A SOP Template for Insurance Claims Processing streamlines the workflow by clearly defining each step involved in handling claims, from initial submission to final resolution. It ensures consistency, compliance, and efficiency while minimizing errors and delays. Implementing this template helps insurance companies maintain high-quality service and improve customer satisfaction.

Claim intake and initial documentation procedures.

This SOP details the claim intake and initial documentation procedures, covering the systematic process for receiving claims, verifying claimant information, recording essential data accurately, and ensuring proper documentation is maintained. The procedure aims to streamline claim handling, improve accuracy in data capture, and facilitate efficient claim processing while maintaining compliance with regulatory standards.

Verification of policyholder information and coverage validation.

This SOP details the process for verification of policyholder information and coverage validation, including the collection of accurate personal and policy details, cross-referencing data with internal databases, confirming coverage status and policy limits, detecting discrepancies or fraudulent information, and ensuring compliance with regulatory standards. The objective is to maintain data integrity, provide reliable coverage confirmation, and support efficient claims processing.

Assignment of claim number and file creation.

This SOP details the assignment of claim number and file creation process, ensuring efficient tracking and management of claims. It covers the steps for generating unique claim numbers, establishing claimant files, organizing documentation systematically, and maintaining data accuracy. The purpose is to streamline claim handling, facilitate easy retrieval of information, and support effective communication throughout the claims lifecycle.

Guidelines for communication with claimants and stakeholders.

This SOP provides guidelines for communication with claimants and stakeholders, focusing on clear, respectful, and timely information exchange. It covers best practices for responding to inquiries, managing expectations, maintaining confidentiality, and documenting all communications. The goal is to foster transparent and effective interactions that support trust, collaboration, and resolution throughout the claims process.

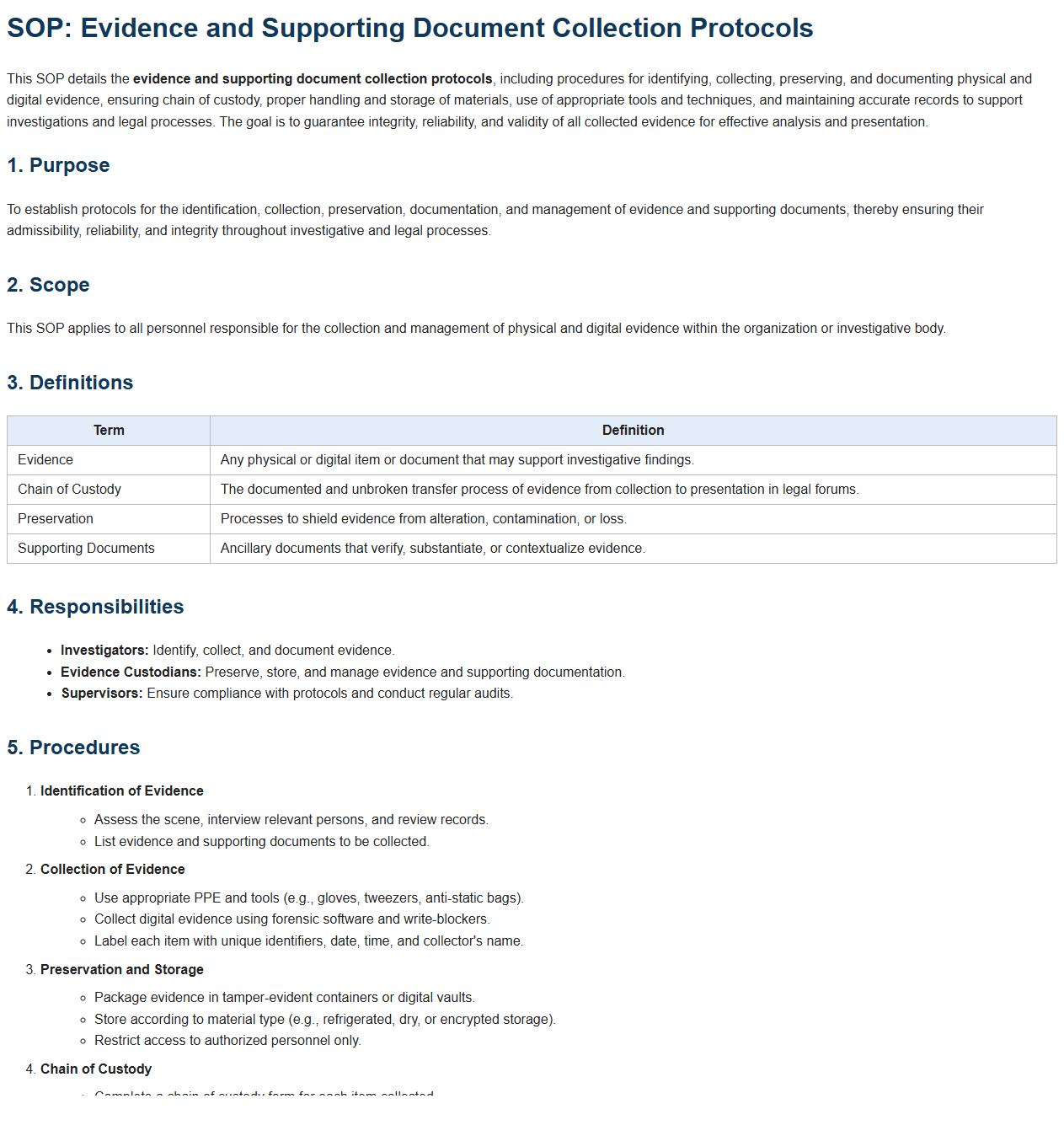

Evidence and supporting document collection protocols.

This SOP details the evidence and supporting document collection protocols, including procedures for identifying, collecting, preserving, and documenting physical and digital evidence, ensuring chain of custody, proper handling and storage of materials, use of appropriate tools and techniques, and maintaining accurate records to support investigations and legal processes. The goal is to guarantee integrity, reliability, and validity of all collected evidence for effective analysis and presentation.

Claim assessment and investigation procedures.

This SOP details the claim assessment and investigation procedures, covering the systematic process for evaluating insurance claims, verifying the validity of claims, conducting thorough investigations, gathering and analyzing evidence, interviewing involved parties, and documenting findings. The objective is to ensure accurate, fair, and timely resolution of claims while minimizing fraud and maintaining compliance with regulatory standards.

Approval, escalation, and exception handling steps.

This SOP details the approval, escalation, and exception handling steps to ensure efficient decision-making and issue resolution within the organization. It covers the process for obtaining necessary approvals, criteria and procedures for escalating unresolved or critical matters to higher authorities, and standardized methods for managing exceptions to established policies or workflows. This approach aims to maintain operational consistency, minimize delays, and enhance accountability across all departments.

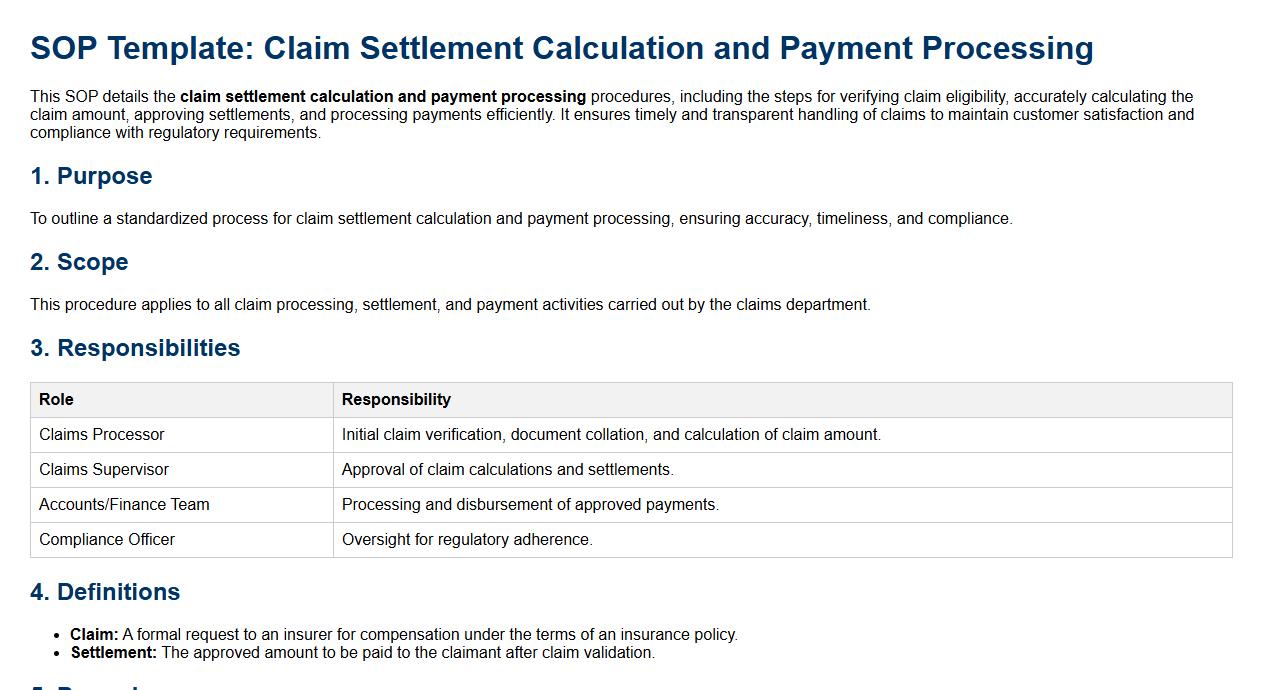

Claim settlement calculation and payment processing details.

This SOP details the claim settlement calculation and payment processing procedures, including the steps for verifying claim eligibility, accurately calculating the claim amount, approving settlements, and processing payments efficiently. It ensures timely and transparent handling of claims to maintain customer satisfaction and compliance with regulatory requirements.

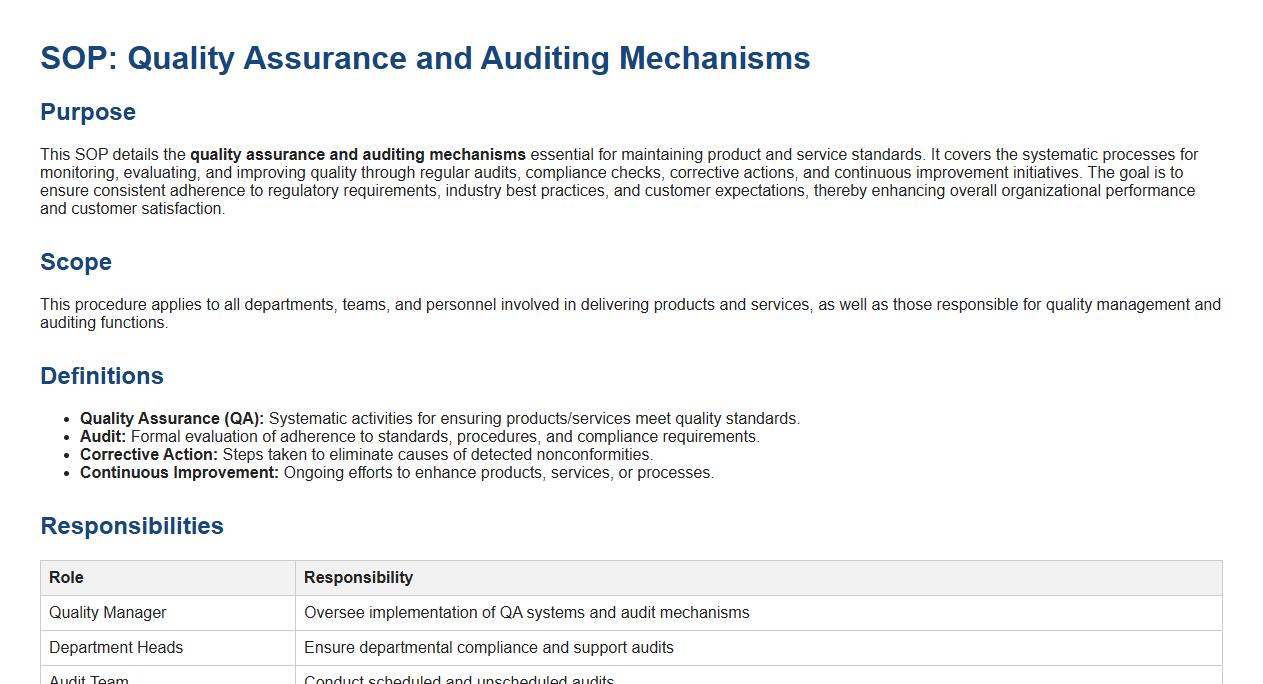

Quality assurance and auditing mechanisms.

This SOP details the quality assurance and auditing mechanisms essential for maintaining product and service standards. It covers the systematic processes for monitoring, evaluating, and improving quality through regular audits, compliance checks, corrective actions, and continuous improvement initiatives. The goal is to ensure consistent adherence to regulatory requirements, industry best practices, and customer expectations, thereby enhancing overall organizational performance and customer satisfaction.

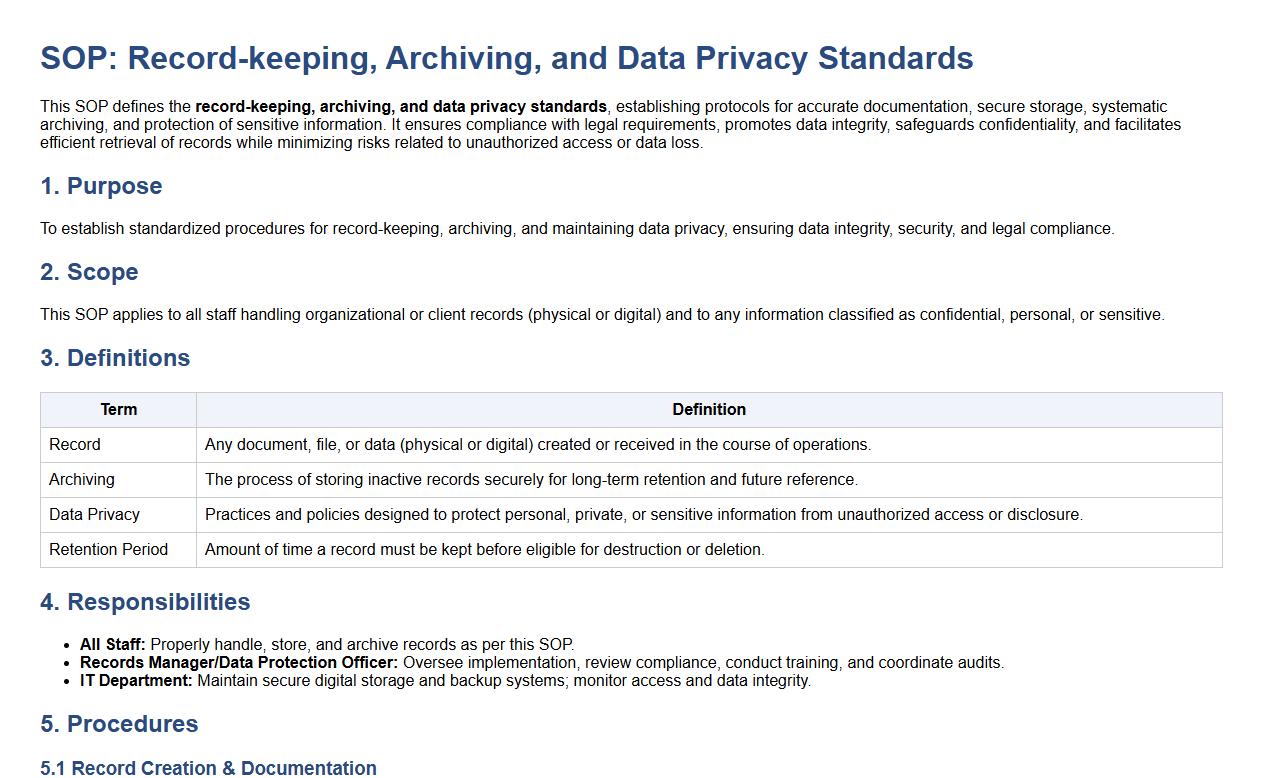

Record-keeping, archiving, and data privacy standards.

This SOP defines the record-keeping, archiving, and data privacy standards, establishing protocols for accurate documentation, secure storage, systematic archiving, and protection of sensitive information. It ensures compliance with legal requirements, promotes data integrity, safeguards confidentiality, and facilitates efficient retrieval of records while minimizing risks related to unauthorized access or data loss.

Primary Steps Outlined in the SOP for Filing and Verifying an Insurance Claim

The SOP outlines the initial claim filing process by requiring the claimant to submit a completed claim form along with necessary documentation. Verification involves a thorough review of the claim details to ensure accuracy and eligibility. Finally, the SOP mandates communication with the claimant to confirm receipt and provide updates on claim status.

Mandatory Documents and Information for Initiating Claims Processing

The SOP specifies that claimants must submit proof of insurance, identification, and incident reports to initiate processing. Additional documents such as medical bills, repair estimates, or police reports may be required depending on claim type. Accurate and complete information is emphasized to avoid delays in the claims workflow.

Defined Roles and Responsibilities within the Insurance Claims Process

The SOP clearly delineates roles by assigning claim intake to customer service, verification to claims adjusters, and final approval to authorized personnel. Each role has specific tasks including documentation review, fraud detection, and decision making. Accountability and communication protocols are emphasized to streamline processing.

Protocols for Investigating and Resolving Disputed or Incomplete Claims

The SOP requires a formal investigation process including fact-finding, claimant interviews, and document verification for disputed claims. It mandates clear documentation of findings and communication of required additional information to the claimant. Resolution is achieved through collaborative discussion or escalation to specialized teams for complex cases.

Timelines and Escalation Procedures for Delayed Insurance Claims

The SOP establishes strict timelines for claim processing to ensure timely resolution, typically ranging from initial acknowledgement to final decision within specified days. If delays occur, escalation protocols require notifying supervisors and involving higher management. These procedures aim to maintain efficiency and customer satisfaction.