A SOP Template for Retail Point of Sale Procedures ensures consistent and efficient transaction handling by outlining standardized steps for cash register operations, payment processing, and customer interactions. This template helps retail staff minimize errors, maintain accurate sales records, and enhance customer satisfaction. Implementing a clear SOP supports compliance with company policies and streamlines daily sales activities.

Customer greeting and engagement protocol.

This SOP details the customer greeting and engagement protocol, focusing on the steps for welcoming customers warmly, establishing positive first impressions, actively listening to customer needs, providing accurate and helpful information, maintaining professional and friendly communication, addressing customer inquiries and concerns promptly, and fostering a customer-centric environment. Its purpose is to enhance customer satisfaction, build lasting relationships, and promote a positive brand image through consistent and effective engagement practices.

Cash register opening and closing procedures.

This SOP details cash register opening and closing procedures, including verifying the starting cash balance, ensuring the cash drawer is secure, performing system logins and logouts, recording and reconciling daily transactions, handling cash discrepancies, documenting end-of-day tills, and preparing deposits. The objective is to maintain accurate financial records, ensure security of cash, and facilitate smooth operational shifts in retail or service environments.

Barcode scanning and item entry process.

This SOP describes the barcode scanning and item entry process, detailing the steps for accurately capturing item information using barcode scanners, verifying scanned data, and entering items into inventory or sales systems. It aims to ensure efficient and error-free data entry, streamline inventory management, and enhance overall operational accuracy within the workflow.

Price override and discount approval steps.

This SOP defines the price override and discount approval steps to ensure proper authorization, consistency, and accountability in applying discounts and price changes. It details the process for requesting overrides, necessary approvals from designated personnel, documentation requirements, and system entry protocols. The goal is to maintain pricing integrity, prevent unauthorized discounts, and support accurate financial reporting.

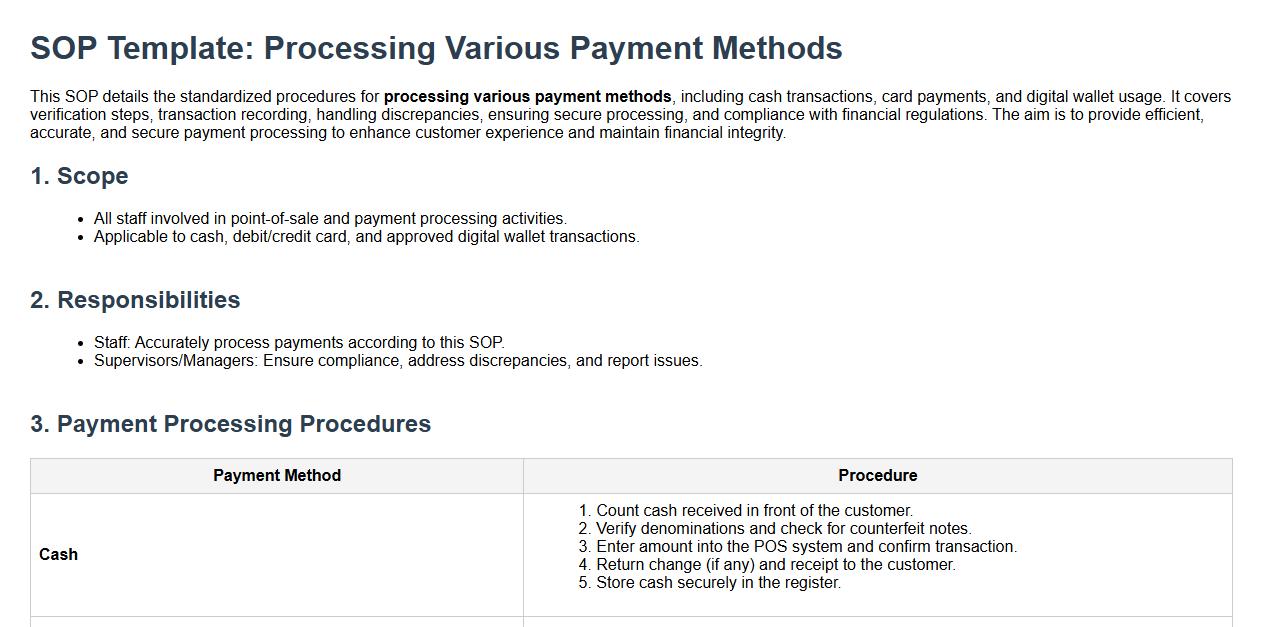

Processing various payment methods (cash, card, digital wallets).

This SOP details the standardized procedures for processing various payment methods, including cash transactions, card payments, and digital wallet usage. It covers verification steps, transaction recording, handling discrepancies, ensuring secure processing, and compliance with financial regulations. The aim is to provide efficient, accurate, and secure payment processing to enhance customer experience and maintain financial integrity.

Sales receipt printing and customer handover.

This SOP details the process for sales receipt printing and customer handover, including verifying transaction details, accurately printing the sales receipt, reviewing the receipt for correctness, and efficiently handing it over to the customer. It ensures clear communication of purchase information, enhances customer satisfaction, and maintains accurate sales records for the business.

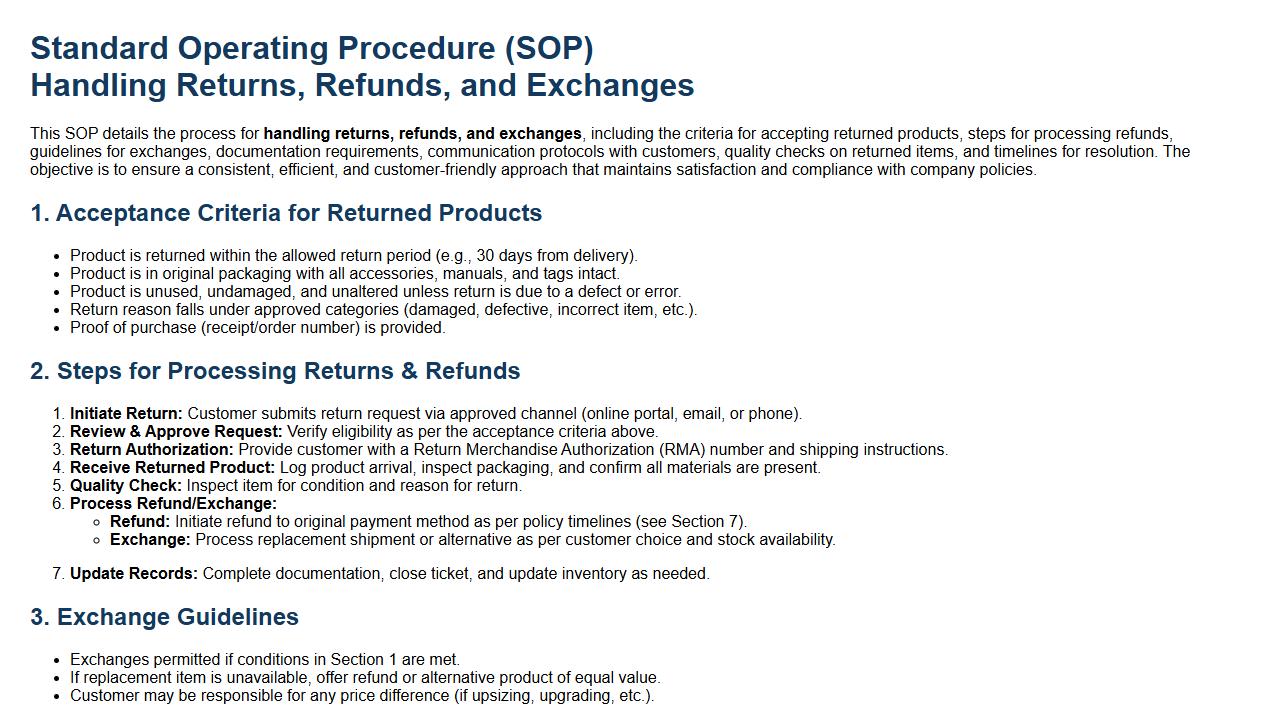

Handling returns, refunds, and exchanges.

This SOP details the process for handling returns, refunds, and exchanges, including the criteria for accepting returned products, steps for processing refunds, guidelines for exchanges, documentation requirements, communication protocols with customers, quality checks on returned items, and timelines for resolution. The objective is to ensure a consistent, efficient, and customer-friendly approach that maintains satisfaction and compliance with company policies.

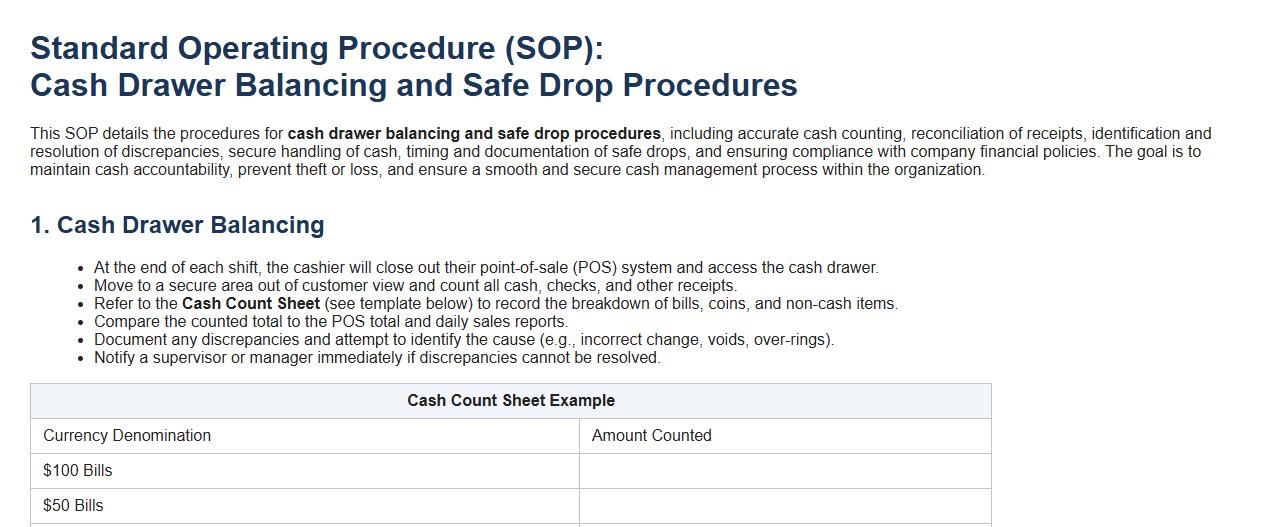

Cash drawer balancing and safe drop procedures.

This SOP details the procedures for cash drawer balancing and safe drop procedures, including accurate cash counting, reconciliation of receipts, identification and resolution of discrepancies, secure handling of cash, timing and documentation of safe drops, and ensuring compliance with company financial policies. The goal is to maintain cash accountability, prevent theft or loss, and ensure a smooth and secure cash management process within the organization.

Daily sales reconciliation and end-of-day reporting.

This SOP details the daily sales reconciliation and end-of-day reporting process, ensuring accurate financial tracking and accountability. It covers procedures for verifying sales transactions, balancing cash registers, resolving discrepancies, compiling sales reports, and securely submitting end-of-day summaries. The objective is to maintain precise sales records, support financial audits, and enhance operational transparency.

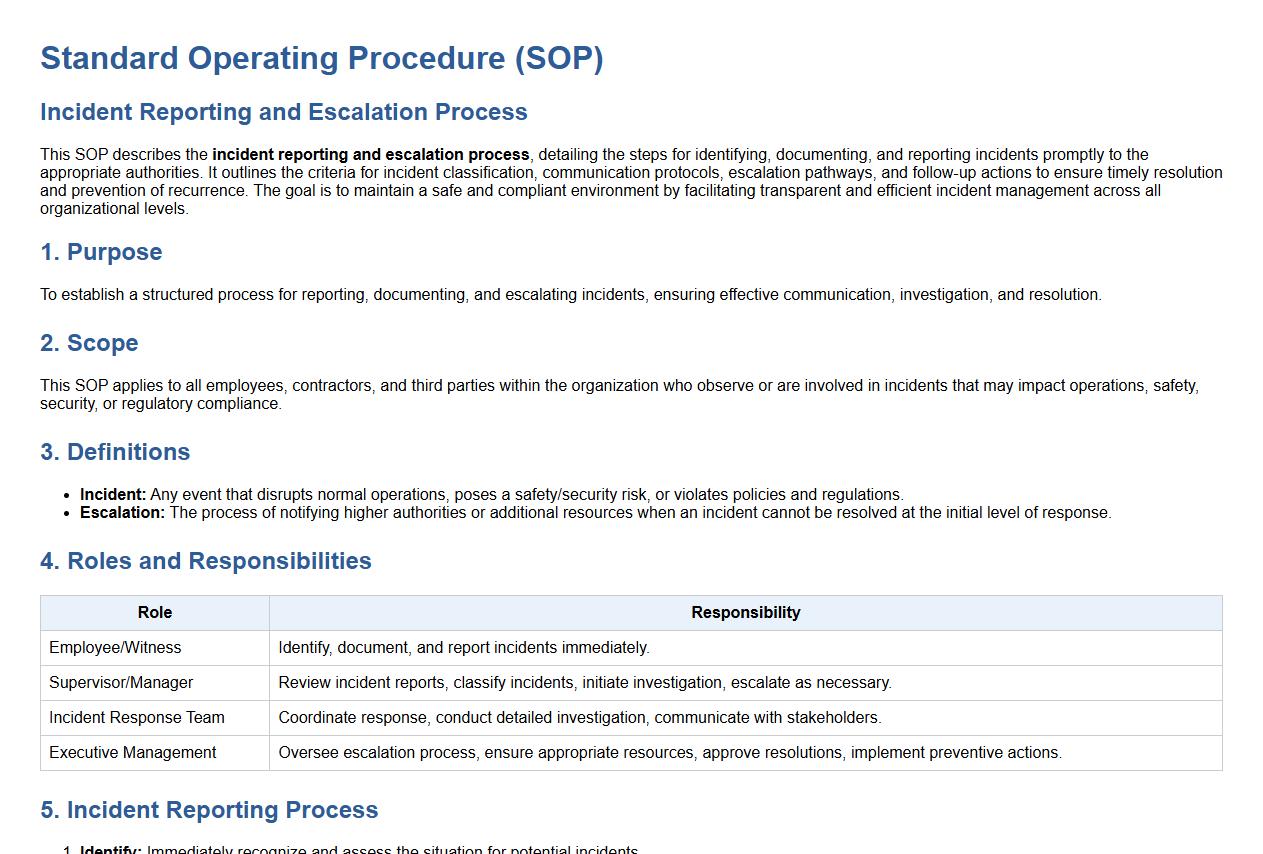

Incident reporting and escalation process.

This SOP describes the incident reporting and escalation process, detailing the steps for identifying, documenting, and reporting incidents promptly to the appropriate authorities. It outlines the criteria for incident classification, communication protocols, escalation pathways, and follow-up actions to ensure timely resolution and prevention of recurrence. The goal is to maintain a safe and compliant environment by facilitating transparent and efficient incident management across all organizational levels.

Key Steps to Process a Customer Transaction According to the SOP for Retail POS Procedures

The first step involves accurately scanning or entering the product details into the POS system to ensure correct pricing and inventory updates. Next, the employee must verify the payment method and carefully process the transaction payment using accepted forms like cash, card, or digital payments. Finally, a receipt should be issued to the customer, completing the sale and documenting the transaction for recordkeeping.

Proper Cash Handling and Reconciliation at End of Shift as Defined by the SOP

The SOP mandates counting all cash in the register and verifying totals against the transaction records to ensure accuracy. Employees must document any discrepancies and prepare a cash reconciliation report to be reviewed by management. Securely depositing cash and maintaining confidentiality in handling money is emphasized throughout the process.

Protocols for Managing Returns, Exchanges, and Refunds Outlined in the SOP

The SOP requires verifying the customer's original receipt before processing any returns or exchanges to confirm purchase legitimacy. Employees should inspect returned items for condition and restock or dispose of them according to company policy. All refund transactions must be properly authorized, recorded in the system, and communicated transparently to the customer.

Security Measures Mandated by the SOP When Operating the POS System

The SOP requires employees to use secure login credentials and never share login information to prevent unauthorized access to the POS system. Sensitive data such as customer payment information must be handled in compliance with data privacy and protection policies. Additionally, employees should monitor the POS area closely to prevent theft or fraudulent activity during transactions.

Documentation and Recordkeeping Required Per the SOP After Completing Sales Transactions

After each transaction, the SOP requires generating and saving a detailed sales receipt that includes items sold, payment method, and transaction ID. Daily sales logs must be compiled and submitted to management for review and auditing purposes. Maintaining accurate digital and physical records ensures transparency and accountability throughout retail operations.