A SOP Template for Expense Reimbursement provides a clear, step-by-step process to ensure employees submit their expenses accurately and timely. It standardizes the documentation requirements, approval workflows, and reimbursement timelines to maintain consistency and accountability. This template helps streamline financial operations and reduces errors in processing expense claims.

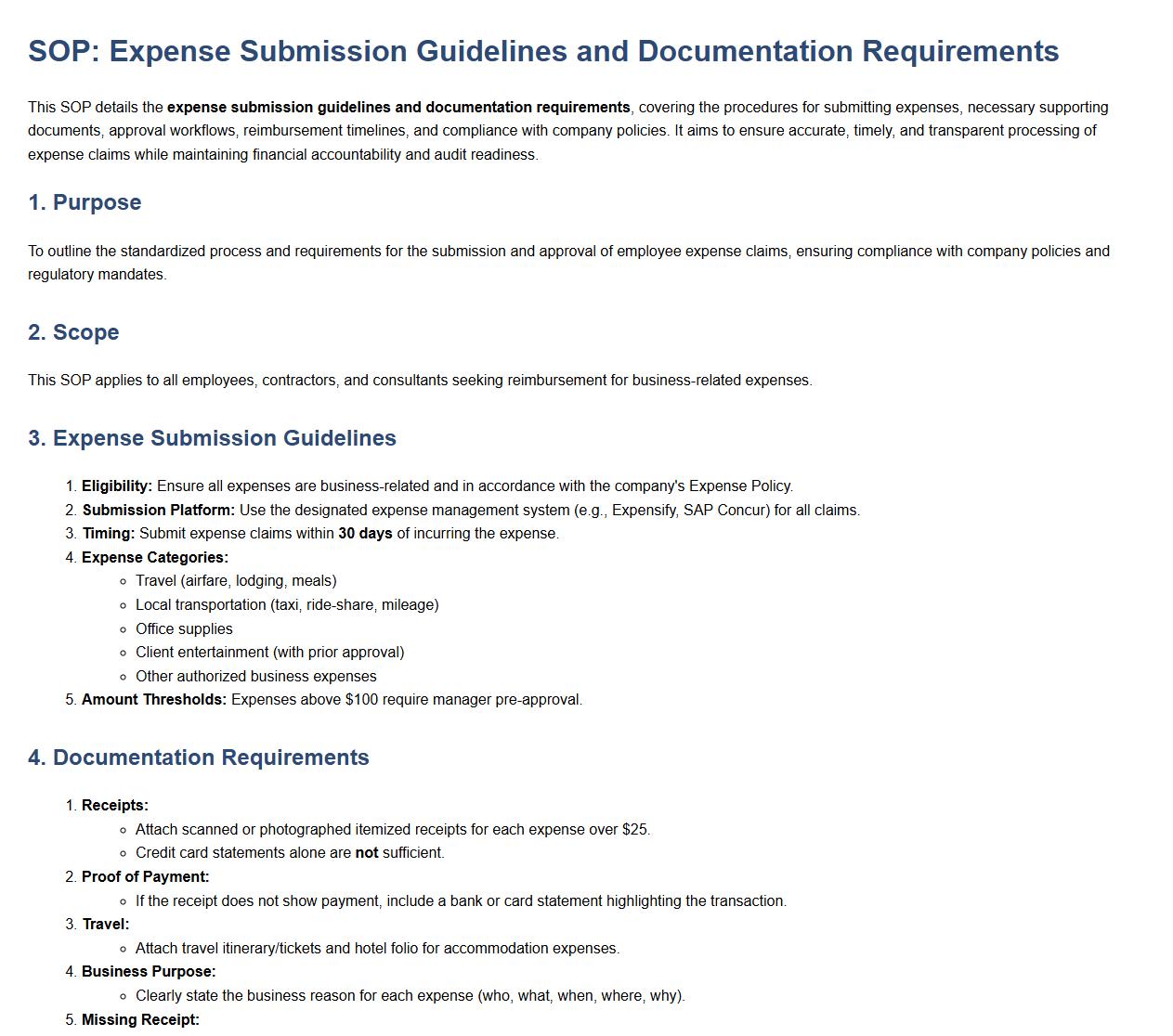

Expense submission guidelines and documentation requirements.

This SOP details the expense submission guidelines and documentation requirements, covering the procedures for submitting expenses, necessary supporting documents, approval workflows, reimbursement timelines, and compliance with company policies. It aims to ensure accurate, timely, and transparent processing of expense claims while maintaining financial accountability and audit readiness.

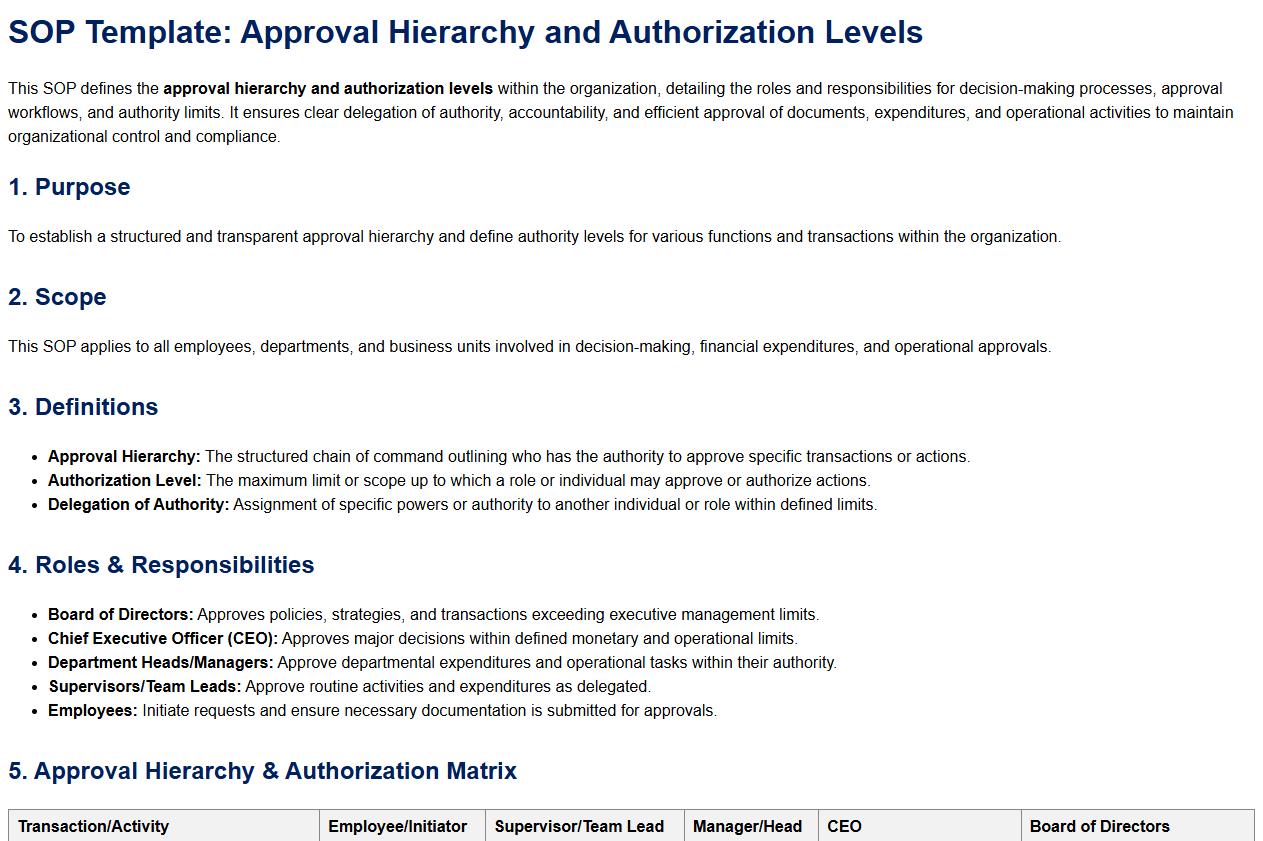

Approval hierarchy and authorization levels.

This SOP defines the approval hierarchy and authorization levels within the organization, detailing the roles and responsibilities for decision-making processes, approval workflows, and authority limits. It ensures clear delegation of authority, accountability, and efficient approval of documents, expenditures, and operational activities to maintain organizational control and compliance.

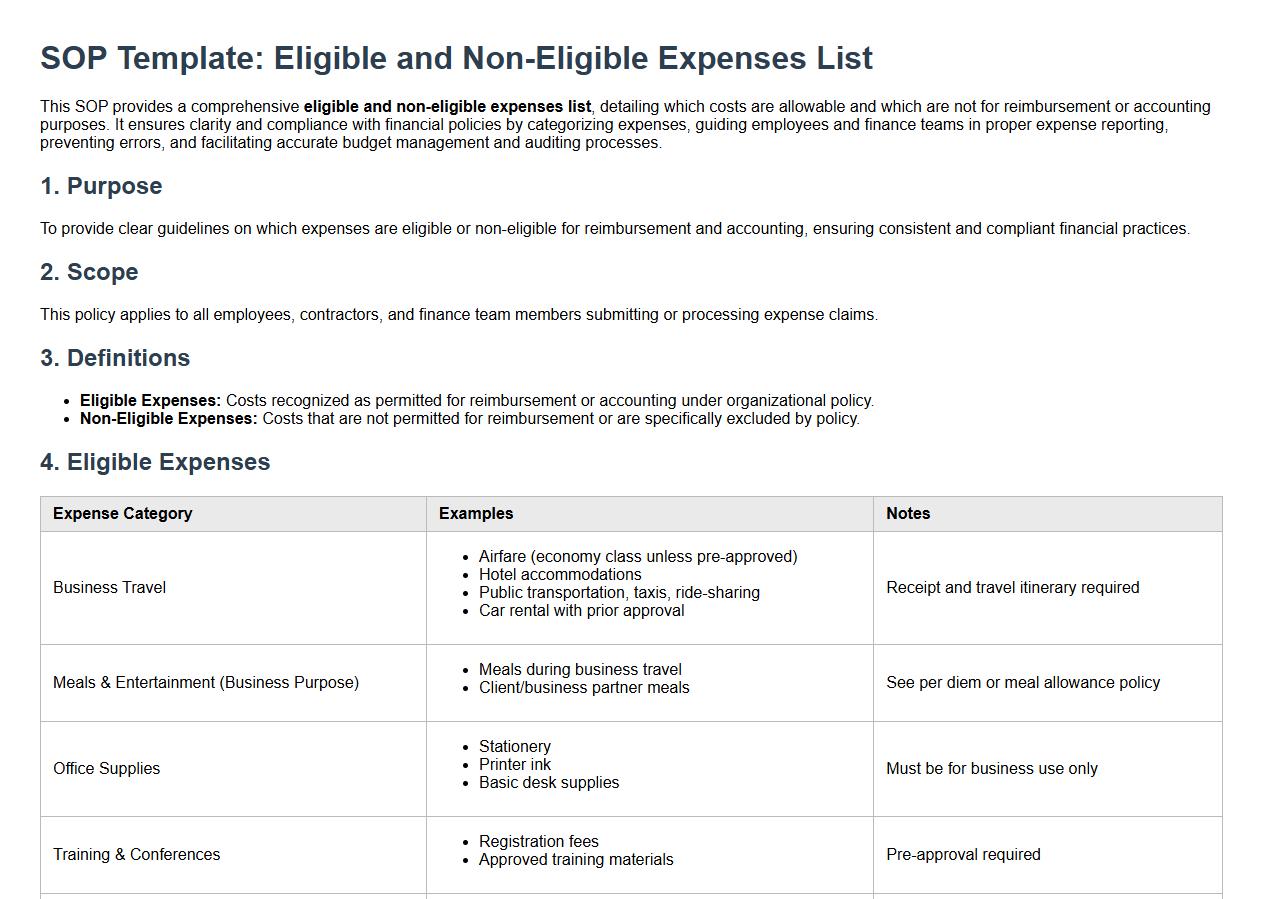

Eligible and non-eligible expenses list.

This SOP provides a comprehensive eligible and non-eligible expenses list, detailing which costs are allowable and which are not for reimbursement or accounting purposes. It ensures clarity and compliance with financial policies by categorizing expenses, guiding employees and finance teams in proper expense reporting, preventing errors, and facilitating accurate budget management and auditing processes.

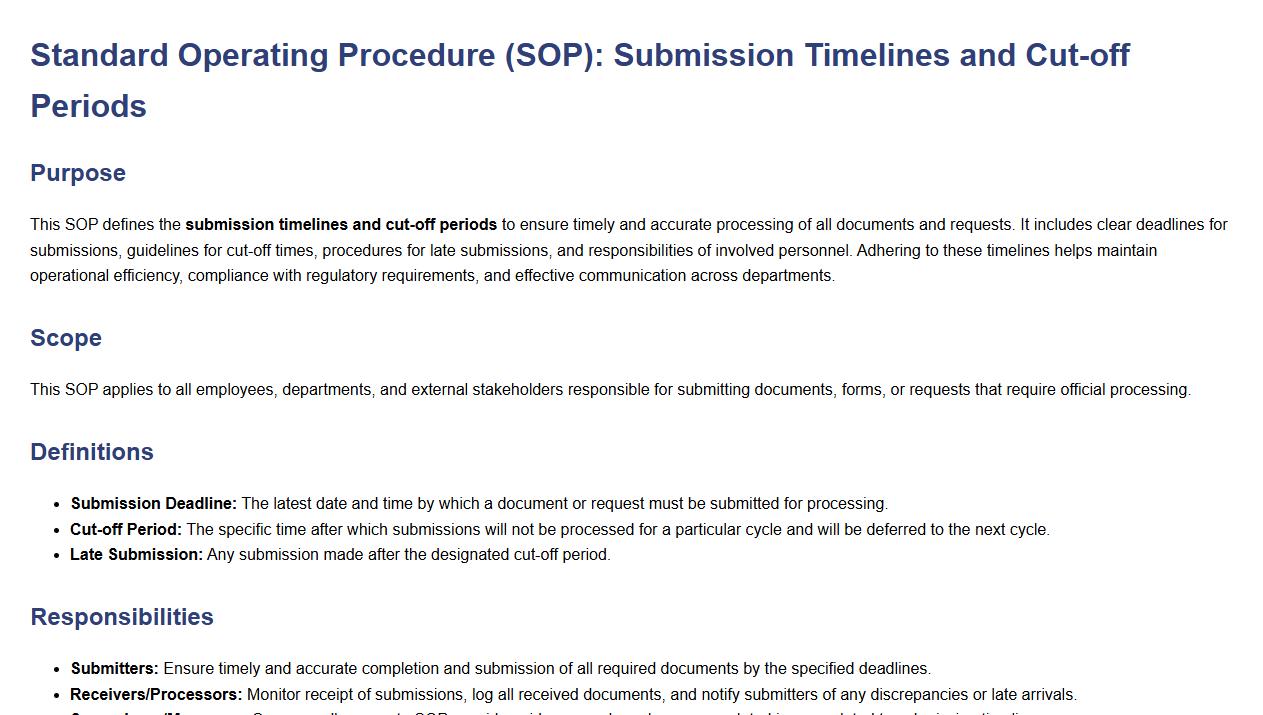

Submission timelines and cut-off periods.

This SOP defines the submission timelines and cut-off periods to ensure timely and accurate processing of all documents and requests. It includes clear deadlines for submissions, guidelines for cut-off times, procedures for late submissions, and responsibilities of involved personnel. Adhering to these timelines helps maintain operational efficiency, compliance with regulatory requirements, and effective communication across departments.

Receipt and proof-of-purchase standards.

This SOP defines the receipt and proof-of-purchase standards required for accurate transaction verification, financial record-keeping, and compliance with company policies. It outlines the process for issuing, collecting, and validating receipts, ensuring they include essential details such as date, items purchased, payment method, and authorized signatures. The procedure also covers the handling of electronic and paper receipts, retention periods, and proper documentation for audits and customer service inquiries. The goal is to maintain transparency, support accounting accuracy, and enhance customer trust through standardized receipt management practices.

Expense claim form completion instructions.

This SOP provides detailed expense claim form completion instructions, guiding employees through the accurate and complete filling out of expense claim forms. It covers required documentation, itemizing expenses, submitting receipts, approval processes, deadlines, and compliance with company policies to ensure timely and efficient reimbursement of business-related expenses.

Digital vs. physical submission protocols.

This SOP defines the digital vs. physical submission protocols to ensure consistent, efficient, and secure handling of documents and materials. It outlines the procedures for submitting documents electronically through designated online platforms, specifying file formats, naming conventions, and deadlines. It also details the requirements for physical submissions, including acceptable formats, packaging, delivery methods, and documentation. This SOP aims to streamline the submission process, reduce errors, ensure compliance with regulatory standards, and maintain proper tracking and record-keeping for both digital and physical submissions.

Reimbursement disbursement process and payment schedule.

This SOP details the reimbursement disbursement process and payment schedule, covering the procedures for submitting reimbursement claims, verification and approval workflows, disbursement methods, payment timelines, and record-keeping requirements. The goal is to ensure timely and accurate reimbursement to employees and stakeholders while maintaining compliance with financial policies and internal controls.

Dispute resolution and claim correction procedures.

This SOP defines dispute resolution and claim correction procedures, detailing the steps for identifying, addressing, and resolving disputes related to claims. It includes guidelines for investigating discrepancies, communicating with relevant parties, correcting claim errors, documenting resolution processes, and ensuring compliance with legal and organizational standards. The purpose is to facilitate efficient, fair, and transparent resolution of claim disputes to maintain trust and accuracy in claims management.

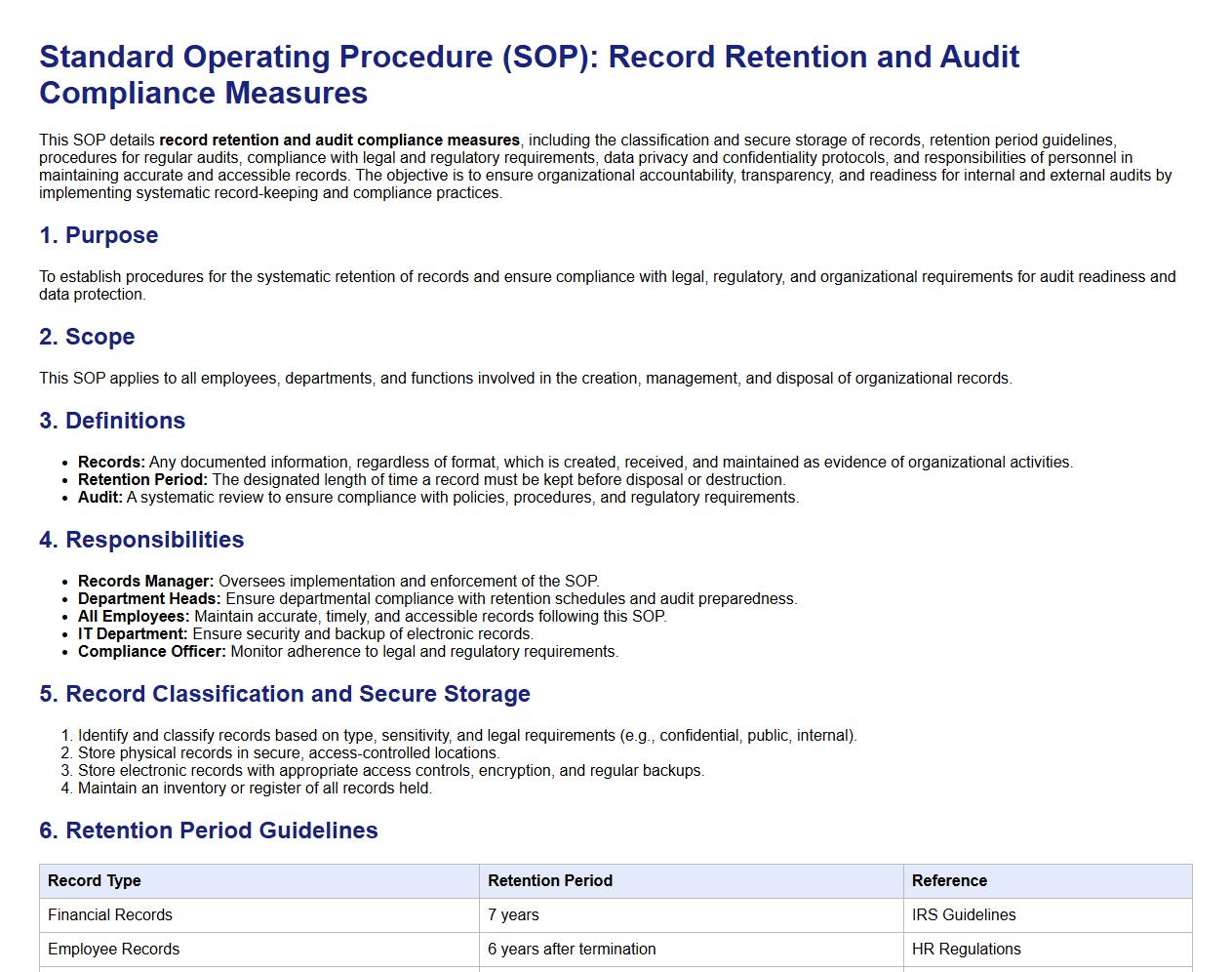

Record retention and audit compliance measures.

This SOP details record retention and audit compliance measures, including the classification and secure storage of records, retention period guidelines, procedures for regular audits, compliance with legal and regulatory requirements, data privacy and confidentiality protocols, and responsibilities of personnel in maintaining accurate and accessible records. The objective is to ensure organizational accountability, transparency, and readiness for internal and external audits by implementing systematic record-keeping and compliance practices.

What is the purpose of the Expense Reimbursement SOP?

The Expense Reimbursement SOP establishes clear guidelines for employees to recover business-related expenses. It ensures consistency and transparency in handling cost claims. This SOP helps maintain financial discipline and prevents unauthorized reimbursements.

Which types of expenses are eligible for reimbursement according to the SOP?

The SOP specifies eligible expenses such as travel, meals, lodging, and office supplies. Only expenses directly related to business activities qualify for reimbursement. Personal or non-approved costs are excluded in this policy.

What documentation is required to process an expense reimbursement request?

To process reimbursement, employees must provide original receipts, detailed expense forms, and relevant approvals. Proper documentation validates the authenticity of claims and facilitates swift processing. Missing or incomplete proof may delay or deny reimbursement.

What is the approval workflow for expense reimbursement outlined in the SOP?

The approval workflow involves submission to a direct supervisor or manager for initial review. Once verified, the claim proceeds to finance for final approval and payment processing. This multi-step approval ensures accuracy and compliance with company policies.

What are the deadlines for submitting and processing expense reimbursement claims per the SOP?

The SOP mandates submission of expense claims within 30 days after the expenditure date. Finance aims to process approved claims within 15 business days. Adhering to these timelines helps maintain efficient financial operations and employee satisfaction.