This SOP Template for Retail Cash Handling ensures standardized procedures for managing cash transactions securely and accurately. It outlines step-by-step guidelines for cash counting, storage, and reconciliation to minimize errors and prevent theft. Following this template helps maintain accountability and efficiency in retail cash operations.

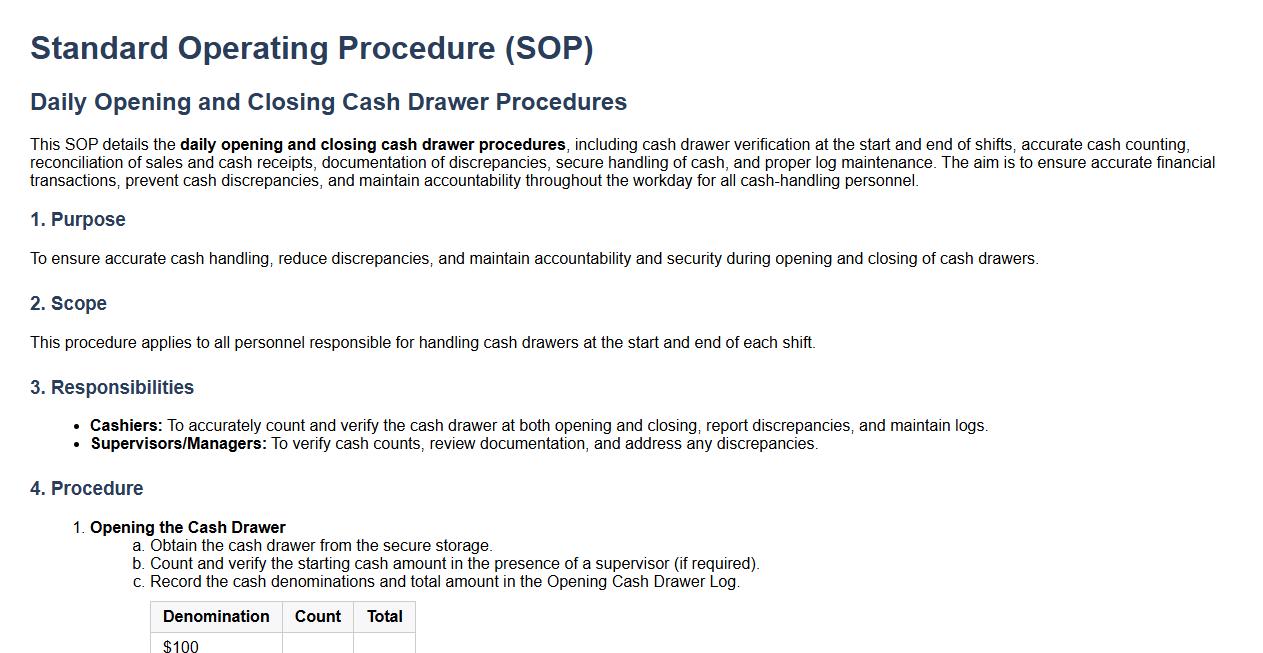

Daily opening and closing cash drawer procedures.

This SOP details the daily opening and closing cash drawer procedures, including cash drawer verification at the start and end of shifts, accurate cash counting, reconciliation of sales and cash receipts, documentation of discrepancies, secure handling of cash, and proper log maintenance. The aim is to ensure accurate financial transactions, prevent cash discrepancies, and maintain accountability throughout the workday for all cash-handling personnel.

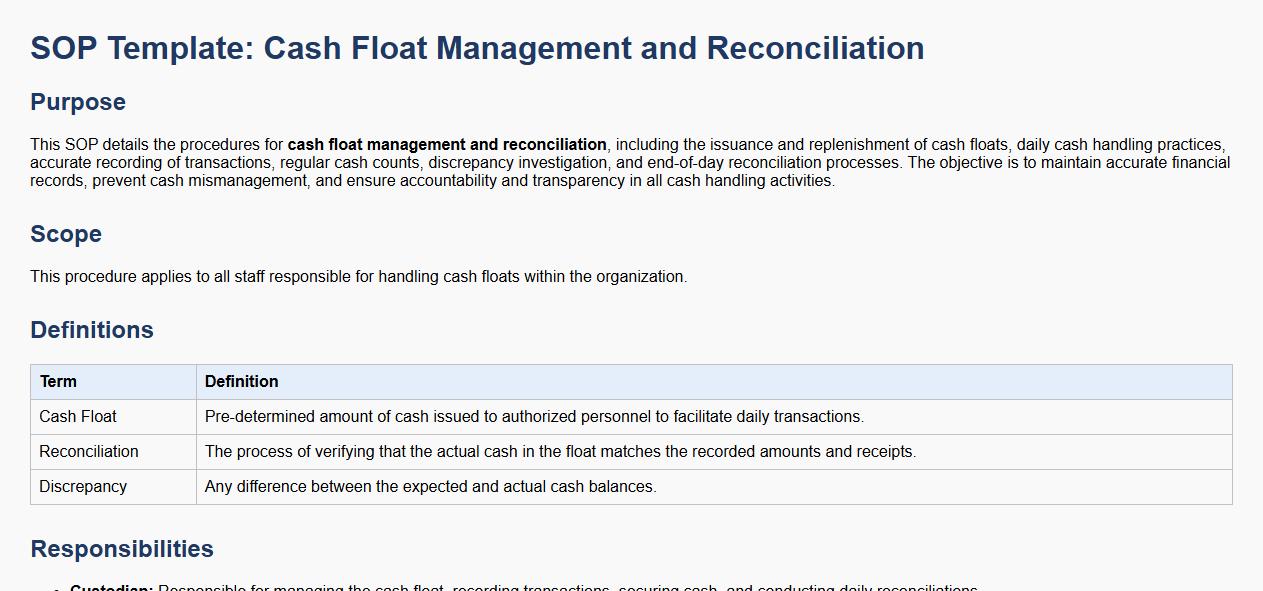

Cash float management and reconciliation.

This SOP details the procedures for cash float management and reconciliation, including the issuance and replenishment of cash floats, daily cash handling practices, accurate recording of transactions, regular cash counts, discrepancy investigation, and end-of-day reconciliation processes. The objective is to maintain accurate financial records, prevent cash mismanagement, and ensure accountability and transparency in all cash handling activities.

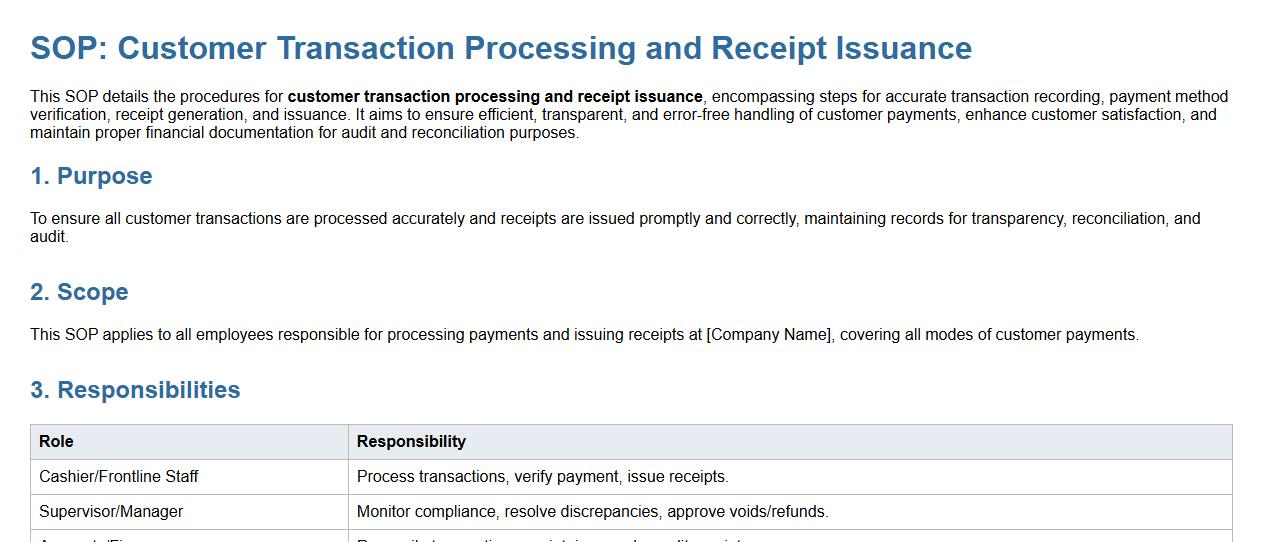

Customer transaction processing and receipt issuance.

This SOP details the procedures for customer transaction processing and receipt issuance, encompassing steps for accurate transaction recording, payment method verification, receipt generation, and issuance. It aims to ensure efficient, transparent, and error-free handling of customer payments, enhance customer satisfaction, and maintain proper financial documentation for audit and reconciliation purposes.

Handling of returns, refunds, and exchange transactions.

This SOP details the processes for handling returns, refunds, and exchange transactions, ensuring customer satisfaction and operational efficiency. It covers the verification of return eligibility, inspection of returned items, approval procedures, refund issuance, and exchange protocols. Emphasizing clear communication, accurate record-keeping, and compliance with company policies, this SOP aims to streamline the resolution of customer issues related to product returns and exchanges while minimizing financial impact.

Identification and management of counterfeit currency.

This SOP details the identification and management of counterfeit currency, including recognizing security features, handling suspected counterfeit notes, reporting procedures, and preventive measures. It aims to minimize financial losses, protect the organization from fraud, and ensure compliance with legal and regulatory requirements by establishing clear guidelines for detecting and managing counterfeit money effectively.

Cash drop and safe deposit protocols.

This SOP details the cash drop and safe deposit protocols, including secure cash handling procedures, timely cash drops, proper documentation, safe transport methods, authorized personnel responsibilities, and storage requirements. The aim is to minimize cash handling risks, prevent theft or loss, and ensure accurate financial accountability through standardized deposit practices.

Documentation and reporting of cash discrepancies.

This SOP details the documentation and reporting of cash discrepancies, outlining procedures for identifying, recording, investigating, and resolving any inconsistencies in cash handling. It ensures accurate record-keeping, timely communication of discrepancies to appropriate personnel, and adherence to internal controls to prevent cash loss and maintain financial integrity.

End-of-shift balancing and cash handover procedures.

This SOP details the end-of-shift balancing and cash handover procedures, including counting and reconciling cash and transactions, verifying sales records, preparing cash deposit documentation, securing cash and financial records, and ensuring proper communication between outgoing and incoming staff. The goal is to maintain accurate financial accountability, prevent discrepancies, and ensure a smooth transition between shifts.

Incident escalation for cash discrepancies and theft.

This SOP details the process for incident escalation for cash discrepancies and theft, including initial detection and reporting of discrepancies, immediate containment measures, notification of supervisory personnel, detailed investigation steps, documentation and evidence preservation, involvement of security and law enforcement if necessary, communication protocols with relevant stakeholders, and corrective actions to prevent recurrence. Its objective is to ensure timely, consistent, and effective response to protect company assets and maintain financial integrity.

Confidentiality and security guidelines for cash areas.

This SOP provides comprehensive confidentiality and security guidelines for cash areas, focusing on protecting sensitive financial information and preventing unauthorized access. It includes protocols for controlled access, secure handling and storage of cash, employee responsibilities, surveillance systems, and incident reporting procedures. The objective is to maintain a secure environment that safeguards cash assets and ensures compliance with organizational security standards.

Key Steps for Verifying, Counting, and Recording Cash During Retail Transactions

The SOP requires accurate verification of cash received by visually inspecting and counting bills at the point of transaction. All cash amounts must be recorded immediately into the register or POS system to ensure real-time tracking. Additionally, a dual-count process is recommended to minimize errors and discrepancies in cash handling.

Procedures for Handling Discrepancies or Cash Shortages During End-of-Day Reconciliation

The SOP mandates that any cash discrepancies be documented thoroughly with detailed notes explaining the shortage or overage. Staff must report these issues immediately to management for review and investigation. If unresolved, discrepancies are escalated following a formal incident reporting protocol to prevent future occurrences.

Security Measures to Prevent and Detect Theft or Unauthorized Access to Cash

The SOP specifies multiple security controls such as restricted access to cash registers and safes, requiring unique passwords and keys. Frequent and random cash audits are conducted to deter theft and identify irregularities promptly. Additionally, video surveillance and dual custody systems are employed to enhance oversight and accountability.

Documentation and Approvals Required for Petty Cash Disbursements or Cash Withdrawals

All petty cash disbursements must be supported by receipts and approval forms signed by authorized personnel. Withdrawals require prior management authorization to ensure transparency and control over cash flow. The SOP emphasizes maintaining a detailed logbook to track all petty cash movements accurately.

Roles and Responsibilities of Staff Involved in Cash Handling and Reporting Processes

The SOP clearly defines the roles of cashiers, supervisors, and managers in the cash handling workflow. Cashiers are responsible for initial cash counting and recording, while supervisors oversee reconciliation and compliance checks. Managers are tasked with final approval, investigation of discrepancies, and ensuring adherence to the SOP policies.