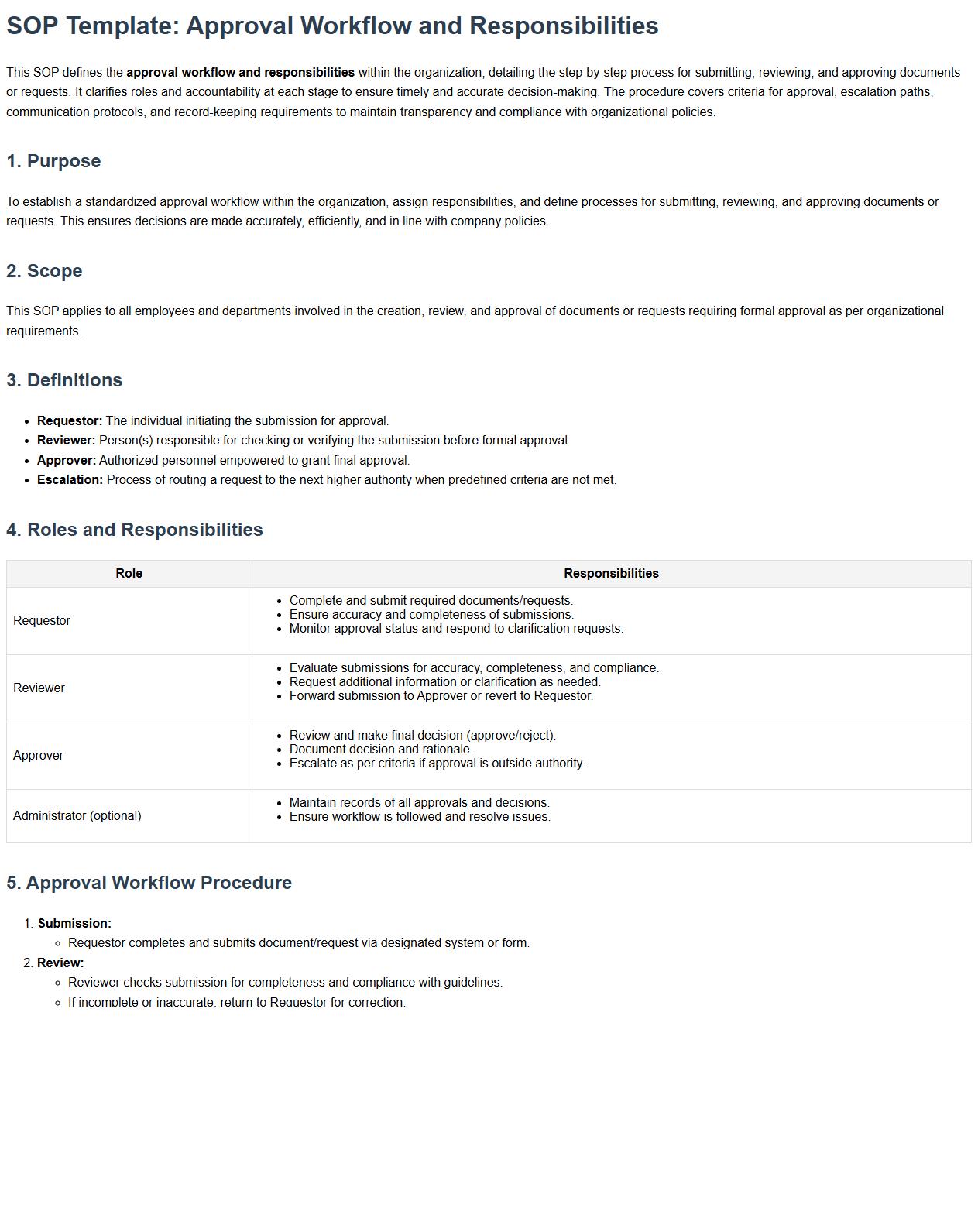

Approval workflow and responsibilities.

This SOP defines the approval workflow and responsibilities within the organization, detailing the step-by-step process for submitting, reviewing, and approving documents or requests. It clarifies roles and accountability at each stage to ensure timely and accurate decision-making. The procedure covers criteria for approval, escalation paths, communication protocols, and record-keeping requirements to maintain transparency and compliance with organizational policies.

Reimbursement processing and payment timelines.

This SOP details the reimbursement processing and payment timelines, covering the submission of reimbursement requests, validation of supporting documents, approval workflows, and standardized payment schedules. The aim is to ensure timely and accurate reimbursement for expenses while maintaining compliance with organizational policies and financial controls.

Non-reimbursable expenses and violation consequences.

This SOP details the classification and management of non-reimbursable expenses, outlining the types of costs that employees cannot claim for reimbursement. It also specifies the consequences of policy violations, including disciplinary actions and potential financial liabilities. The objective is to ensure compliance with company expense policies, promote responsible spending, and maintain financial integrity through clear guidelines and enforcement measures.

What documentation is required to substantiate a travel or expense reimbursement claim?

To substantiate a travel or expense reimbursement claim, original receipts and invoices are mandatory. Additional supporting documents such as travel tickets, hotel bills, and boarding passes must also be included. Expense claims without proper documentation may be rejected according to the SOP guidelines.

What are the approval hierarchies or authority levels defined for travel and expense reimbursement requests?

The SOP defines a clear approval hierarchy starting from the immediate supervisor to the department head and finance department. Higher-value claims may require additional authorization from senior management or CFO. Each authority level ensures compliance with company policies before approval.

What types of expenses are considered eligible or non-eligible according to the SOP?

Eligible expenses include transportation, lodging, meals, and business-related incidentals, strictly documented and justified. Non-eligible expenses often cover personal items, entertainment, and luxury services that are not business-related. The SOP clearly categorizes these to prevent misuse and ensure transparency.

What is the standard process for submitting a travel and expense reimbursement request as outlined in the SOP?

The standard process requires employees to complete an expense report form and attach all relevant receipts. The claim is then submitted for departmental review and approval before forwarding to finance for payment processing. Digital submission platforms may be used to streamline the workflow.

What are the timelines for submitting expense claims and receiving reimbursements under the SOP?

Expense claims should be submitted within a predefined period, typically within 30 days of travel or expense occurrence, to avoid delays. Reimbursements are generally processed within 15 to 30 business days after approval. Timely submission and approval are emphasized to maintain orderly financial operations.