A SOP Template for Cash Handling in Retail ensures consistent procedures for managing cash transactions, reducing errors and theft risks. It outlines step-by-step guidelines for counting, storing, and depositing cash securely. This template enhances accountability and compliance with financial regulations in retail environments.

Cash register setup and float verification procedures.

This SOP details cash register setup and float verification procedures, including preparing the register for transactions, counting and verifying the starting float, ensuring accuracy in cash denominations, documenting discrepancies, and maintaining accountability for cash handling. The objective is to promote efficient cash management, prevent errors, and safeguard financial integrity during business operations.

Customer transaction processing guidelines.

This SOP provides comprehensive customer transaction processing guidelines, detailing procedures for accurate order entry, payment processing, transaction verification, refund and cancellation protocols, customer data security, and compliance with financial regulations. The goal is to ensure efficient, secure, and transparent handling of all customer transactions to enhance customer satisfaction and maintain financial integrity.

Cash counting and balancing at shift changes.

This SOP details the procedures for cash counting and balancing at shift changes, including accurate cash drawer verification, reconciliation of sales and cash receipts, identification and resolution of discrepancies, documentation of cash counts, and secure handover of cash between shifts. The goal is to ensure accountability, maintain cash integrity, and prevent financial discrepancies during shift transitions.

Acceptable forms of payment and verification steps.

This SOP defines acceptable forms of payment and verification steps, detailing the types of payments permitted, such as cash, credit/debit cards, and digital wallets, along with the necessary procedures to verify payment authenticity. It ensures secure and efficient transaction processing by outlining verification protocols, including ID checks, authorization processes, and fraud prevention measures, to protect both the business and customers.

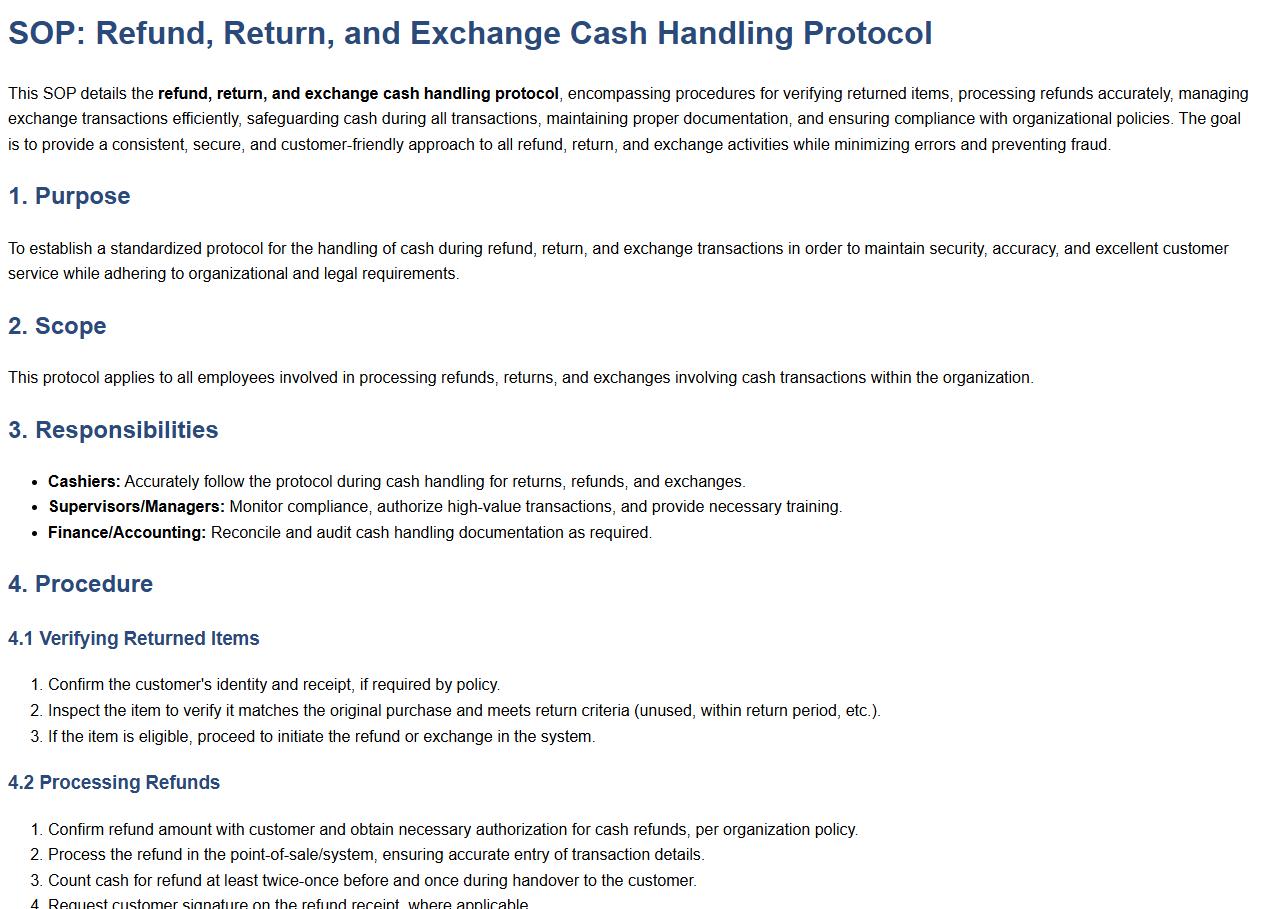

Refund, return, and exchange cash handling protocol.

This SOP details the refund, return, and exchange cash handling protocol, encompassing procedures for verifying returned items, processing refunds accurately, managing exchange transactions efficiently, safeguarding cash during all transactions, maintaining proper documentation, and ensuring compliance with organizational policies. The goal is to provide a consistent, secure, and customer-friendly approach to all refund, return, and exchange activities while minimizing errors and preventing fraud.

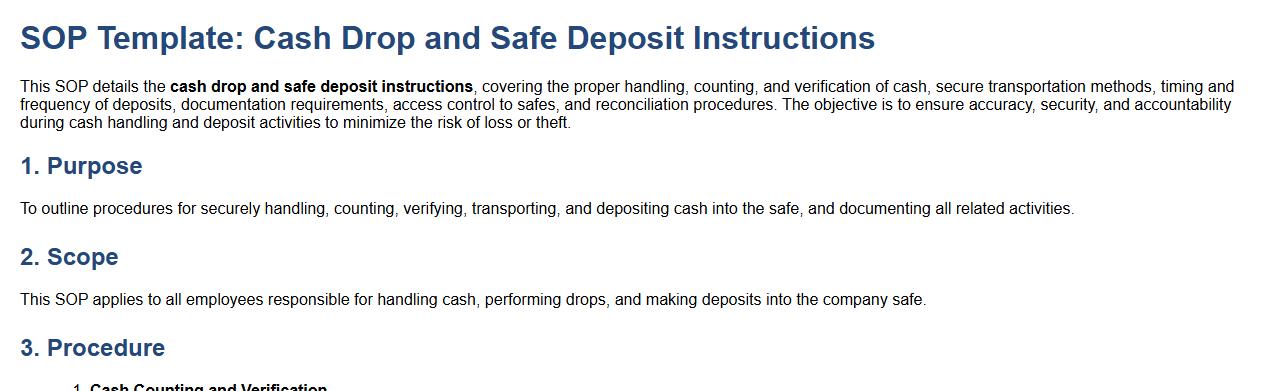

Cash drop and safe deposit instructions.

This SOP details the cash drop and safe deposit instructions, covering the proper handling, counting, and verification of cash, secure transportation methods, timing and frequency of deposits, documentation requirements, access control to safes, and reconciliation procedures. The objective is to ensure accuracy, security, and accountability during cash handling and deposit activities to minimize the risk of loss or theft.

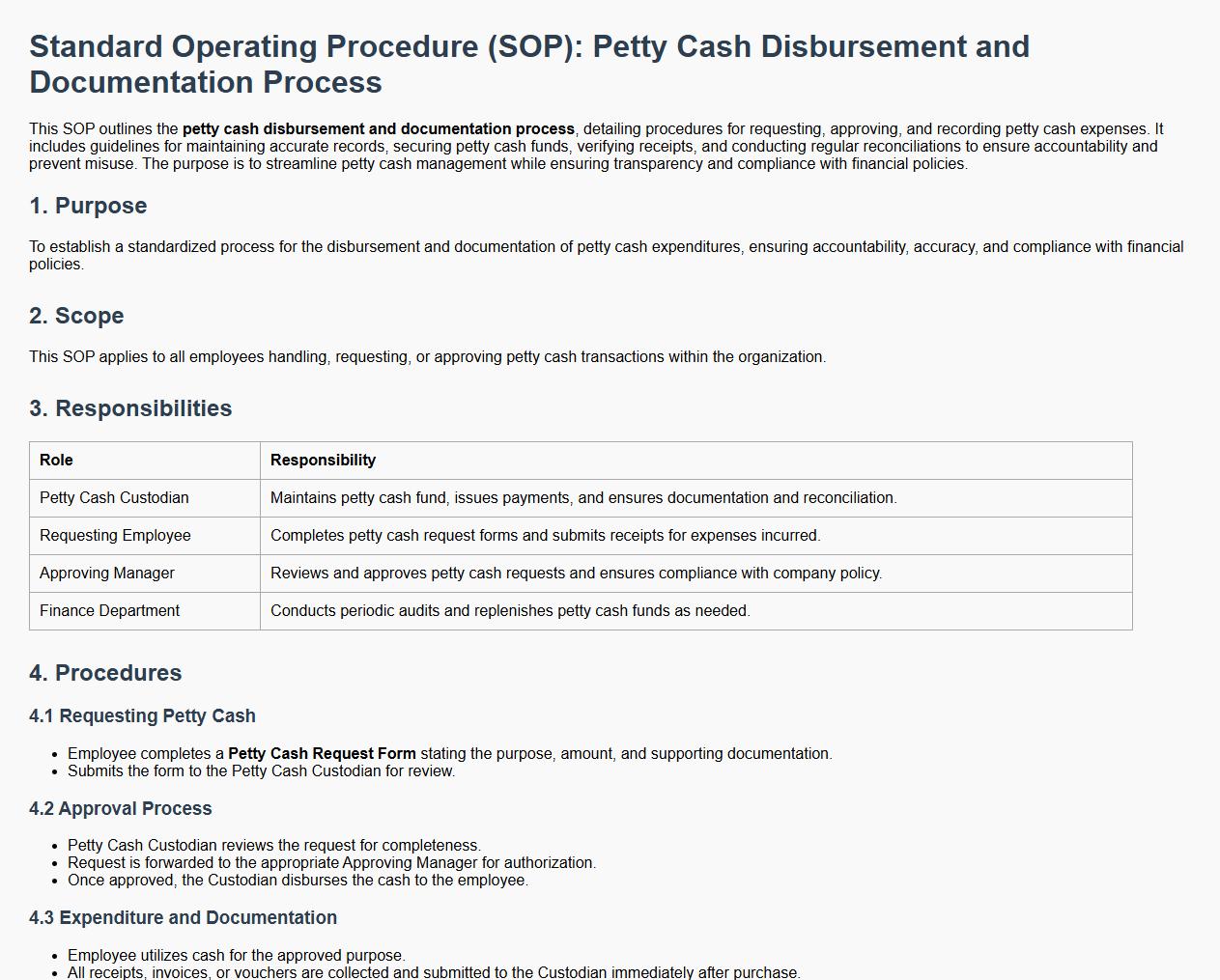

Petty cash disbursement and documentation process.

This SOP outlines the petty cash disbursement and documentation process, detailing procedures for requesting, approving, and recording petty cash expenses. It includes guidelines for maintaining accurate records, securing petty cash funds, verifying receipts, and conducting regular reconciliations to ensure accountability and prevent misuse. The purpose is to streamline petty cash management while ensuring transparency and compliance with financial policies.

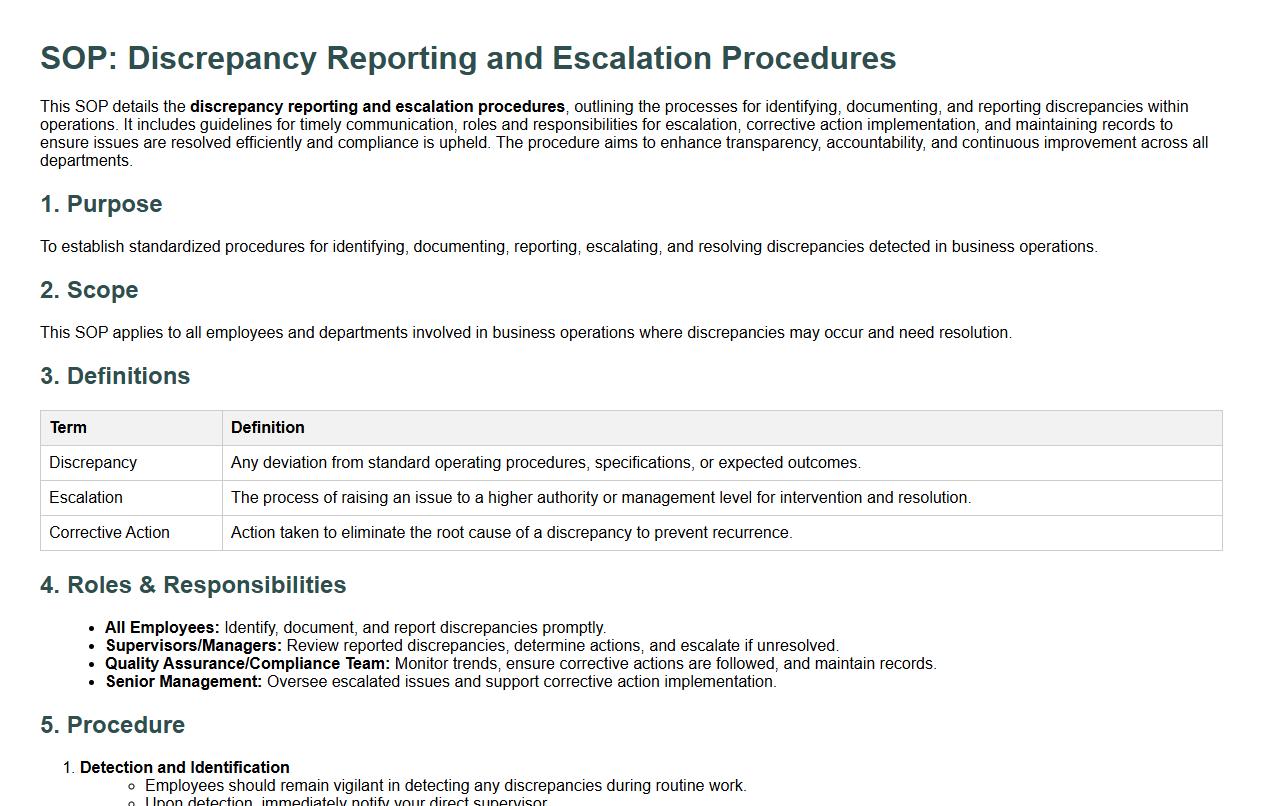

Discrepancy reporting and escalation procedures.

This SOP details the discrepancy reporting and escalation procedures, outlining the processes for identifying, documenting, and reporting discrepancies within operations. It includes guidelines for timely communication, roles and responsibilities for escalation, corrective action implementation, and maintaining records to ensure issues are resolved efficiently and compliance is upheld. The procedure aims to enhance transparency, accountability, and continuous improvement across all departments.

End-of-day cash reconciliation and deposit preparation.

This SOP details the end-of-day cash reconciliation and deposit preparation process, including cash counting, balancing sales records, preparing deposit slips, securing cash and checks, documenting discrepancies, and ensuring timely bank deposits. The goal is to maintain accurate financial records, prevent discrepancies, and safeguard cash assets through consistent and thorough procedures at the close of each business day.

Cash handling security measures and staff access controls.

This SOP details cash handling security measures and staff access controls, including procedures for secure cash collection, storage, and transport, staff authorization protocols, monitoring and reconciliation processes, and measures to prevent theft and fraud. The objective is to safeguard financial assets, ensure accountability, and maintain operational integrity through controlled access and rigorous security practices.

What procedures are outlined for daily cash register balancing in the SOP for Cash Handling in Retail?

The SOP mandates a daily balancing procedure to ensure accuracy in cash registers. Staff must count cash at the start and end of each shift, verifying totals against sales records. Any discrepancies must be documented immediately to maintain transparent cash flow.

How does the SOP specify roles and responsibilities for cash handling among staff members?

The SOP clearly defines roles and responsibilities to maintain accountability in cash handling. Designated staff members are assigned tasks such as cash counting, register operation, and reconciliation. Supervisors are responsible for oversight and approval of cash handling activities.

What security measures for cash storage and transportation are stated in the SOP?

Strict security measures are outlined for cash storage including the use of lockable cash drawers and safes. Cash transportation protocols require secure, sealed containers and two-person escort when moving significant amounts. The SOP ensures these precautions minimize risk of theft and loss.

According to the SOP, what steps must be followed for reporting cash discrepancies or shortages?

The SOP requires immediate reporting of cash discrepancies to a supervisor or manager. Staff must complete a discrepancy report form detailing amounts and possible causes. Prompt investigation and documentation ensure proper resolution and reduce future errors.

How does the SOP address the process for handling customer returns and issuing cash refunds?

The SOP specifies a controlled process for customer returns and refunds to prevent fraud. Staff must verify the purchase receipt, inspect returned items, and obtain managerial approval before issuing a cash refund. This ensures proper validation and accurate recording of refund transactions.